Biden administration stoking higher energy prices with oil and gas crackdown, JEC analysis shows

Energy prices have been major driver behind inflation, which surged 7% in December

How will war between Russia, Ukraine impact oil prices

Price Futures Group senior analyst Phil Flynn argues 'this could be a major event' that could be felt for decades.

EXCLUSIVE: The Biden administration is exacerbating soaring energy prices by cracking down on the oil and gas industry with new regulations that limit production and discourage investments in traditional energy infrastructure, according to a new analysis published Wednesday by the Joint Economic Committee Republicans.

For months, the prices of all kinds of energy – gasoline, diesel fuel, natural gas, oil and more – have been a major driver behind inflation, which surged 7% in December, the highest level since 1982. Energy costs have climbed more than 29% over the past year, in part due to lopsided supply and demand. Consumers are traveling more, but the supply side has not kept up with the demand.

SURGING INFLATION TAKES HOLD IN MOUNTAIN STATES, WITH RATES NEAR 9%

But it's more complicated than that: The JEC study, shared exclusively with FOX Business, shows how President Biden's policies have stoked higher energy prices by "imposing new barriers to accessing American oil and gas reserves, and by discouraging investment in these historically reliable and inexpensive sources of energy." Rep. Mike Lee, R-Utah, is the ranking member of the Joint Economic Committee.

"Washington is sending conflicting messages," the report, authored by economist Hugo Dante and data analyst Kole Nichols, said. "Policymakers seem simultaneously concerned about high prices reflecting the weak supply of oil and gas, while aggressively pursuing an agenda designed to entirely phase-out oil and gas from domestic energy production."

In the early days of the pandemic, the U.S., like other oil-producing countries, shut down production and canceled new investments in expanded capacity, leading to the lowest level of oil and gas wells in the U.S. on record in the summer of 2020. But while demand has rebounded since then, production capacity remains about 13% below pre-pandemic levels, the JEC report shows.

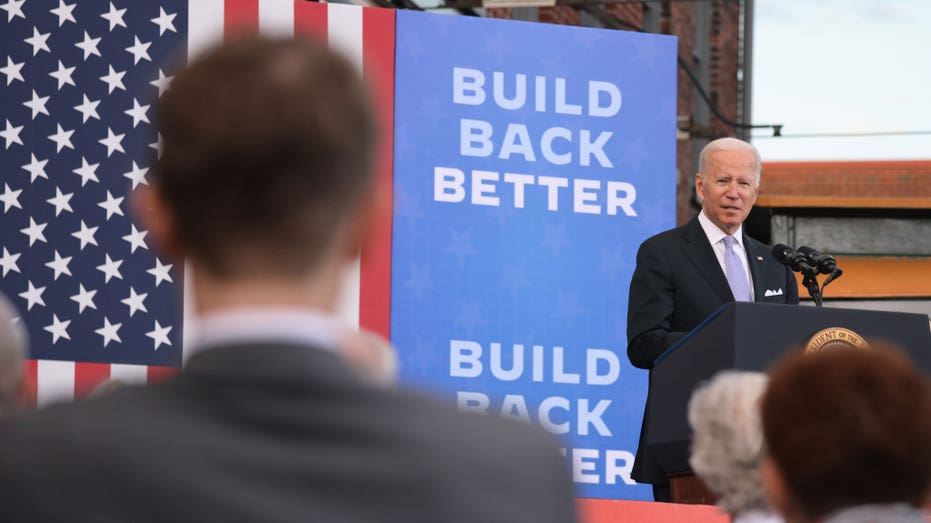

President Biden speaks at an event at the Electric City Trolley Museum in Scranton, Pennsylvania, on Oct. 20, 2021. (Spencer Platt/Getty Images / Getty Images)

For energy prices to fall, the JEC Republican report said oil and gas supply must rise to meet global demand; although U.S. production is tethered to the global market, the White House needs to take "important steps to ease barriers for domestic producers," the analysis said.

The report cited Biden's executive order that established a moratorium on leasing federal lands for oil and gas production; his call for the implementation of an Obama-era rule requiring oil and gas producers, processors and refiners to install expensive technology to detect methane leaks; the rollback of Trump-era reforms that lowered costs for energy producers; and the revocation of permits for the Keystone XL pipeline, which would have transported 830,000 barrels of oil a day; and proposed fee hikes on domestic energy producers leasing government land.

"These and other federal actions would directly and indirectly halt new investments that are critical to expanding domestic supply," the report said, adding: "The Biden Administration has consistently threatened oil and gas producers with new taxes, regulation, and reporting requirements that raise costs for domestic producers."

DECEMBER INFLATION BREAKDOWN: WHERE ARE PRICES RISING THE FASTEST?

Oil prices have also soared this year, with West Texas Intermediate (WTI) crude futures, the U.S. oil benchmark, topping $88 on Wednesday. By comparison, a barrel of WTI was worth about $54 one year ago.

The Labor Department reported in January that gasoline prices have skyrocketed 49.6% over the past year, while natural gas has surged 24.1% and electricity is up 6.3%. A gallon of gas, on average, was $3.37 nationwide on Monday, according to AAA – up from $2.42 a year ago. In California, gas prices are well over $4 per gallon.

The rising prices are eating away at the strong wage gains Americans saw last year and are hitting the lowest-income households the hardest. An analysis from the University of Pennsylvania's Penn Wharton Budget Model shows that higher energy prices cost the average American an additional $1,200 last year. The lowest-income households spent about 11% of total expenditures on energy in 2021, up from 8% in 2020.

A natural gas flare on an oil well pad burns as the sun sets outside Watford City, North Dakota, Jan. 21, 2016. (Reuters/Andrew Cullen / Reuters Photos)

The inflation spike has been bad news for Biden, who has seen his approval rating plunge as consumer prices rose. The White House has blamed the price spike on supply chain bottlenecks and other pandemic-induced disruptions in the economy, while Republicans have pinned it on the president's massive spending agenda.

In an attempt to reduce prices at the pump, Biden ordered a record-setting 50 million barrels of oil released from the nation's Strategic Petroleum Reserve, a decision made in coordination with other major energy-consuming countries, including India, the United Kingdom and China.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The president has also called on the Federal Trade Commission to probe whether oil and gas companies are engaging in criminal conduct by profiting from artificially high prices at the pump, even as wholesale fuel costs decline.