Inflation creating 'stress' in the economic environment: Philadelphia Fed board member

Chris Maher weighs in on how long it will take to control inflation

Is a recession in the US expected? Philadelphia Fed board member weighs in

Chris Maher weighs in on the current economic climate on "Mornings with Maria," arguing that a recession will be "mild" in the event that it happens.

Chris Maher, a Federal Reserve Bank of Philadelphia board member, argued that inflation is creating "stress" in the environment that will "take a while" to get under control.

The OceanFirst Financial CEO also noted on Tuesday that rising prices for all goods, especially food and energy, are "making a significant impact."

"There are real concerns in the economy," he stressed, speaking on "Mornings with Maria" four days after it was revealed that inflation remained painfully high in May with consumer prices hitting a new four-decade high that exacerbated a financial strain for millions of Americans.

The Labor Department said Friday that the consumer price index, a broad measure of the price for everyday goods, including gasoline, groceries and rents, rose 8.6% in May from a year ago. Prices jumped 1% in the one-month period from April. Those figures were both higher than the 8.3% headline figure and 0.7% monthly gain forecast by Refinitiv economists.

YELLEN CALLS ELEVATED INFLATION 'UNACCEPTABLE,' BUT OFFERS FEW SOLUTIONS TO COOL PRICES

Does the Federal Reserve need to raise rates to tamp down inflation?

Andrew Brenner and Peter Schiff provide insight on the Federal Reserve and inflation on 'The Claman Countdown.'

The figure marks the fastest pace of Inflation since December 1981.

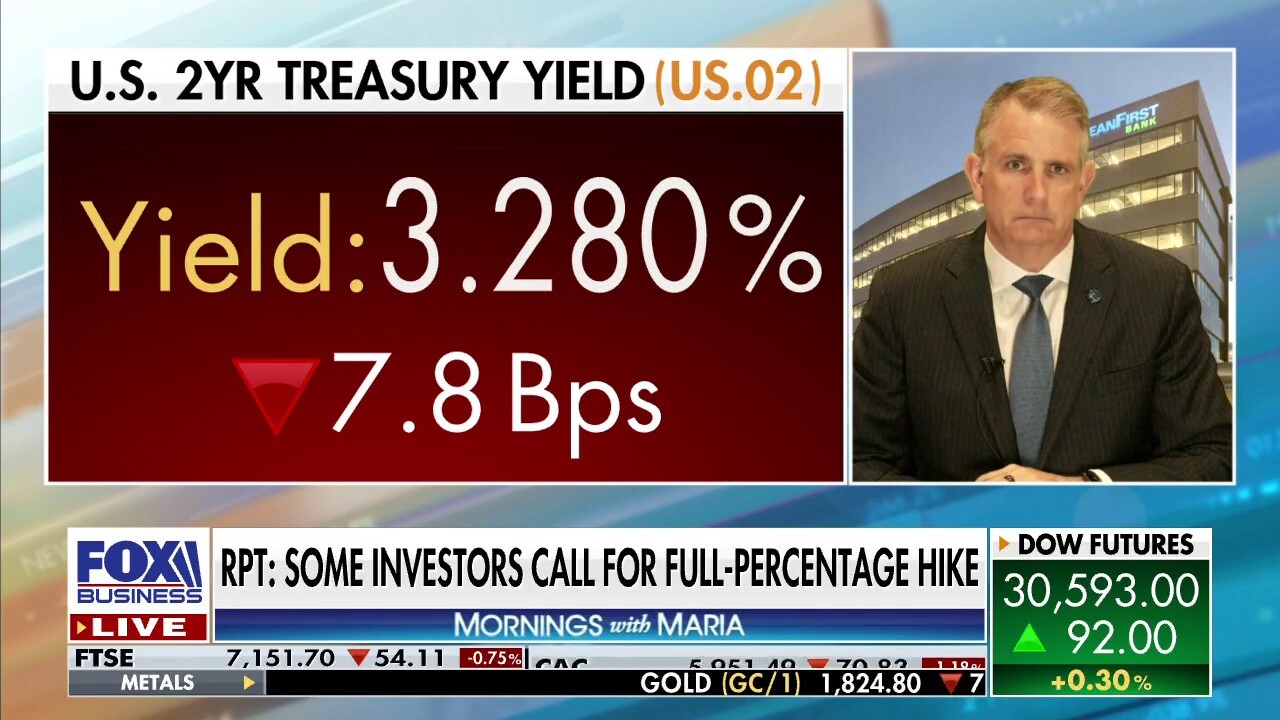

The dismal May inflation report has some Wall Street economists betting that the Federal Reserve will raise interest rates by 75-basis points this month or next as policymakers try to tame runaway consumer prices.

Federal Reserve Chairman Jerome Powell rebuffed the possibility of a 75-basis point interest rate hike at the beginning of May following a policymakers' meeting at which they voted to lift rates by a half-point. Officials have signaled that half-point rate hikes are on the table in June and July, although it's unclear how Friday's report could affect that.

"To have a soft landing is going to be particularly difficult this time around," Maher warned on Tuesday. "We’ve had such an unusual set of circumstances between the pandemic and other items that make it just very, very tricky."

"There’s been a lot of money put into the money supply. There’s been a tremendous amount of inflation; it’s very broad-based. We have the continuing disruptions in supply chains, so it’s going to be very difficult to kind of feather that down to a soft landing," he continued.

The CEO of OceanFirst Financial argues it will be difficult to have a soft landing as inflation sits at 40-year highs. (iStock / iStock)

Policymakers are trying to cool consumer demand enough so that prices stop rising, but if they fail, they risk throwing the country into a recession. That elusive sweet spot between curbing demand without crushing the economy is what's known as a soft landing – and history shows that the Fed often struggles to successfully thread the needle between tightening policy and preserving growth.

Maher said he believes, in the event there is a recession in the United States, "it may be a very mild one" - more like "the recession you saw with the dot-com issue, and nothing like the credit recession you saw in 2008."

The dot-com bubble was a quick rise in U.S. equity valuations mostly due to investments in internet-based companies in the late 1990s.

RECESSION RISKS GROW AS DISMAL INFLATION REPORT ERODES ODDS OF FED 'SOFT LANDING'

The previous two recessions were likely caused by what’s known as an "asset bubble." Although neither featured a large increase in price inflation, both featured the rapid growth and subsequent bursting of asset bubbles. The 2001 recession was preceded by the dot-com bubble burst, and the 2007-2009 recession was preceded by the housing bubble.

Asset bubbles develop when the economy is thriving and investors in a particular asset purchase large quantities of that asset on the belief that it will sell for a higher price. But if those asset prices plummet, and if enough people had significant exposure to that asset, it could drain the value of people across the country.

Inflation will 'take a while' to get under control: OceanFirst Financial CEO

OceanFirst Financial CEO Chris Maher, a Federal Reserve Bank of Philadelphia board member, argues that if the U.S. heads into a recession it will be 'mild.'

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"I think we can look forward to maybe a much more benign cycle than you would have had in previous cases," Maher argued on Tuesday, stressing that currently "we are in a way different environment" compared to 2008.

"I don’t think we’ve got much risk at all going into a typical credit recession, which would be a much more destructive event," he concluded.

FOX Business’ Megan Henney contributed to this report.