Biden corporate tax hike could hit middle-class Americans – here's how

White House billing the American Jobs Plan as a once-in-a-generation infrastructure fix

President Biden on Wednesday unveiled a proposal for the largest corporate tax rate in decades as a means of paying for his nearly $2.25 trillion spending package – an increase that could indirectly hurt middle-class Americans.

The White House is billing the eight-year initiative, dubbed the American Jobs Plan, as a once-in-a-generation infrastructure fix that will make massive investments in the nation's roads and bridges, as well as transit systems, schools and hospitals. The measure will be funded by raising the corporate tax rate to 28% from 21% – rolling back part of former President Donald Trump's 2017 tax cuts – and increasing the global minimum tax on U.S. corporations to 21% from 13%.

WHAT'S IN BIDEN'S $2.2T INFRASTRUCTURE AND TAX PROPOSAL?

But critics say hiking taxes on corporations will ultimately end up hurting workers in the form of lower wages, possibly violating the president's campaign promise to not raise rates on anyone earning less than $400,000.

"The corporate tax, it's just not absorbed by the companies, it's shouldered by workers in the terms of lower wages," John Kartch, vice president of communications at the right-leaning Americans for Tax Reform, told FOX Business. "That's something to consider, even a left-of-center economist will tell you that some measure is borne by lower wages."

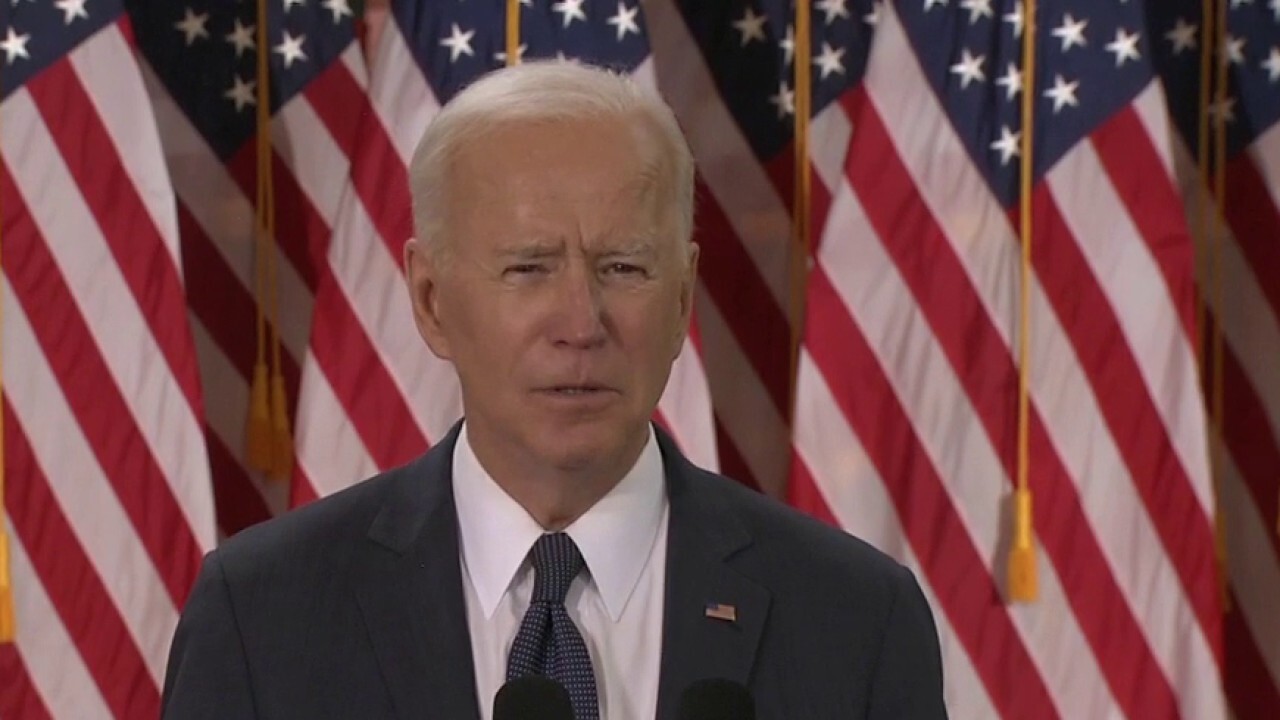

President Biden delivers a speech on infrastructure spending at Carpenters Pittsburgh Training Center, Wednesday, March 31, 2021, in Pittsburgh. (AP Photo/Evan Vucci)

One study published by the American Enterprise Institute, a conservative think tank, found that a 1% increase in the corporate tax rate is correlated with a 0.5% decline in real wages. And in 2007, the nonpartisan Congressional Budget Office determined that workers pay more than 70% of the cost of corporate taxes.

BIDEN'S PLANNED TAX HIKES COULD BE 'DEVASTATING' FOR DEMOCRATS IN 2022

"When Biden says he will raise taxes on only those earning over $400,000, he is saying his tax law will target only those high-income taxpayers," Taylor LaJoie, a policy analyst at the Tax Foundation, recently wrote. "Economists, however, trace the economic impact of these taxes past the person writing the check."

That's not to mention the broader economic effect that raising the corporate tax rate could have: Recent findings from the Tax Foundation show that Biden's plan to raise corporate taxes would reduce GDP, the broadest measure of goods and services produced in the country, by 0.8% and eliminate 159,000 jobs. It would also reduce workers' wages by 0.7%, the nonpartisan organization said.

"The economic literature shows that corporate income taxes are one of the most harmful tax types for economic growth, as capital investment is sensitive to corporate taxation," the analysis said. "The corporate income tax raises the pretax return firms required to pursue investment opportunities, reducing the pool of investments that firms find worthwhile to pursue. This lowers long-run economic output, reducing wages and living standards."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The corporate tax increase would generate about $740 billion in new revenue over the next decade, according to a recent analysis published by the Tax Policy Center.

But the proposal faces an uphill battle in Congress: Republicans have already started to attack the plan as a "trojan horse" for major tax hikes, while progressive Democrats have argued the proposal doesn't go far enough in addressing climate change or other issues.

If Democrats decide to pass the measure on a party-line vote via reconciliation, they can stand to lose no members in the Senate and just three in the House, assuming all GOP lawmakers are aligned against the bill.