Debt ceiling showdown risks triggering ‘self-inflicted’ recession

US could default on its federal debt as soon as June 1

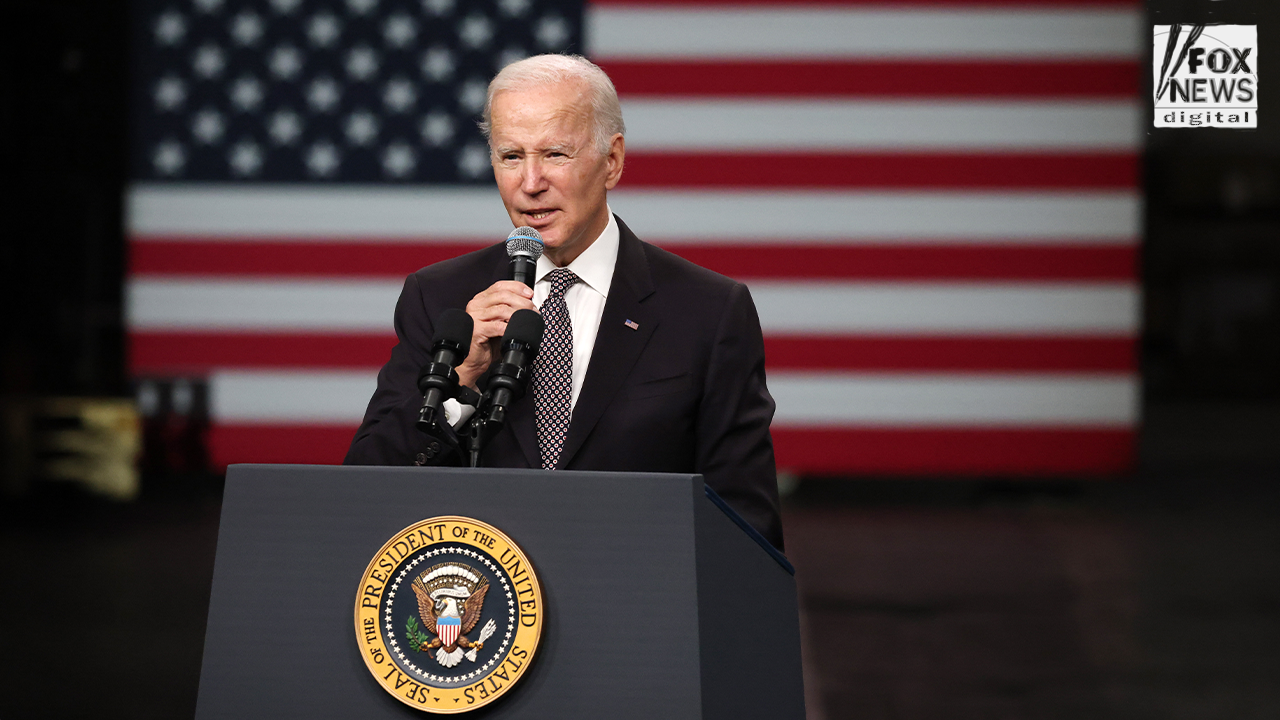

Biden on debt ceiling: America 'never has, never will' default

In comments in the Roosevelt Room Tuesday, President Biden claimed the United States is 'not a deadbeat nation' in debt talks with congressional leaders.

The U.S. government is on a collision course for a potentially catastrophic default on its financial obligation if Congress fails to raise the debt ceiling within a matter of weeks.

Treasury Secretary Janet Yellen warned last week the country could run out of money as early as June 1 if legislators do not raise or suspend the nation's borrowing limit.

"This would be a huge hit to the economy and really an economic catastrophe," Yellen told CNBC on Monday.

"If Congress doesn't raise the debt ceiling, the president will have to make some decisions about what to do with the resources we do have, and there are a variety of different options, but there are no good options. Every option is a bad option."

BANKING CRISIS THREATENS TO IGNITE CREDIT CRUNCH OF US HOUSEHOLDS: WHAT TO KNOW

Analysts agree the economic consequences of such a default could be shattering, sending the already-fragile U.S. economy into a deep, self-inflicted recession.

Senate Minority Leader Mitch McConnell, R-Ky.; Speaker of the House Kevin McCarthy, R-Calif.; and President Biden, meet with other lawmakers in the Oval Office of the White House May 9, 2023, in Washington, D.C. (Anna Moneymaker/Getty Images / Getty Images)

"In the event Treasury could not meet all its obligations on time, we estimate that the combination of spending cuts along with severe financial market stress and a private sector confidence hit would lead to a real GDP hit worth around 4.5%, inducing a self-inflicted recession," said Gregory Daco, the chief economist at EY Parthenon.

The debt ceiling, which is currently around $31.4 trillion, is the legal limit on the total amount of debt that the federal government can borrow on behalf of the public, including Social Security and Medicare benefits, military salaries and tax refunds. In a worst-case scenario, the U.S. would be so cash-strapped that it would have to delay its payment of interest or principal on the nation's debt.

"Such an outright default on Treasury securities would very likely result in severe disruption to the Treasury securities market with acute spillovers to other financial markets and to the cost and availability of credit to households and businesses," the Brookings Institution said in a recent analysis. "Those developments could undermine the reputation of the Treasury market as the safest and most liquid in the world."

AMERICANS BRACING FOR HIGHER INFLATION IN THE LONG TERM, NY FED SURVEY SHOWS

The U.S. government bumped up against that limit in January, prompting the Treasury Department to initiate a series of actions that are known as "extraordinary" measures intended to stave off a default.

President Biden speaks to African leaders gathered for the U.S.-Africa Leaders Summit Dec. 14, 2022, in Washington. (AP Photo/Patrick Semansky / AP Newsroom)

But, due to a lower-than-expected collection of tax revenue in April, those initiatives are poised to run out by early June.

"While greatly uncertain, the effects of allowing the debt limit to bind could be quite severe, even assuming that principal and interest payments continue to be made," the Brookings Institution said.

The dire warnings come amid a lengthy standoff over the debt limit. Republicans, who control the House, have promised to raise the borrowing limit only in exchange for deep spending cuts. In turn, President Biden and his fellow Democrats, who control the Senate, have refused to negotiate and insisted on a "clean" debt ceiling bill that does not include any cuts.

INFLATION JUMPED 0.4% IN APRIL AS PRICES REMAIN STUBBORNLY HIGH

Biden hosted House Speaker Kevin McCarthy, R-Calif., and other congressional leaders at the White House on Wednesday to discuss the nation's spending and debt, but the meeting concluded with no consensus reached.

"I made clear during our meeting that default is not an option," Biden said after the meeting. "I repeated that time and again. America is not a deadbeat nation. We pay our bills, and avoiding default is a basic duty of the United States Congress."

People walk outside the Capitol building in Washington June 9, 2022. (AP Photo/Patrick Semansky, File / AP Newsroom)

McCarthy likewise said the two sides were at an impasse.

"I didn't see any new movement," he said.

Biden, McCarthy and the other congressional leaders will meet again Friday, while staff from both sides of the aisle were also preparing for discussions this week.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

If the U.S. failed to raise or suspend the debt limit, it would eventually have to temporarily default on some of its obligations, which could have serious negative economic implications. Interest rates would likely spike, and demand for Treasuries would drop; even the threat of default can cause borrowing costs to increase, according to the Committee for a Responsible Federal Budget.

While the U.S. has never defaulted on its debt before, it came close in 2011, when House Republicans refused to pass a debt-ceiling increase, prompting rating agency Standard and Poor's to downgrade the U.S. debt rating one notch.