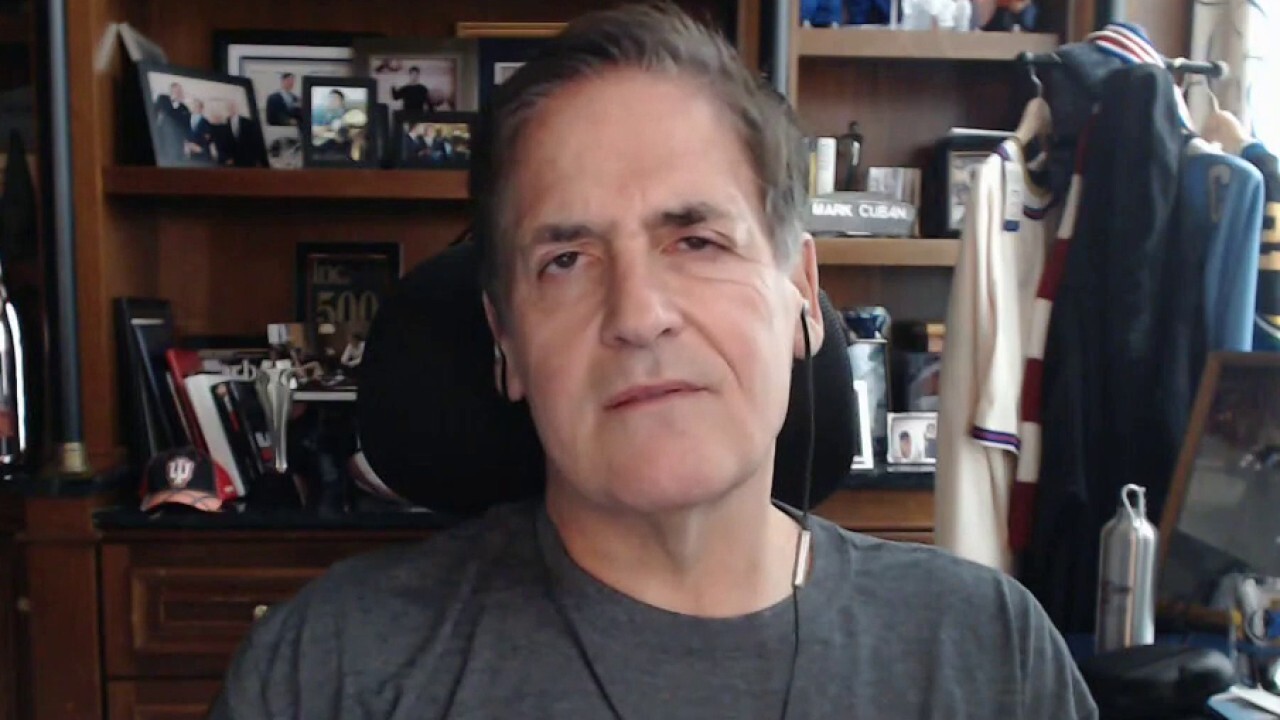

Billionaire entrepreneur Mark Cuban explains the 'different types of utility' associated with crypto

The Dallas Mavericks owner also weighs in on recent market volatility amid rising tensions overseas

Mark Cuban points out the 'challenge' with crypto investing

Billionaire investor Mark Cuban argues it's important to invest in a crypto token or application that provides value and utility.

Billionaire entrepreneur and investor Mark Cuban explained the different types of utility associated with cryptocurrencies on Monday and argued that the "challenge" with investing in crypto "is separating the signal from the noise."

When explaining the different utilities, the Dallas Mavericks owner told "Cavuto: Coast to Coast" that while Bitcoin "is like alternative to gold" and is "a store of value, Ethereum "has a programing language on top of it called smart contracts that allow you to build all kinds of different applications."

"You have to look investing at crypto the same way as you look at investing in anything," he told host Neil Cavuto.

"Do you think there is a value proposition there that consumers or businesses are going to use? If you think the answer is yes, and you think it provides enough growth, then you invest. If the answer is no, you don’t."

He then explained the "challenge" associated with the asset class, comparing what is currently happening in the market to the "the early days of internet stocks."

"Back in 1995 when all the internet companies were going public with only a website, people got all excited and invested in things just because they were there," he said. "And you see some of that with crypto as well, but the reality is, then like now, if you find a crypto token or application that really provides value and utility, that is where you invest and that’s what I look for."

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| COIN | COINBASE GLOBAL INC. | 167.25 | +2.13 | +1.29% |

| BITQ | BITWISE CRYPTO INDUSTRY INNOVATORS ETF - USD DIS | 20.23 | +1.04 | +5.42% |

The business titan provided the insight as cryptocurrency prices were regaining some of the losses from over the weekend - which saw Bitcoin dip below $40,000 - and as tensions between Russia and Ukraine escalated.

On Monday afternoon, Bitcoin, however, was trading lower compared to the morning at approximately $37,798 (-1.66%), while rivals Ethereum and Dogecoin were trading at $2,640 (-.66%) and 13 cents (-1.72%), respectively, according to Coindesk.

