How a change in Washington attitude has moved markets

A strong U.S. economy is mostly thanks to business-friendly policies enacted by the Trump administration – and it’s unlikely to slow down anytime soon, according to the founder and chairman of Equity International.

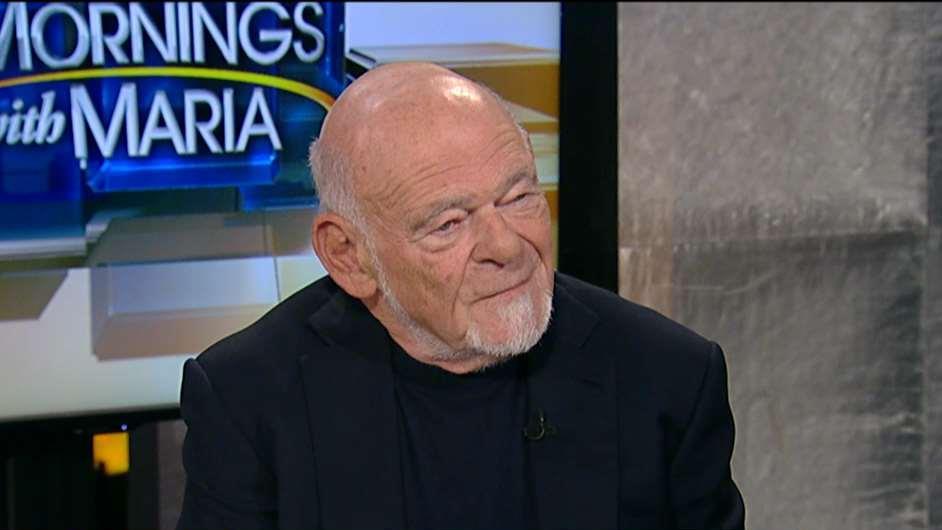

“Generally speaking, I think the economy is doing as well as it has because there’s been a change in attitude in Washington,” Sam Zell said on Wednesday during an interview with FOX Business’ Maria Bartiromo.

Zell largely attributed that to President Trump’s efforts to deregulate business, like rolling back key portions of the Dodd-Frank Act in May, or signing legislation to end Obama-era rules that restricted the coal mining industry.

Under Trump, Republicans also passed a massive tax overhaul – the biggest since Ronald Reagan was president – that slashed the corporate tax rate by 14 percentage points.

“Somebody described it to me the other day, they’re in a heavily regulated industry, and prior to the 2016 election, every discussion with the regulator was how much the punishment should be,” Zell said. “And today, every conversation with a regulator is, ‘How do we avoid a punishment?’ That's a huge, huge change of circumstance.”

Despite that, a number of investors have predicted the record-long bull run may be coming to an end soon. (In a FOX Business interview, the vice chairman of Blackstone Advisory Partners warned the next recession would likely occur after the next presidential election.)

Zell, however, said that some analysts have been predicting an end to the economic boom for years, but it still hasn’t come. He also said the current economic stability will not necessarily change just because the Federal Reserve may hike interest rates as many as three to four times this year.

“Everybody has been predicting the two-year slow down for four years now,” he said. “And for four years, we haven’t had an end to the longest string of positive scenarios. Almost 10 years of a positive environment.”