Ex-Fed Chair Alan Greenspan sees a US recession as the ‘most likely outcome’

Americans are likely to withstand 'a lot of pain' in the first half 2023

Fed's recent rate hikes expected to ‘bite’ in 2023: Darrell Cronk

Darrell Cronk, Chief Investment Officer for Wealth & Investment Management, and Advisor Group chief market strategist Phil Blancato react to former Federal Reserve Chair Alan Greenspan saying that a U.S. recession is likely.

Former Federal Reserve Chair Alan Greenspan warned Americans that an economic recession is the "most likely outcome," as the central bank continues to tighten monetary policy to fight inflation.

Former New York Federal Reserve President William Dudley reinforced Greenspan's claims, saying that a U.S. recession is "likely" forthcoming because the Federal Reserve's rate hikes are inducing one.

FED OFFICIALS EXPECT TO KEEP INTEREST RATES ELEVATED FOR 'SOME TIME,' MINUTES SHOW

Chief Investment Officer for Wealth and Investment Management Darrell Cronk reacted, Wednesday, to the former Federal Reserve officials' grim predictions for 2023, telling FOX Business' "Making Money" guest host Lauren Simonetti he agrees that a recession is the "likely outcome" to the U.S.'s feeble economy.

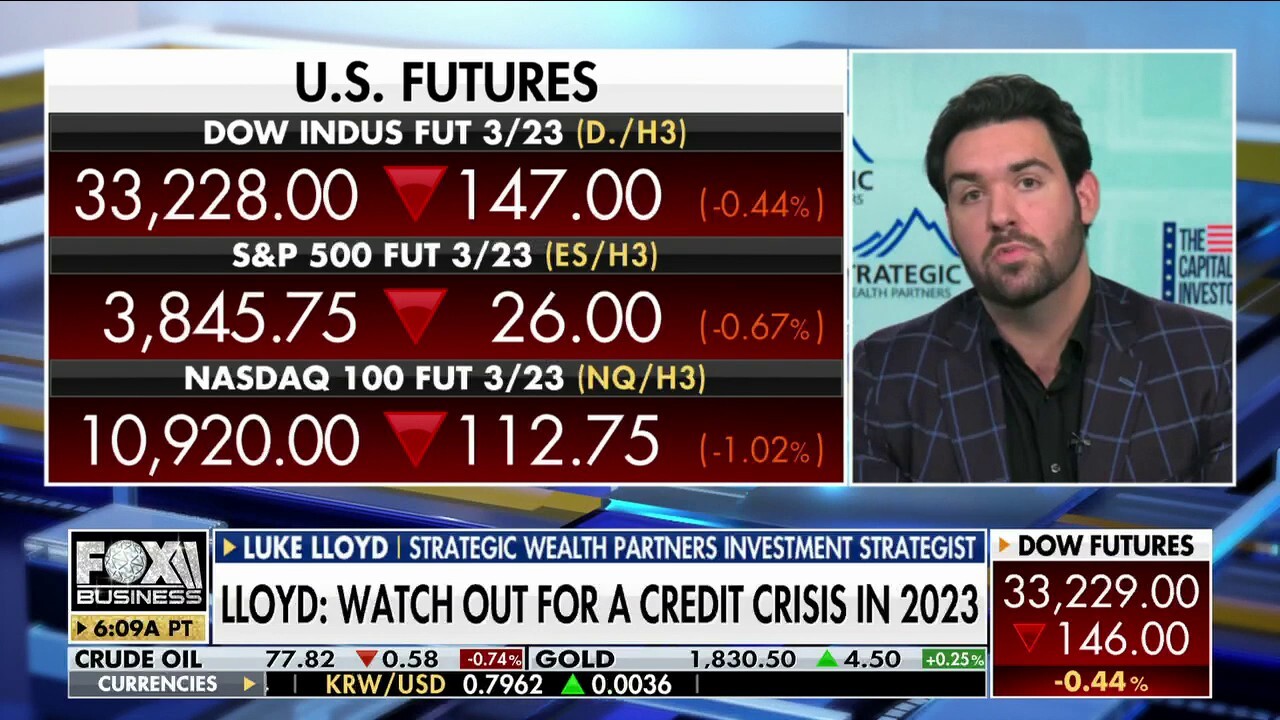

Mild recession, credit crisis are risks for 2023: Luke Lloyd

Strategic Wealth Partners investment strategist Luke Lloyd addresses the biggest risks for the 2023 economy, which could include a mild recession and a credit crisis.

"I tend to agree more with Alan Greenspan that it's {recession] probably the likely outcome," Cronk said Wednesday.

"And keep in mind, it's not just interest rate hikes or cuts for that matter. It's the combination of the money, supply is tightening, the stronger U.S. dollar has put pressure on financial conditions. Bank reserves are running off. So there's a whole myriad of other elements that are also conspiring to tighten financial conditions simultaneously," Cronk explained on "Making Money with Charles Payne."

Alan Greenspan is a former Federal Reserve chairman who led the U.S. central bank for nearly two decades. (Reuters / Reuters Photos)

On the other hand, he refuted Dudley's argument that the Federal Reserve's rate hikes are what's causing a recession, clarifying that he doesn't believe the incremental raises are solely responsible. While Cronk noted the Fed's involvement is "a great point," he said he would have to take "a little bit" of the other side of the argument into consideration.

"I'm not sure that just simply cutting rates would do it [avoid a recession]. There's the lag effect that we all know about with monetary policy. So typically 6 to 9 months, which means, if you use that as the lag effect, we're just now feeling the June 75-basis point and maybe the July 75-basis point hikes," Cronk explained.

US HEADED FOR RECESSION AND ANOTHER INFLATION SPIKE IN 2023, FAMED INVESTOR MICHAEL BURRY SAYS

"We've yet to feel the 75 in September, the 75 in November and the 50 in December, and whatever else we do here in 2023. So that's going to bite in the first half of 2023," he added.

Study: Inflation hitting the middle class the hardest

Former Dallas Fed Adviser Danielle DiMartino Booth discusses the impact of inflation on the middle class and how major expenses are outpacing wage increases on ‘Fox Business Tonight.’

Cronk went on to argue that consumers are going to experience a "two-sided coin" in 2023 - with the first half of the year being particularly difficult - but said the second half is likely to see improvements.

"I think you get a strong rally in the second half, but, be weary of the first half because there's a lot of pain yet to feel," he cautioned.

Fed ‘behind the curve,’ going to create more pain in 2023: Warren Pies

3Fourteen Research founder Warren Pies unpacks his economic outlook for 2023 on ‘Making Money.’

"I mean, you know, everybody wants inflation to come down to two, two and a half percent, including Chair Powell of the Federal Reserve. But there's a lot of pain to go from 6.7 on the CPI, 6.7 down to 2.0 between here and there," Cronk concluded.

GET FOX BUSINESS ON THE GO BY CLICKING HERE