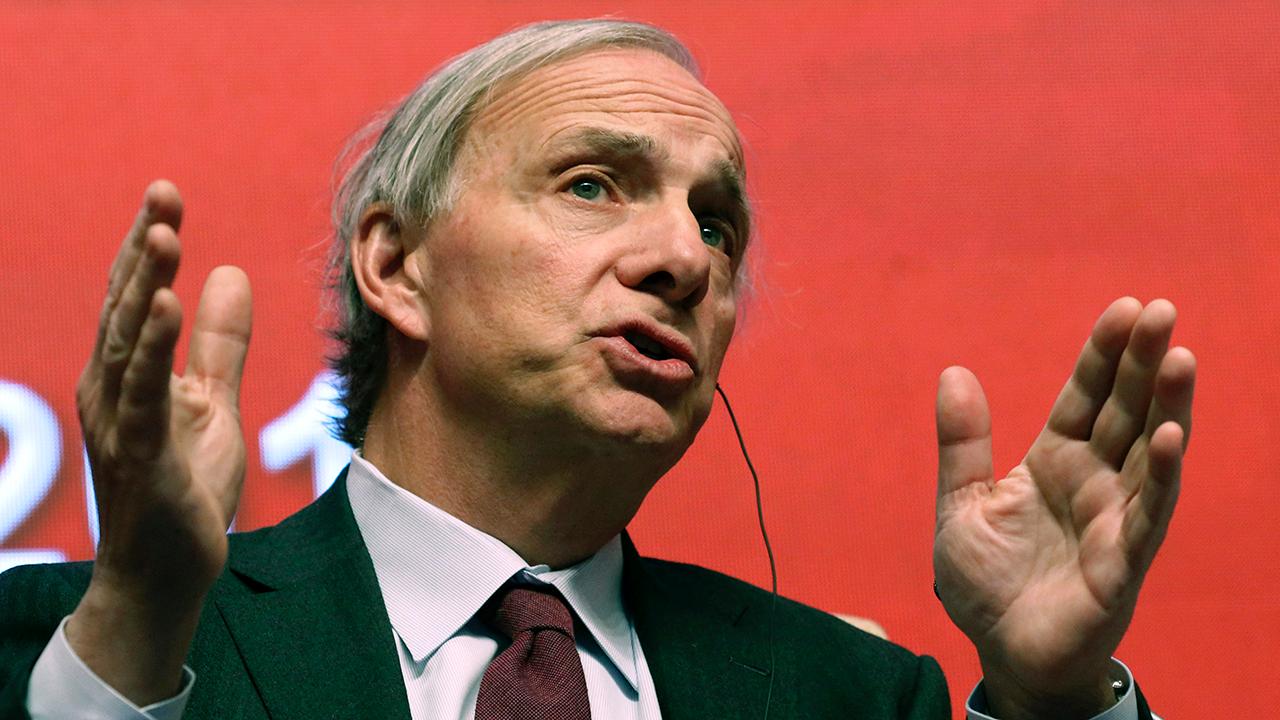

Ray Dalio, capitalism and white man's guilt

Ray Dalio, a billionaire market speculator and founder of the oddest investment company that I have ever come across, Bridgewater Associates, has been making the rounds on cable news and even "60 Minutes" feeding the liberal media what it loves most: A big, piping hot helping of bull---t about the various evils of capitalism and his solution to fix things by, of course, raising taxes on the rich.

Not that this matters to most business journalists who are covering and loving Dalio’s weird roadshow because they aren’t very capitalist themselves. Telling most business reporters that “the American Dream is lost,” or “capitalism needs to be reformed” and we must make the “rich” pay their fair share is like offering President Trump three scoops of ice cream for dessert instead of two; you will never hear a word of protest.

This is a shame because Dalio is a particularly odd guy to be calling balls and strikes on capitalism. Yes, Wall Street guys like Dalio know a lot about markets, but they are particularly tone deaf on economics. They know how to make a quick buck on a trade but they know a lot less on how to make something work for the long haul.

Dalio fits this profile neatly. He’s a billionaire many times over, not from inventing anything special, but as a market speculator. Now some of my best friends and sources are really good at market speculating, but that doesn’t mean they’re incredibly deep thinkers, and those who say they are, like Dalio, should be judged with a degree of skepticism.

First, see Dalio’s book, “Principles: Life and Work”, a weird personal manifesto of what he believes are ways to be successful in business and life. Some of his principles are cringe-worthy obvious (PAIN + REFLECTION = PROGRESS), others just cringe worthy pedantic as in the one that advises: “Great planners who don’t execute their plans go nowhere.”

