Inflation nation heats up as CEOs to White House talk prices

The Federal Reserve seeks to anchor inflation around 2%

How investors can find opportunity in inflation: Expert

Richard Bernstein Advisors CEO Richard Bernstein provides insight into economic recovery, the markets, inflation, taxes and what to expect from America’s GDP.

Inflation talk, after years of being dead in the water, is gaining momentum on Main and Wall Street as reports of higher prices at the grocery store and the pump, with gas averaging $2.91 a gallon per AAA, are fueling the conversation.

"Mentions of "inflation" are now up nearly 800%" compared to the year-ago first-quarter earnings season, noted the team at Bank of America led by Savita Subramanian.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:COMP | NASDAQ COMPOSITE INDEX | 23238.66991 | +207.46 | +0.90% |

| SP500 | S&P 500 | 6964.82 | +32.52 | +0.47% |

| I:DJI | DOW JONES AVERAGES | 50135.87 | +20.20 | +0.04% |

Inflation chatter turned hotter on Tuesday after U.S. Treasury Secretary Janet Yellen gave her take on managing the economic rebound.

YELLEN SAYS RATE MAY NEED TO RISE TO HANDLE INFLATION

"It may be that interest rates will have to rise somewhat to make sure that our economy doesn’t overheat," she said during a summit hosted by The Atlantic. Her remarks put downward pressure on U.S. equities.

Consumer prices jumped 2.6% in March compared to the same period a year ago, the highest year-over-year rise since August of 2018.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| KMB | KIMBERLY-CLARK CORP. | 104.70 | +0.37 | +0.35% |

Companies including Kimberly Clark, maker of Cottonelle toilet paper, said it would raise prices before the end of June "across a majority of its North America consumer products business" to help offset "significant commodity cost inflation." Freight costs are also rising as companies try to navigate what was pent-up-pandemic demand.

Still, the threat of runaway inflation is not much of a threat, according to Richard Bernstein of Bernstein Advisors.

"Demand has picked up so rapidly that we are seeing some short-term bottlenecks but the longer-term story is I think we will see more inflation than people think, rather than less, but don’t think the 1970s. That’s way too extreme," he remarked during an appearance on "Mornings With Maria" on FOX Business.

Photo by Monica Schipper/Getty Images

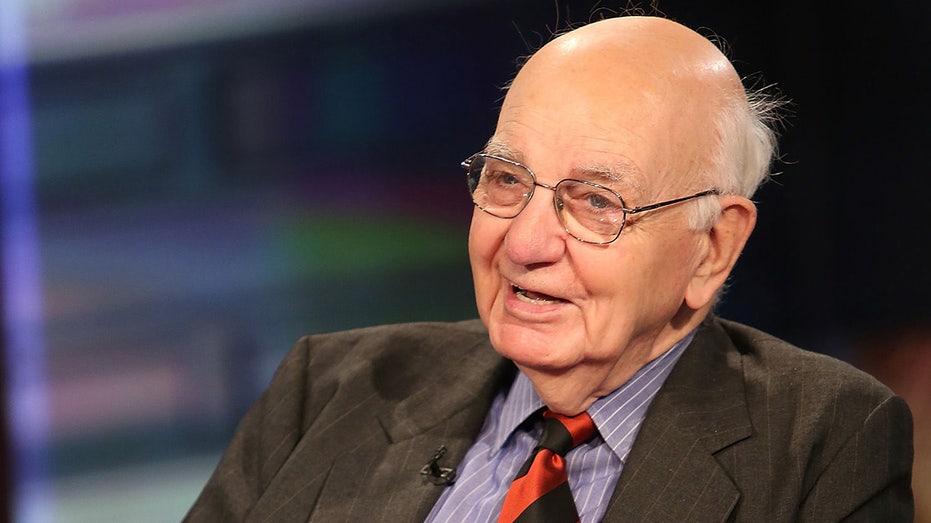

During the heyday of the '70s inflation was running around 11% as Paul Volcker became Federal Reserve Chairman. Currently, inflation remains below the Fed's 2% longer-term goal.

THESE ITEMS ARE DISAPPEARING FROM COSTCO SHELVES

BofA also added that companies are successfully managing higher costs. "Record net margins suggest inflation has been manageable so far", which means companies are able to still reap profits minus expenses.

The White House, also chimed in Tuesday, echoing recent comments from the Federal Reserve.

KIMBERLY CLARK TO RAISE PRICES

"We also take inflationary risk incredibly seriously, and our economic experts have conveyed that they think this would be temporary and that the benefits far outweigh the concern," said White House Press Secretary Jenn Psaki.

Policymakers, which left interest rates near zero last month, observed "Inflation has risen, largely reflecting transitory factors" but chose to remain "accommodative" until the U.S. economy fully heals from the pandemic.

Many see the bounce back from consumers as a positive sign for the recovery.