Elon Musk, Amazon's Bezos and Fed's Powell land on 2018 blunders and bright spot list

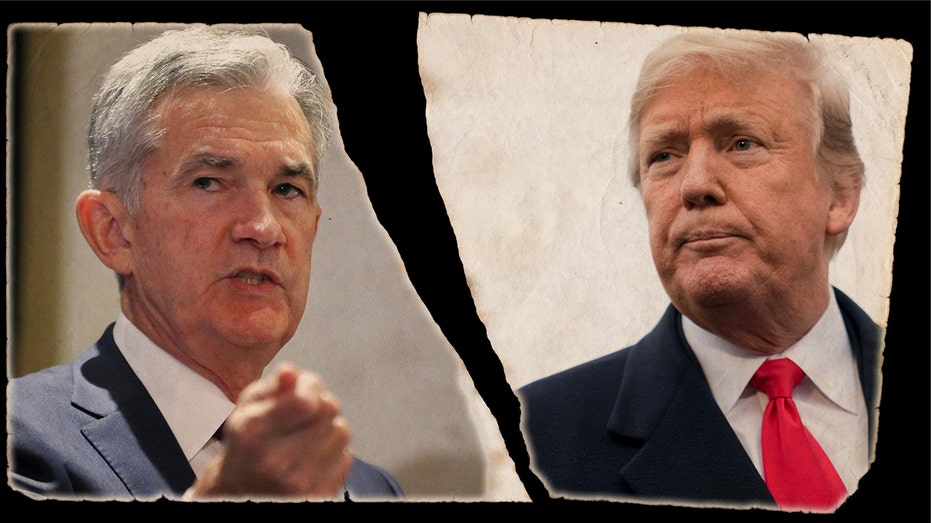

There was no shortage of headlines in 2018, some wilder than others that engulfed some of the world’s biggest personalities. Whether it was President Trump’s frequent Twitter and verbal attacks on Federal Reserve Chair Jerome Powell or Elon Musk’s tweet that nearly torpedoed Tesla shareholders.

Investors also suffered whiplash as the Dow Jones Industrial Average registered some of the biggest point gains and losses in what was one of the most volatile years in history.

Here’s our take on some of the year’s biggest losers and winners in business and public policy that impact the economy...many of whom are worth watching in 2019.

LOSERS

CBS boots Les Moonves:

A year ago he was the king of all media and today he's the newest face of the #MeToo movement, right up there with Hollywood disgrace Harvey Weinstein. He vehemently denies the sexual abuse allegations that cost him his CEO job, but CBS had enough evidence to withhold his $120 million severance pay, which he doesn't need (with an estimated net worth of $700 million, according to Forbes) but he most certainly wanted. His ouster paves the way for a potential media merger with weaker cousin Viacom, should majority shareholder Shari Redstone move forward.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| CBS | NO DATA AVAILABLE | - | - | - |

| VIA | VIA TRANSPORTATION INC | 20.30 | -0.26 | -1.26% |

Elon Musk-Tesla:

The company on the front curve of the electric car industry finally turned a profit in 2018, but not without massive volatility and renewed questions about its business model, and even bigger questions about founder Elon Musk's ability to lead a public company and interface with shareholders. Musk began 2018 as a superstar and ended the year as the guy who tweets dumb stuff, and allegedly violated securities laws, which cost him and Tesla a combined $40 million in fines imposed by the SEC. Let’s not forget he smoked pot on a podcast, meaning he may lose his NASA security clearance for his SpaceX venture. And who knows if Tesla has enough cash on hand to make a $1 billion bond payment in March. Despite all the drama, shares of Tesla will end the year with a 7 percent gain, better than the S&P 500’s decline of nearly the same amount. Also, not bad for a CEO who divides his time running the Boring Company, which is digging tunnels in hopes to speed up travel, Musk also is a busy seller of flamethrowers.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TSLA | TESLA INC. | 417.32 | +6.21 | +1.51% |

Tesla CEO and founder Elon Musk ( (AP Photo/Kiichiro Sato))

Facebook’s Mark Zuckerberg and Sheryl Sandberg:

They too also started the year as corporate icons and ended as the people who steal our privacy data, while we post photos of our pets on Facebook. Both got hauled to Capitol Hill to face the music about the all-to-frequent privacy flubs that eventually became public. In 2019 the Democrats are taking control of Congress and they promise even more heat so shareholders should proceed with caution. Facebook shares lost over 24 percent in 2018, the first annual decline in history, according to Dow Jones Market Data Group.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| FB | PROSHARES TRUST S&P 500 DYNAMIC BUFFER ETF | 42.54 | +0.12 | +0.29% |

Nissan’s Carlos Ghosn:

Once a rock star of the global auto world, his fall from grace was rapid, even though he may be innocent of the charges of tax malfeasance. The former high-flying Nissan CEO sits in a Japanese jail cell for stuff no one can really understand while we get ready to party ringing in the new year. He is expected to remain in the clink until at least January 11 2019.

