Joe Biden's tax hikes will cause your life savings to collapse, Grover Norquist warns

'You’re looking at losing a third of your life savings' the Americans for Tax Reform president says

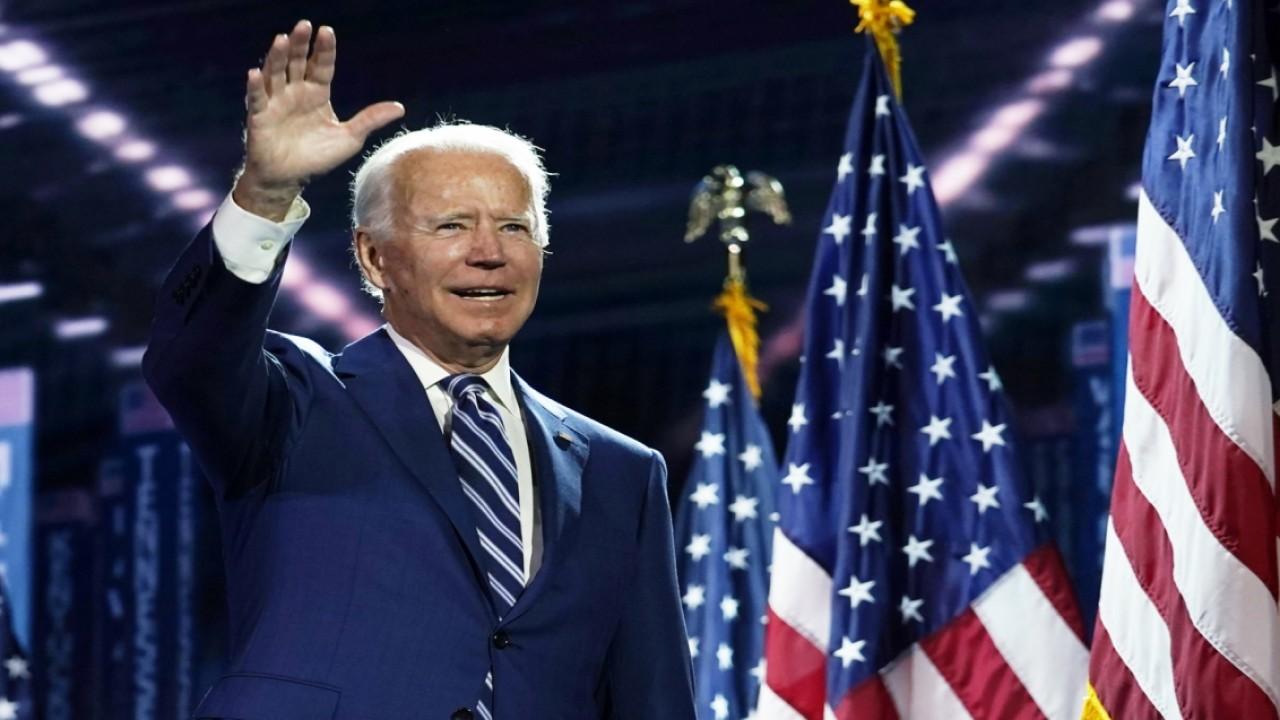

Democratic presidential nominee Joe Biden’s “tax hikes will cause your life savings to collapse,” founder of Americans for Tax Reform Grover Norquist said on Thursday.

“Remember, this is similar to the promise that Barack Obama made back in 2008 when he ran for president. Then he promised no one who made more than $250,000 would pay higher taxes. There is a series of taxes on the middle class in Obamacare. One painfully that Biden wants to re-establish,” Norquist told FOX Business' Stuart Varney on "Varney & Co."

JOHN PAUL DEJORIA: DEMOCRATIC WEALTH TAX WOULD ‘DESTROY AMERICA TOTALLY’

Norquist said that Americans who refuse to buy Obamacare will be “hit” with a tax.

“That is a $700 fine for not buying Obamacare. You don’t get something for it, you just get punished,” Norquist said. “You pay $700, $2,000 for a family of four, three-quarters the people who paid that tax fine under Obama made less than $50,000 a year. Not $100,000, not $250,000, not $400,000.”

President Trump, who is running for reelection on a record of lowering taxes, has taken aim at his presumptive 2020 Democratic opponent Biden for a number of policies that would increase rates for some Americans.

