House passes tax reform 2.0 to make cuts permanent

Republicans have sped legislation through the House to expand their massive new tax law, capping their session for the year as they rush out of town to face voters in the November elections. The new bill would make permanent the individual and small-business tax cuts in the law.

Friday's vote was 22-191 in the Republican-led House to approve the legislation. The vote was mostly along party lines. Democrats continued their solid opposition to tax-cut legislation, asserting it favors corporations and wealthy individuals over middle-income Americans.

It's the second tax-cut proposal that Republican leaders have pushed in less than a year.

“On top of making lower rates for individuals and small businesses permanent, these bills create new savings options for families to plan for education and retirement," House Speaker Paul Ryan said in a statement obtained by FOX Business.

Prospects for the legislation in the Senate are weak, given the slim Republican majority and concern over the potential for further blowing up the deficit.

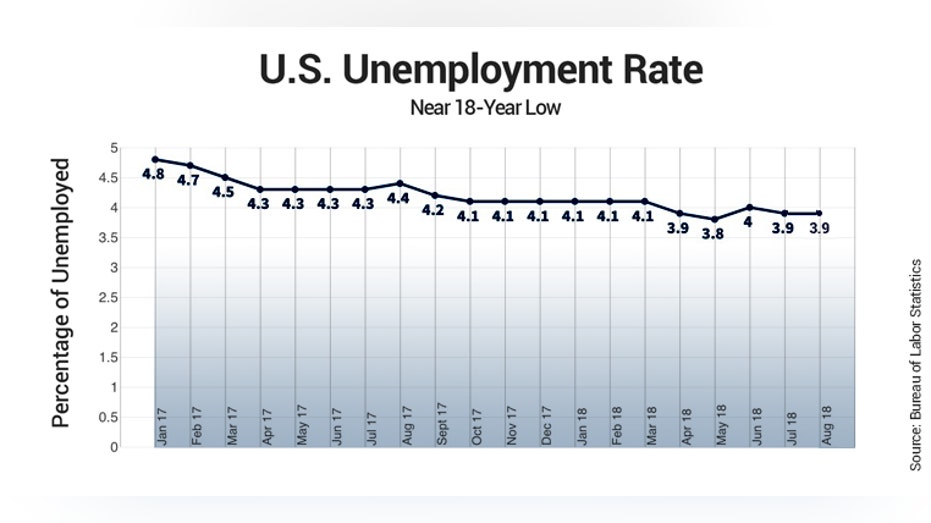

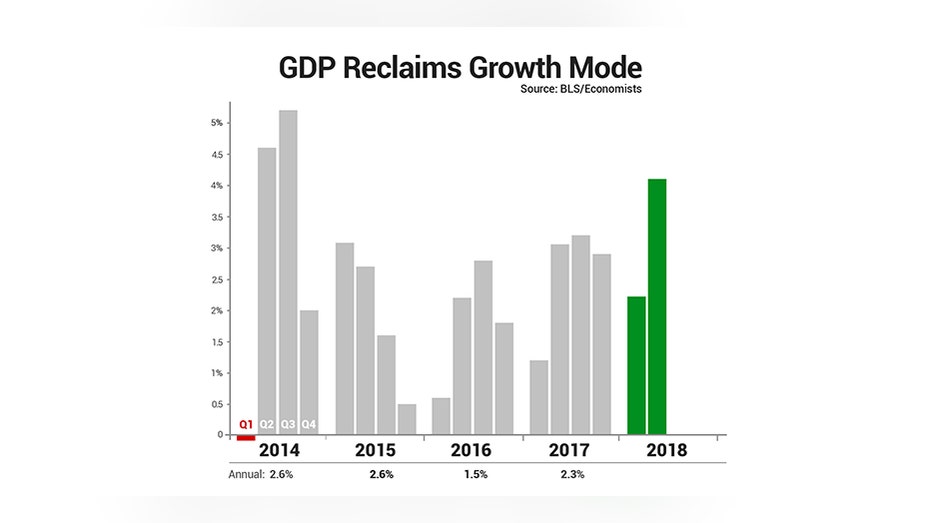

President Trump's historic tax reform plan, enacted late last year, has been credited with reviving the U.S. economy. Second-quarter GDP grew 4.2%, the strongest showing since 2014. Jobs are plentiful with U.S. unemployment falling to 3.9 percent. Additionally, U.S. stocks are sitting at record levels.

The Associated Press contributed to this report.