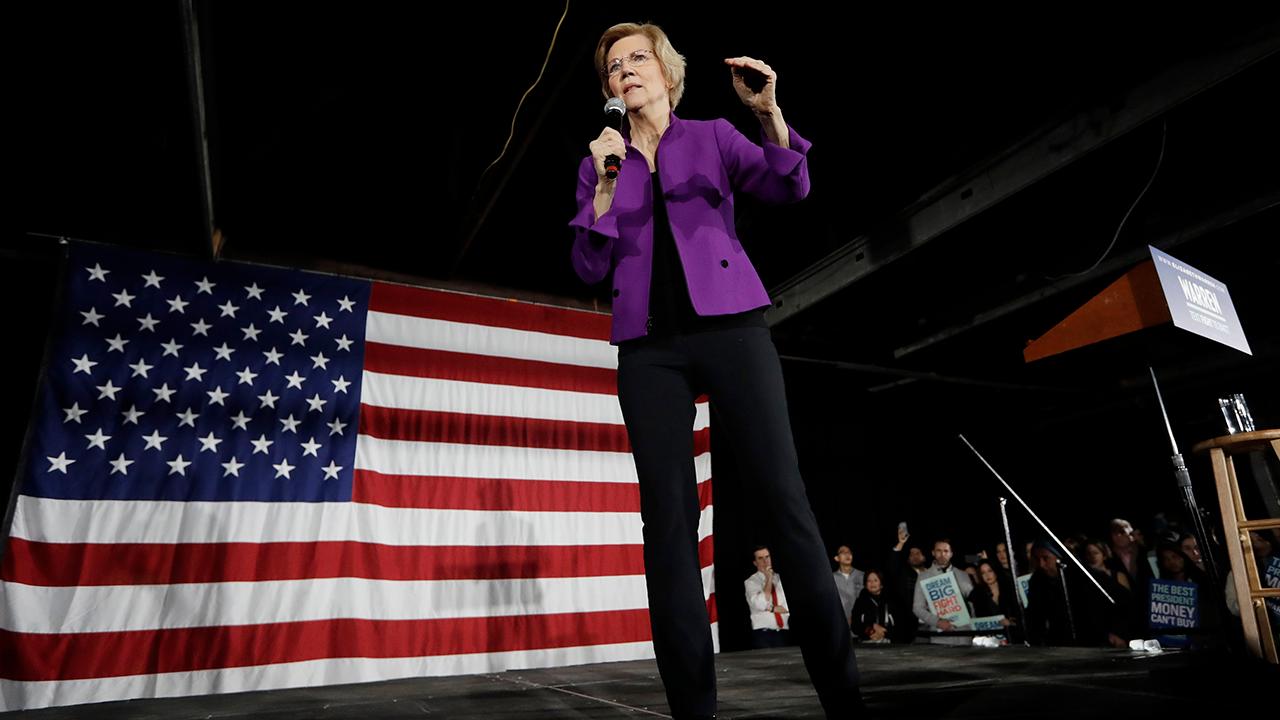

Elizabeth Warren's tax on corporate profits would reduce GDP, wages and jobs: study

Massachusetts Sen. Elizabeth Warren, who is running for the Democratic presidential nomination in 2020, has unveiled a slew of tax proposals throughout recent months – including one that could meaningfully hamper economic growth.

Warren’s Real Corporate Profits Tax, which would levy a 7 percent tax on every dollar of profit a company reports above $100 million, would have many negative effects on the U.S. economy over the long-term, according to a new analysis from the conservative Tax Foundation.

Because such a tax would reduce incentives to invest in the U.S., GDP would shrink by an estimated 1.9 percent over the long-term, and reduce a firm's capital by 3.3 percent, the Foundation said.

Less capital formation would decrease output which would therefore also negatively affect workers.

The Foundation's researchers estimate that wages would drop by about 1.5 percent, while 454,000 full-time jobs could be eliminated.

After-tax income across the entire economy would be reduced by 0.93 percent, with the biggest reductions seen for the top 1 percent of taxpayers. However, taxpayers of all income groups would be affected. Taking into account the fact that the proposal could cause the economy to shrink, the reduction in after-tax income could be even larger at an average of 2.16 percent.

“Shareholders bear the burden of the corporate tax directly through reduced after-tax returns on their investments,” researchers wrote. “Workers bear the burden of the corporate tax indirectly through reduced compensation.”

Over the course of a decade, the Tax Foundation estimates the legislation would raise $872 billion, while corporate tax collections would be $79 billion higher in 2020. By 2029, that figure could hit $102 billion as corporate profits increase.

CLICK HERE TO GET THE FOX BUSINESS APP

Warren said the goal of the legislation was to address a loophole whereby some of the country’s most profitable companies rake in billions of dollars in profits, yet pay $0 in federal income taxes. Her tax would be assessed on the profits reported to shareholders, not what is reported to the IRS.

Warren opted for this route instead of raising the corporate tax rate in order to prevent companies and their “armies of lawyers” from finding loopholes.