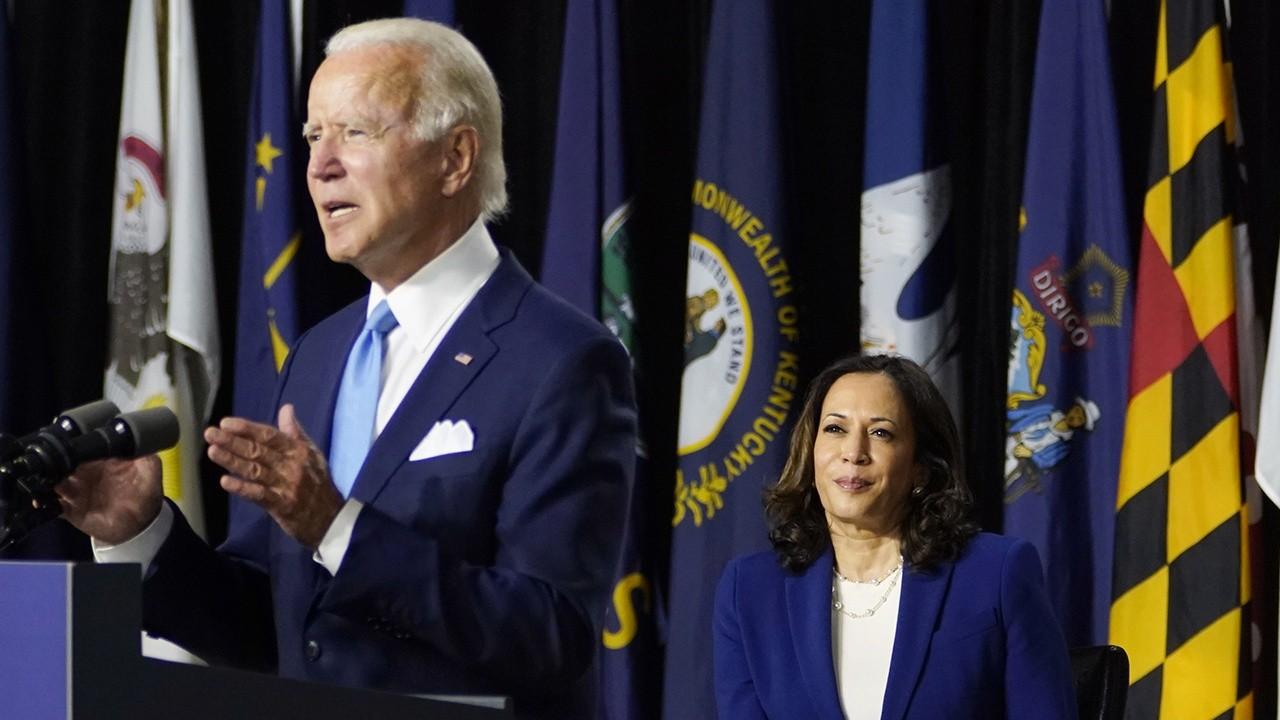

During an interview with FOX Business last week, Trump suggested Biden and running mate Sen. Kamala Harris’ plan could cause a record-setting depression.

"They want to tax $4 trillion, it's going to be the biggest tax increase in history by far," Trump told Maria Bartiromo last week. "They’re big taxers. It’s just something that won’t work. We’ll have – you will see a depression the likes of which you have never seen. You’ll have to go back to 1929, I guess it doesn’t get too much worse than that."

Biden has said the wealthy should pay more in taxes, and that the tax code should be more progressive and equitable. That includes eliminating loopholes that favor the rich and large corporations.

Economic platforms are likely to be a central focus this November due to a recession brought on by the coronavirus pandemic.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Norquist said that “if you repeal all of the Trump tax cuts, it is a $2,000 tax increase on the median-income family of four, making $70,000 a year.”

“A $2,000 tax increase,” Norquist said.

Norquist went on to say Americans will see their life savings "collapse."

“When you cut taxes as the Republicans did and deregulate it if you have a 401K in the S&P 500, it’s the value from when the president got elected to the height of COVID, we’re getting back to that was up 50%. Your life savings increased by 50%. Everything that was done to bring that 50% increase is going to be undone and on top of that, an energy tax, a gasoline tax, plus on top of that, other taxes that they’re looking to put beyond getting you out of the tax cut that Trump put through. So, you’re looking at losing a third of your life savings," he explained.

CLICK HERE TO READ MORE ON FOX BUSINESS

Fox News' Brittany De Lea and FOX Business' Evie Fordham contributed to this report.