Full disclosure: I haven’t read “Principles” but I bet I can probably get more practical self-help advice from a Tony Robbins video.

Then listen to the problems he says he’s worried about and how he plans to fix them.

Education, or the lack of it in poor communities, is high on his list. He wants to raise taxes to make sure kids in poor school districts get a better education. Sounds good until you dig a bit deeper and realize that the money he’s raising goes right into the pockets of the teachers unions and education establishment, which has spent the past two decades opposing school choice and other reforms that have been proven to benefit poor kids.

Dalio has been talking a lot about the gap between the rich and poor, which he says remains disturbingly high and will sow the seeds of violent conflict. Ok, but lots of anecdotal evidence is pointing to the fact that a combination of the Trump tax cuts and a decline in immigration has increased wages on the low end of the scale.

Meanwhile, a lot of other quantitative evidence shows the wealth gap grew alarmingly wide during the Obama years, and well after the ravages of the Great Recession when the Fed printed money making stock speculators like Dalio rich, and expanded social programs that did little for the working class.

Finally do a little research on the hedge fund he runs, Bridgewater Associates.

Yes it's big ($160 billion in assets) and successful most of the time, but it’s also run like a police-state version of a hedge fund. All meetings are taped and recorded. Secrecy is paramount and the firm is notorious for its strictly enforced non-disclosure agreements. All of which makes sense because we’re dealing with a lot of money here, but also because the place is so damn weird to work at, as I am told by my Wall Street sources who have a first-hand knowledge of the weirdness.

In an almost cult like fashion, employees must read and nearly memorize a short version of Dalio’s mind-numbing “Principles” book. But that’s just the beginning. Dalio preaches something called “radical transparency,” where employees gather around and grade investment ideas in one of the investment world’s most hostile work environments, something along the lines of that famous Mexican standoff scene in “Reservoir Dogs” only without guns. People who stumble over one of Dalio’s “Principles” are subjected to what is known as a “public hanging” of ridicule.

No wonder the turnover rate at Bridgewater is around 25 percent over approximately a year.

That wouldn’t be so bad if Dalio and his crew were doing something special in the world. They’re not. They’re charging big bucks for investing money. In fact, they’re not doing anything special as far as investing goes. Since its inception, Bridgewater’s flagship “Pure Alpha Strategy” fund has had an annualized total return of around 12 percent, making it just a little better than the S&P 500 index I can buy from Vanguard.

OK, Dalio must be doing something right or he wouldn’t be worth nearly $17 billion, right? Yes, it's true that Dalio built his firm from scratch, and is smart at convincing people to give him their money, but that doesn’t mean his critiques of capitalism and his solutions are all that smart. Dalio is credited with predicting the 2008 financial crisis (he was far from alone on this one). But he also recently gave Connecticut Gov. Ned Lamont $100 million to improve public education and fund a bunch of other great stuff like making poor communities a better place to live.

Dalio is supposed to be good at numbers, which is why it’s odd that he thinks his $100 million filtered through one of the most wasteful state governments in the country will do much of anything.

It’s also odd that Dalio thinks higher taxes are the solution to capitalism’s ills. Dalio told "60 Minutes" that people like him (i.e. the rich) should pay more to make the economy more equitable as long as the money is going to something “productive” like education. “Am I saying something that's controversial?," he asked correspondent Bill Whitaker, who replied: “It's just strange to hear it come from the mouth of a billionaire."

CLICK HERE TO GET THE FOX BUSINESS APP

It’s also absurd. Government is one of the least productive organizations on the face of the earth. We have a pension crisis, we had a housing crisis, and we have a student-loan debt crisis, not to mention a looming Social Security crisis, lots of debt and a fiscal deficit, because government is big and wasteful and inefficient and until recently, funded by higher taxes.

And who exactly are the people like Dalio who will be paying even more taxes? Does he mean we need to raise taxes on dudes who have $17 billion in the bank? Or people with just a few million?

Try funding the utopia Dalio envisions by taxing billionaires and most will leave the country. Even if they stayed there wouldn’t be enough money to pay for all the education and poverty eradication in Dalio’s utopia. That’s why people who earn around $250,000 a year, not $250 million, get hammered so hard by the tax man: There’s more of them.

My guess is that Dalio’s little capitalism bashing media tour is a manifestation of rich, white man’s guilt, and a need for a big liberal media hug as he approaches 70 years on this earth. Now that he got his hug, maybe he can just go away.