Diet industry getting fat off of the pandemic

Publicly traded weight-loss companies reversing losses months after lockdowns began

The pandemic version of the “Freshman 15” is proving an unexpected boon to many diet companies.

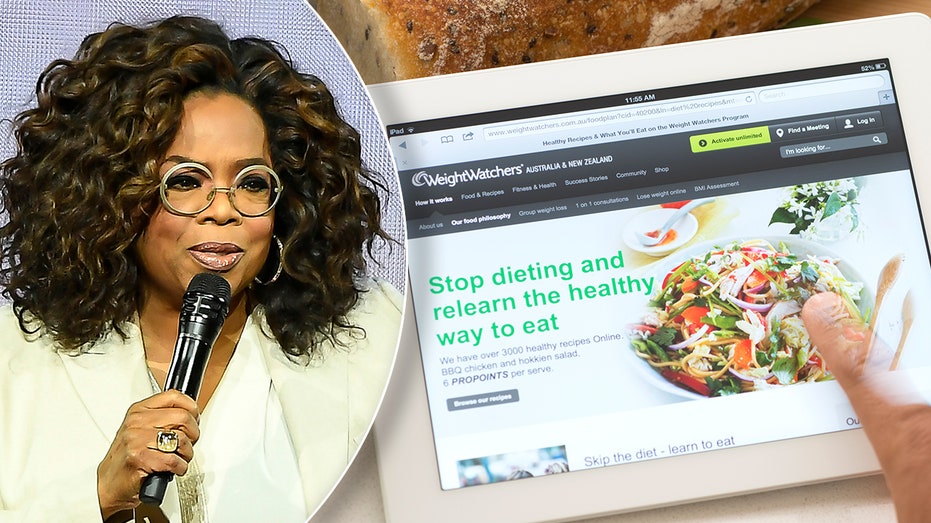

Publicly traded weight-loss companies like Medifast and Oprah Winfrey’s WW International were clobbered when coronavirus lockdowns forced Americans from New York to California to hunker down back in March.

Medifast’s stock on March 17 plummeted 53 percent from the start of the year, while WW’s shares plunged 68 percent.

BAR RESCUE STAR SLAMS GOVERNMENT'S CORONAVIRUS RESTRICTIONS ON RESTAURANTS WITHOUT STIMULUS PROGRAM

But the stay-at-home trend is now fueling demand for weight loss services. And the clamoring is only expected to grow as droves of Americans pledge to lose weight in the new year, experts say.

“There is a lot of anecdotal research showing that this will be a banner year for the weight loss business,” said dietician Michele Smallidge.

The stay-at-home trend is now fueling demand for weight loss services. And the clamoring is only expected to grow as droves of Americans pledge to lose weight in the new year,

Many Americans have added an extra five to 10 pounds over the past nine months as people stopped commuting to work and increasingly turned to food and alcohol to manage stress, said Smallidge, who is also program director of the Bachelor of Science Program in Exercise Science at the University of New Haven in Connecticut.

That helped New York-based WW, formerly known as Weight Watchers, fatten its subscriber base to 4.7 million in the quarter ended Sept. 26, an increase of 5 percent over last year — despite the company being forced to shutter thousands of indoor spaces where its dieters had gathered for years prior to the pandemic.

WW, which boasts Winfrey as a major investor and pitchwomen, had to beef up its digital business model to survive and it now brings in less revenue because the digital service costs just $21 a month, compared to the $45 fee for the studio program.

CORONAVIRUS RESTRICTIONS IN NYC MAKE IT 'VERY TOUGH' TO MAKE MONEY: CHEF DAVID BURKE

While the revenue loss has weighed on WW’s stock, Wall Street analysts are now predicting the company will emerge from the pandemic bigger than ever.

Lane Research analyst Doug Lane is forecasting that WW’s subscribers will grow by 12.6 percent next year instead of the 9 percent growth rate he had estimated before the company’s latest financial results.

And DA Davidson analyst Linda Bolton Weiser has raised her price target for WW three times since June, most recently to $38 on Dec. 9.

“I like the weight loss sector right now, because people have gained more weight and are more sedentary,” Bolton Weiser said.

Baltimore-based Medifast Inc., which sells pre-packaged powders and bars combined with personal coaching advice, has also seen demand skyrocket — fattening its bottom line. “Medifast has been beating Wall Street’s expectations since the pandemic hit,” Lane told The Post.

Sales in the quarter ended Sept. 30 grew a massive 43 percent to $271 million, besting Wall Street’s expectations for revenue of $240.6 million. Earnings per share came in at $2.91 a share, also beating Wall Street’s estimates of $2.49 a share.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The stock is now up 85 percent for the year after closing on Christmas Eve at $196.65 a share.

Trilby Barton started Medifast’s Optavia diet program in August after the pandemic worsened her binge-eating habit, which she says was triggered the year earlier by a miscarriage.

“That nasty habit escalated when I didn’t have any structure to my day,” Barton said of working from home during the pandemic. She’s lost 42 pounds on the program, which sells branded food products including brownies and mac-and-cheese, along with personalized coaching.

The market for diet coaches, who get paid for recruiting new users, including by boasting about their success on social media, is also soaring — doubtlessly boosted by record unemployment.

CLICK HERE TO READ MORE ON FOX BUSINESS

“We achieved a record number of coaches, more than we’ve ever had in the history of the company,” Medifast’s Chief Executive Dan Chard told The Post of the company’s 31 percent rise to 42,100 coaches. “That is the best indicator of how we will perform in 2021,” he said.

Manhattan-based dieting app Noom is also seeing demand for coaching positions skyrocket — putting it on track to double its 2020 revenue to $400 million over last year.

“We don’t know if people are signing up for Noom because of Covid, but we’ve added more than 900 coaches over the past three months alone,” Noom co-founder and chief executive, Saeju Jeong told The Post. The new hires represent more than a third of Noom’s 3,000 coaches.