Fed's George says it's time to start tapering asset purchases

Fed's Kansas City Federal Reserve president: Tapering should begin 'sooner rather than later'

KC Fed president: Better to taper sooner rather than later

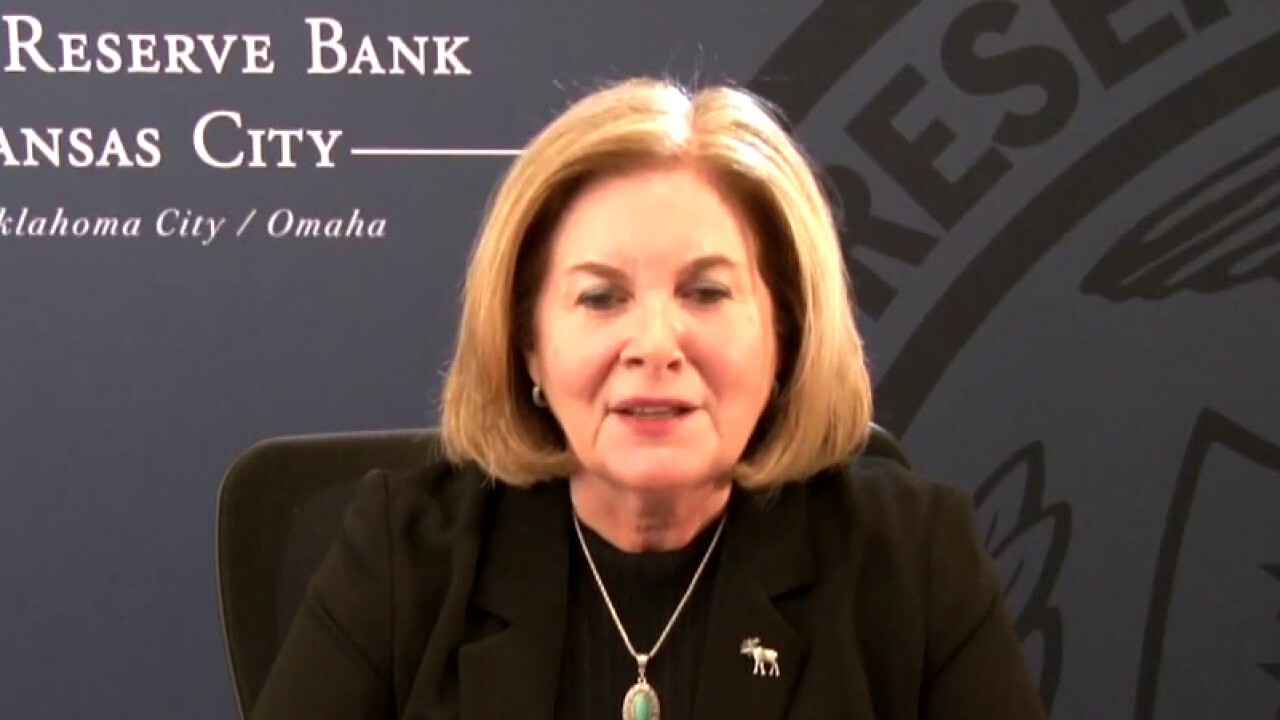

Kansas City Federal Reserve Bank President Esther George on the U.S. economy and tapering measures.

Kansas City Federal Reserve President Esther George said Thursday the U.S. central bank should begin winding down its massive bond-buying program as the U.S. economy continues to recover from the COVID-19 pandemic.

Though George did not mention specifics about tapering the Fed's $120 billion in monthly purchases Treasuries and mortgage-backed securities – including a start date or amounts – she suggested policymakers should begin sometime this year.

"I'm less precise about amounts and dates, and really more focused on saying: Sooner rather than later," she told FOX Business' Edward Lawrence. "With a baseline outlook that suggests we're going to continue to see job gains, continue to see strong growth, it suggests we can begin to make some of those adjustments this year."

FED BALANCE SHEET TOPS $8T FOR THE FIRST TIME

For months, the U.S. central bank has been grappling with conflicting economic data – surging inflation but slower-than-expected job growth, coupled with the new threat posed by the highly contagious delta variant – and when to begin unwinding the ultra-easy monetary policies implemented to keep the economy afloat in March 2020.

The issue has been complicated by a sharp divergence of opinions among members of the Federal Open Market Committee; minutes from the Fed's July meeting show that while "most" officials are prepared to reduce the $120 billion in monthly asset purchases this year, others think it best to wait until 2022.

George – who will be a voting member of the FOMC next year – is among the most hawkish Fed officials. She suggested that policymakers will provide further insight into reducing asset purchases during the Fed's September meeting, which ends on Sept. 22.

CLICK HERE TO READ MORE ON FOX BUSINESS

"That adjustment process, the conversation about that is already underway," she said. "I think the communication about that coming out of our September meeting will reflect the deliberations and the views of the committee on how that progress is being achieved."

Her comments come during the Fed's annual economic symposium; while traditionally it's held in Jackson Hole, Wyoming, the gathering was switched to a virtual single-day meeting at the last minute due to concerns about the highly contagious delta variant.

Chairman Jerome Powell is slated to deliver a keynote speech Friday morning, although investors expect the Fed head to steer clear of tapering details.

"We probably won’t get clarity on the timing, magnitude and roadmap on tapering that the market is craving," said Joe Brusuelas, RSM chief economist. "It’s been years since [Alan] Greenspan and [Ben] Bernanke utilized Jackson Hole to make major policy pronouncements that moved global financial markets."