Renault-Nissan's CEO Carlos Ghosn ((AP Photo/Ng Han Guan, File))

General Electric:

$7 per share says it all. Once among the world’s most valuable corporations, GE is a shell of its former corporate self. While former GE board member Ken Langone told FOX Business longtime CEO Jeff Immelt “destroyed” the industrial giant, there are many issues as detailed by FOX Business, including the debt-heavy balance sheet, which led to the collapse of the share price. FOX Business was first to report that Immelt’s ouster was imminent, led by activist Nelson Peltz who grew tired of years of stock underperformance. His replacement, insider John Flannery, didn’t last long in his role. New CEO Larry Culp has a better chance of reviving what will likely be a smaller GE by the end of 2019 as he moves to sell assets at lightning speed.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GE | GE AEROSPACE | 316.74 | -4.26 | -1.33% |

REUTERS/Benoit Tessier

Fed Chair Jerome Powell:

President Trump turned on his Fed chair appointee Jerome Powell. What began as tweets berating the central banker for raising interest rates, soon became a steady verbal bash in the numerous interviews Trump conducted near yearend with FOX Business, The Wall Street Journal and others. As Powell kept his poker face, the U.S. stock market swooned, and in December it appears he may have blinked. While the Federal Reserve raised rates for a fourth time, policymakers dialed back the pace of planned rate hikes in 2019. Ironically, Trump's recent attack on the Fed came ahead of the group's final meeting and decision of the year.

U.S. stocks:

2019 can’t come soon enough for investors who are long U.S. stocks as the markets registered the worst year in a decade and the worst December since 1931. The S&P 500 lost 6 percent for the month and Dow Jones Industrial Average nearly 6 percent and while the Nasdaq Composite held up better with a decline of 4 percent, volatility was stomach churning with the Dow registering some of its biggest declines and gains in 2018. The Nasdaq Composite, the S&P 500 and the Russell 2000 skidded into bear markets.

WINNERS

Rupert Murdoch:

I know he's our boss, but no one knows the evolving media landscape better. He also knows when to hold 'em and when to fold 'em. And folding them, which included his deal to sell most of 21st Century Fox’s entertainment assets to Disney for a cool $71 billion, edging out Comcast, at a time of cord cutting and other changes in the way media content is distributed, was a master stroke. Myself and my colleagues will soon be working for ‘New Fox’ as described by Murdoch himself. The company remains the parent of FOX Business and Fox News. Shares of 21st Century jumped nearly 40 percent in 2018.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| FOXA | FOX CORP. | 62.85 | -1.93 | -2.98% |

| DIS | THE WALT DISNEY CO. | 107.13 | -1.57 | -1.44% |

Amazon’s Jeff Bezos:

OK, Amazon's stock is off its highs, but no one plays the long game better. CEO Jeff Bezos has no shortage of haters but he survived 2018 despite having made an enemy of Trump. Even the people who hate his liberal politics continue to order from Amazon, which has changed the way consumers shop for just about everything, including food as well as the way we watch content. And now he's on the verge of breaking into streaming New York Yankees games with a possible deal to purchase a stake in the Yankees Entertainment Network (YES). While MLB Commissioner Rob Manfred declined to comment to FOX Business on Amazon, he did indirectly confirm some of FOX Business’ prior reporting on the behind-the-scenes deal making. Amid all these moving parts, shareholders celebrated a 26 percent pop in the stock this year.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AMZN | AMAZON.COM INC. | 208.72 | -1.60 | -0.76% |

Microsoft in the money

Dow member Microsoft saw its shares jump 17 percent in 2018, beating another Dow member Apple which saw its stock fall 7 percent. The software giant, under the direction of CEO Satya Nadella, is slowly transforming itself into a cloud and services leader. Its market cap also now exceeds not only Apple but Amazon as well. All three are bouncing around the $700 to $800 billion market cap level. In a December interview with FOX Business, Nadella touted Microsoft's committement to the U.S. military.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MSFT | MICROSOFT CORP. | 413.60 | +12.46 | +3.11% |

| AAPL | APPLE INC. | 274.62 | -3.24 | -1.17% |

Microsoft CEO Satya Nadella: REUTERS/Shailesh Andrade

Mick Mulvaney:

The Georgetown grad is giving new meaning to being versatile. As 2018 comes to a close no other member of the White House economic team controls more real estate than Mulvaney. In addition to his duties as budget director and CFPB chief, which he recently handed over to Kathy Kraninger, he's also acting chief of staff. Some see that as an example of Trumpian disarray, but if the economy does just average in 2019 Mulvaney will be one of the chief reasons since he has the president's ear and can talk him out of his dumbest instincts on issues like trade.

JPMorgan’s Jamie Dimon -- shocker!

The straight-talking Dimon is a great CEO! Ok... he's always on this list and while JPMorgan’s stock price (like all financials) took a beating this year, who in the world runs a bigger company better? Dimon is also spending more time in Washington, D.C., and while he has poo-pooed a potential presidential run in 2020, he is dipping his toe deeper into politics and policy issues. As FOX Business reported, Dimon could have a change of heart when it comes to the White House.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| JPM | JPMORGAN CHASE & CO. | 322.10 | -0.30 | -0.09% |

Jamie Dimon, CEO of JPMorgan Chase (REUTERS/Brian Snyder)

Juul’s workforce:

The company put vaping on the map and did such a good job tobacco giant Altria paid nearly $13 billion for a 35 percent stake in the company, giving the newbie a valuation of around $38 billion. And if you are one of Juul’s 1,500 employees you may be entitled to a hefty windfall. Juul employees are getting a $2 billion bonus from Altria, which is being paid out as a special dividend. If that money is evenly divided, it would amount to about $1.3 million per person. While the bonus payments will be determined on factors like length of employment, the payout reminds us of how entrepreneurs and capitalism can win big.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MO | ALTRIA GROUP INC. | 64.40 | -1.00 | -1.53% |

The FOX Business team contributed to this report.