Bitcoin, which hit an all-time high in 2021 of $68,990, has dropped about 18% so far this year, according to data provided by Coindesk. Bitcoin had been struggling recently along with equities as the Federal Reserve sets out its roadmap to raise rates.

Bitcoin Foundation chair on Fed rate hikes: 'Probably a net positive for crypto'

Bitcoin Foundation Chair Brock Pierce discusses the impact of Fed rate hikes on cryptocurrency, how long it will take to integrate crypto into daily life, and novice investors looking to get into the crypto-sphere.

The Federal Reserve late last month signaled it could "soon" raise interest rates for the first time in three years, paving the way for a March liftoff as policymakers seek to keep prices under control and combat the hottest inflation in nearly four decades.

CLICK HERE FOR FOX BUSINESS' REAL-TIME CRYPTOCURRENCY PRICING DATA

U.S. equity markets, as well as the bond market, were closed on Monday and on Friday U.S. stocks fell across the board as investors kept a close eye on mounting worries over the possibility of Russia invading Ukraine.

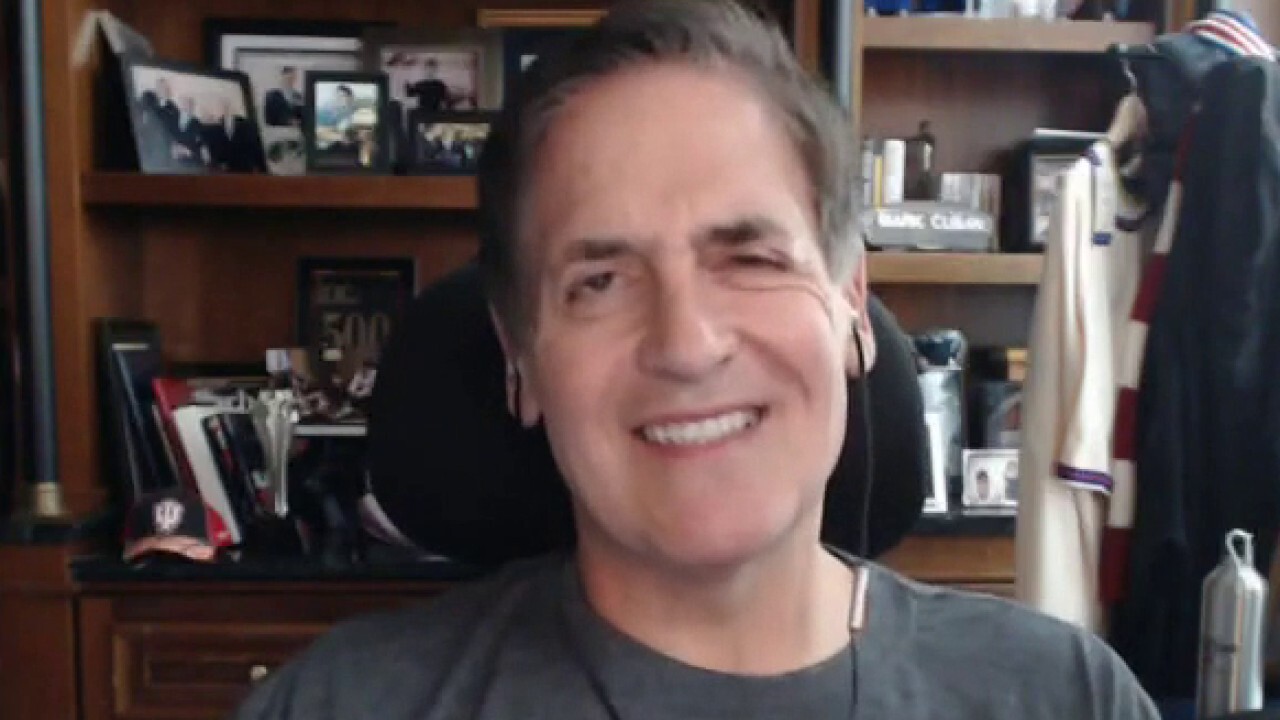

Mark Cuban on market turbulence, future of crypto

Investor and Dallas Mavericks owner Mark Cuban argues 'people will come back to the markets' even though there is 'a lull now.'

Cuban also weighed in on the recent market turbulence as well, stressing that "markets always overreact and overcorrect to news or anticipated news, particularly after a big runup, because speculators and investors want to protect their profits, so people run to cash."

"But the reality is, whether rates go to 3% or 4%, there are not a lot of other good places to put your money and so while there may be a lull now, just like we’ve seen in the past, people will come back to the markets," he continued.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 50135.87 | +20.20 | +0.04% |

| SP500 | S&P 500 | 6964.82 | +32.52 | +0.47% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23238.66991 | +207.46 | +0.90% |

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Last week, the major indexes recorded losses for a second straight week.

FOX Business’ Ken Martin contributed to this report.