Housing market goes from bad to worse

Housing starts, builder confidence continue to fall

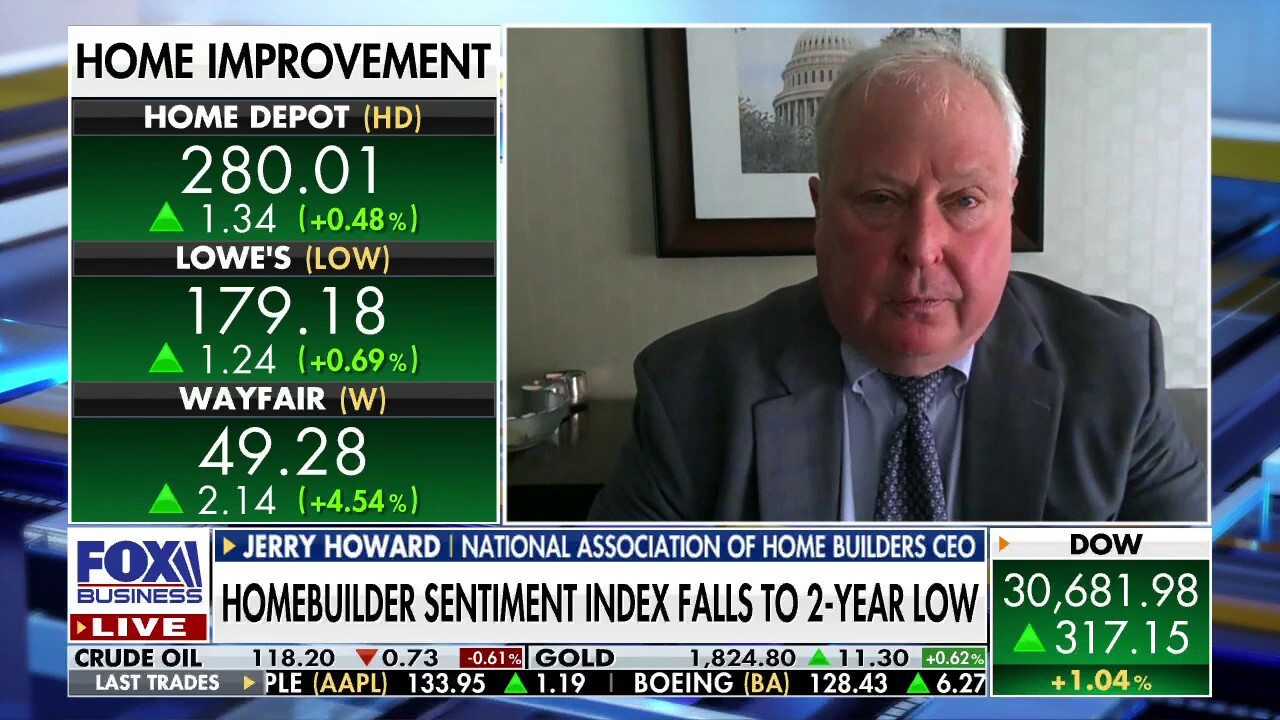

Housing market facing a 'perfect storm' amid inflation, higher mortgage rates: NAHB CEO

Jerry Howard, the CEO of the National Association of Home Builders, provides insight into the housing market amid economic challenges.

The U.S. housing market continues to get pummeled by rising interest rates and soaring inflation, and data released this week shows things have gone from bad to worse.

Housing starts tumbled 14.4% to a 13-month low in May to a seasonally adjusted annual rate of 1.549 million units, and permits for new construction fell 7% to 1.695 million, according to data released Thursday by the Census Bureau.

Contractors work on a home under construction in Antioch, California, US, on Tuesday, June 14, 2022. (Photographer: David Paul Morris/Bloomberg via Getty Images / Getty Images)

The declines were much steeper than analysts expected: Economists surveyed by Refinitiv forecasted that housing starts would only fall by 1.3%, and that building permits would drop by 2.1%.

REDFIN LAYS OFF 8% OF WORKERS, FORECASTS YEARS OF FEWER HOME SALES AMID RATE HIKES

Perhaps unsurprisingly, home builder confidence is down, too.

The National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index released Wednesday showed that builder confidence in the market for newly built single-family homes fell for the sixth straight month in June, dropping two points from the month before to 67. The NAHB said in a press release that the ongoing decline in builder confidence was a "troubling sign for the housing market."

A contractor works on a home under construction in Antioch, California, US, on Tuesday, June 14, 2022. (Photographer: David Paul Morris/Bloomberg via Getty Images / Getty Images)

"The housing market faces both demand-side and supply-side challenges," said NAHB chief economist Robert Dietz.

MIGRATION FROM BIG CITIES BOOSTS HOUSING PRICES IN SMALLER MARKETS

"Residential construction material costs are up 19% year-over-year with cost increases for a variety of building inputs, except for lumber, which has experienced recent declines due to a housing slowdown," he said. "On the demand-side of the market, the increase for mortgage rates for the first half of 2022 has priced out a significant number of prospective home buyers, as reflected by the decline for the traffic measure of the HMI."

A contractor carries new doors to a home under construction in Antioch, California, US, on Tuesday, June 14, 2022. (Photographer: David Paul Morris/Bloomberg via Getty Images / Getty Images)

Rates are expected to keep climbing as the Federal Reserve hikes rates in an effort to tame inflation, which sits at a 40-year high.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The latest data from Freddie Mac shows the average rate for a 30-year fixed-rate mortgage surged to 5.78% last week, up more than 50 basis points from 5.23% the week before, marking the largest increase since 1987. The 5.87% level is the highest since November 2008.