College costs have soared multiple times the rate of inflation over 50 years

Meanwhile, enrollment has fallen for the past decade

Forgiving more student loans is 'incredibly costly, highly disappointing': Economy expert

Maya MacGuineas, president of the bipartisan Committee for a Responsible Federal Budget, says Biden's promises of caring about a fiscal future 'fall flat.'

Americans are experiencing sticker shock these days everywhere, from the grocery store to the car dealership. Still, data shows the sky-high inflation of everyday goods does not hold a candle to price hikes in higher education.

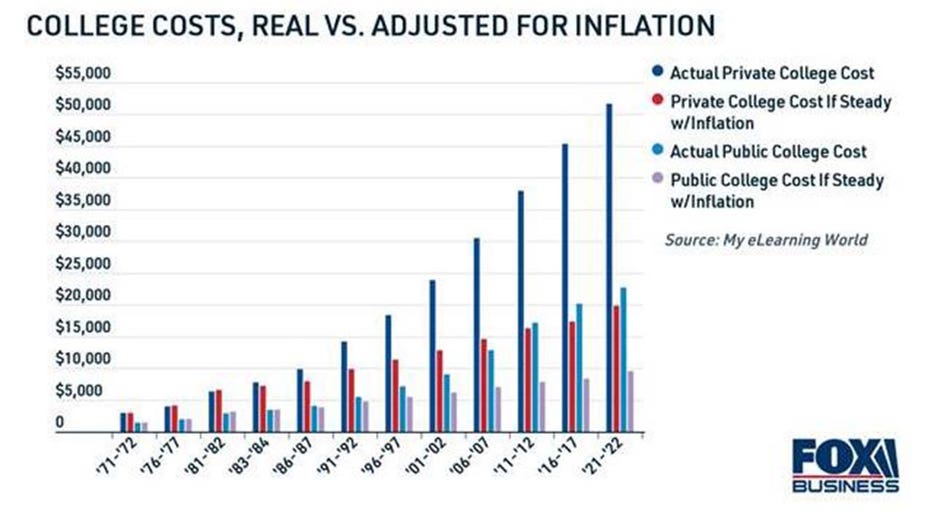

The cost of attending college in the U.S. has ballooned by multiple times the rate of inflation over the past five decades, according to an analysis by My eLearning World, which shows would-be students are increasingly opting out or choosing alternatives due to the hefty cost.

Using data from the nonprofit College Board last year, My eLearning found that the average cost of going to a private college — including tuition, fees, books, and room and board — went from $2,930 per year in 1971 to $51,690 in 2021. That is an increase of roughly 4.6 times the rate of inflation over the past 50 years.

An analysis by MyLearning shows the cost of college has soared far above inflation for the past 50 years. (FOX News / Fox News)

The price tag for public college has surged, too, going from $1,410 annually in the early 1970s to $22,690 for in-state students and $39,510 for out-of-state students as of last fall.

LARRY SUMMERS WARNS STUDENT LOAN DEBT RELIEF COULD WORSEN INFLATION

So why has the rising cost of college far outpaced inflation? Studies suggest institutions of higher learning are able to hike costs further due to the federal government's increasing generosity in handing out loans.

A New York Federal Reserve Bank report from 2017 found that federal expansion in student loan credit in the late aughts led institutions to raise tuition prices by 60% "in the years of policy changes relative to what would have been expected without the policy change."

The New York Fed further noted that "student debt has continued to grow unabated."

Many debt-riddled student borrowers are having buyer's remorse and seeking relief from the federal government. (Photo by Erik McGregor/LightRocket via Getty Images / Getty Images)

But data from the last decade also suggests would-be students are increasing balking at the price of college and the loans that often come with it.

MyeLearning shows that U.S. college enrollment declined every year from 2012 to 2019, and tumbled dramatically by over 5% in spring 2020 in the early throes of the COVID pandemic.

FORMER OBAMA ECONOMIST SLAMS STUDENT DEBT RELIEF: IT'S NOT ‘FREE MONEY,’ WILL ‘HURT’ ALMOST EVERYONE

Now, many debt-riddled student loan borrowers are having buyer's remorse and asking the federal government to step in and issue relief.

President Biden is expected to announce Wednesday that he will grant $10,000 in one-time forgiveness per borrower for single earners making up to $125,000 annually. It is a promise he campaigned on in 2020. Biden will also extend the repayment pause until January 2023. Progressive groups have pushed for him to forgive $50,000 per borrower.

President Joe Biden is expected to announce Wednesday whether he will forgive student loan debt for some Americans. (AP Photo/Evan Vucci / AP Newsroom)

But wiping away either amount for tens of millions of higher-education customers will come at a hefty cost to taxpayers and disproportionately benefit wealthy Americans, according to a new study.

The Penn Wharton Budget Model, a nonpartisan group at the University of Pennsylvania's Wharton School, released a new analysis Tuesday showing that forgiveness of $10,000 per borrower without income caps would cost roughly $344 billion, and $50,000 in forgiveness per individual would cost around $980 billion.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The study found that if either of those scenarios occur, somewhere between 69% and 73% of the debt forgiven would be for households that are in the top 60% of income distribution in the U.S.

FOX Business' Megan Henney contributed to this report.