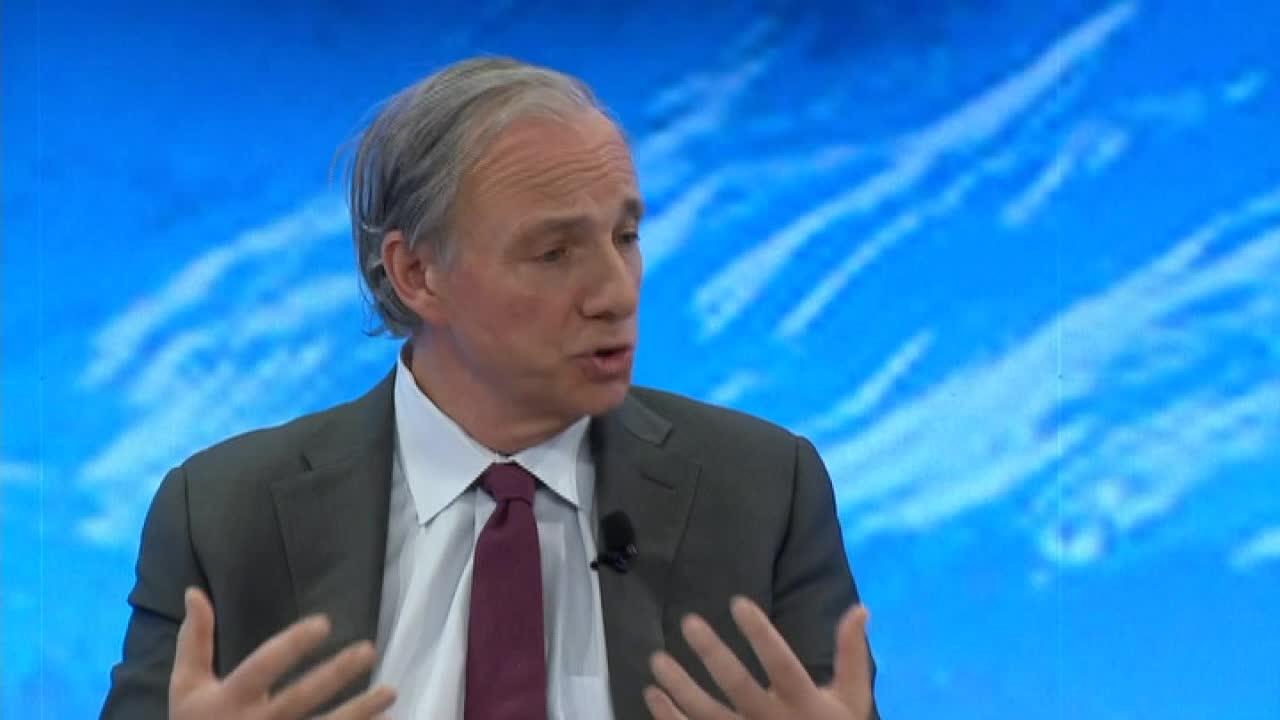

Ray Dalio lowered his odds of a recession before 2020. Here's why

One week ago, billionaire investor Ray Dalio warned of a relatively high chance of a recession occurring before the next presidential election.

Now, the hedge fund manager is walking back his words, thanks to a more dovish approach by the Federal Reserve.

In a LinkedIn post, Dalio, the founder of Bridgewater Associates, wrote that he was lowering his odds of a U.S. recession coming prior to the 2020 election to about 35 percent. (Previously, Dalio said it was higher than 50 percent, and while speaking at Harvard University last week, said it could be as high as 70 percent.)

That’s because, as a result of softening economic conditions globally, the Federal Reserve has taken a more patient approach to monetary policy in 2019.

“Because the markets weakened and Fed officials now see that the economy and inflation are weak there has been a shift to an easier stance by the Fed,” Dalio said. “Similarly, because of weaker markets, economies, and inflation rates in other countries, other central banks have also become more inclined to ease, though they have less room to ease than the Fed.”

Indeed, while testifying before the Senate Banking, Housing and Urban Affairs Committee this week, Fed Chair Jerome Powell said that despite relatively strong economic data, policymakers at the U.S. central bank will be “patient” with raising the benchmark federal funds rate for the time being, as they monitor potential geopolitical turmoil, including a U.S.-China trade war and Brexit uncertainties.

While the Fed doesn’t have quite the power to offset a deep recession, Dalio said the central bank could probably help to manage “the big sag that we expect.”

However, Dalio noted that other countries’ banks -- particularly the European Central Bank and Bank of Japan -- have less leniency to ease their monetary policies.

CLICK HERE TO GET THE FOX BUSINESS APP

“For these reasons,” he said, “I still remain worried about economic weakness coming at the same time as central banks’ powers to reverse it are limited (especially in Europe and Japan), domestic and international conflicts are great, and there will be elections in a number of countries.”