Fed’s Powell pledges inflation fight in renomination hearing

Consumer prices rose 6.8% in November, while producer prices soared 9.6%

Federal Reserve Chairman Jerome Powell testifies at a nomination hearing in front of the Senate Banking, Housing, and Urban Affairs committee

Federal Reserve Chairman Jerome Powell testifies at a nomination hearing in front of the Senate Banking, Housing, and Urban Affairs committee.

Federal Reserve Chairman Jerome Powell hammered home the central’s bank commitment to cooling red-hot inflation as he made his case for a second term.

Stocks reversed losses as his testimony concluded.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 50115.67 | +1,206.95 | +2.47% |

| SP500 | S&P 500 | 6932.3 | +133.90 | +1.97% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23031.213218 | +490.63 | +2.18% |

HERE'S WHERE SURGING PRICES ARE HITTING CONSUMERS THE MOST

"I think that inflationary pressures do seem to be on track to last well into the middle of next year. And if they last longer than that, then I'll just say that our policy will continue to adapt," he said.

CONSUMER PRICES JUMP TO HIGHEST IN 31 YEARS

Policymakers underestimated the rapid uptick in prices coining the ascent "transitory" even as costs skyrocketed.

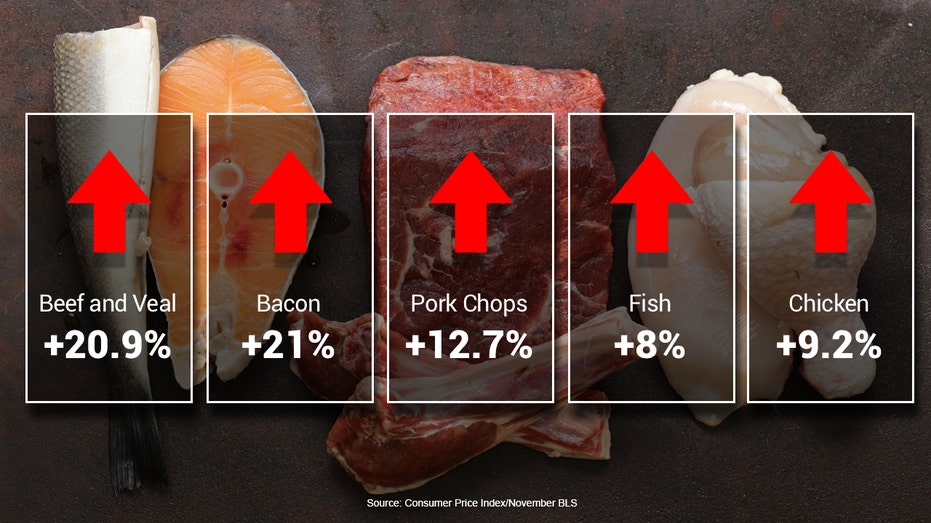

Everything from gas, home heating fuel and appliances cost more, with beef, veal and bacon up by double-digits.

The Consumer Price Index jumped 6.8% in November, while prices at the producer level soared by a record 9.6%. Powell, during the Fed’s final meeting of 2021, gave a mea culpa on the wrong way call.

"These problems have been larger and longer lasting than anticipated, exacerbated by waves of the virus. As a result, overall inflation is running well above our 2 percent longer-run goal and will likely continue to do so well into next year" he said.

Following the meeting, Larry Summers, who served as Treasury Secretary under President Clinton and National Economic Council Director under President Obama, called Powell out-of-touch.

FED BEHIND THE CURVE: LARRY SUMMERS

Former Treasury Secretary and White House Economic Advisor Larry Summers is interviewed by FOX News' Maria Bartiromo at FOX Studios on May 24, 2017, in New York City. (Robin Marchant/Getty Images / Getty Images)

"A recognition of the need to change direction, as manifest in the Federal Open Market Committee statement and Chair Jerome H. Powell’s news conference Wednesday, was necessary but not sufficient for successfully achieving price stabilization and sustained growth. I see grounds for substantial concern in both the intrinsic difficulty of the task at hand and in misconceptions that the Fed still seems to hold," Summers wrote in a commentary.

THREE RATE HIKES WON'T FIX INFLATION

Last week, during the minutes of that meeting, policymakers disclosed they may need to accelerate the pace of rate hikes this year to cool inflation sending U.S. financial markets into a tailspin and the yield on the 10-Treasury to a 12-month high.

All three of the major averages are in the red this year, with the Nasdaq Composite off 4.5%, while the S&P 500 has dropped 2% and the Dow Jones Industrial Average down 0.7%.

Powell was first nominated as chair under President Trump replacing Janet Yellen, who went onto to become President Biden's Treasury secretary.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Fresh data on the CPI is due Wednesday, with economists forecasting a 7.1% jump, while the PPI, out the following day, is seen jumping 9.8%.