Inflation nation: These states are paying the highest prices

Inflation costs the average American family $385 more per month: JEC

The fed knows it’s ‘way behind’ the curve as inflation hits 40-yr high: Larry Lindsey

Former economic council director Larry Lindsey discusses 40-year high inflation rates and the effects of Russia’s invasion of Ukraine on ‘Wall Street.’

President Biden, in his first State of the Union, addressed the elephant in the room: fixing inflation via more government spending.

"I have a better plan to fight inflation, lower your costs, not your wages, make more cars and semiconductors in America, more infrastructure and innovation in Americab…," he said, alluding to his Build Back Better plan, which calls for at least $2 trillion in spending.

RUSSIA INVADES UKRAINE: LIVE UPDATES

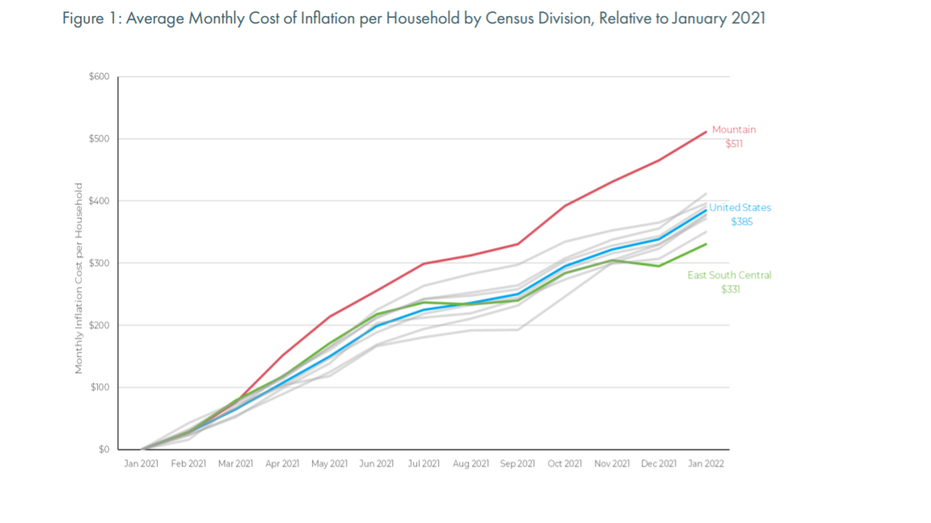

(Source: Joint Economic Committee/Sen. Mike Lee (R-UT))

While some economists debunk his plan to fix inflation, for most Americans' relief can’t come soon enough. Hours ahead of Biden’s speech, U.S. oil hit $106 per barrel and climbed higher during his address, complicating already sky-high fuel prices, which are a big reason why inflation across the board is at record levels. The conflict between Russia and Ukraine is driving energy prices even higher.

INTEL ONE OF BIDEN'S QUIVERS IN SPENDING PUSH

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| USO | UNITED STATES OIL FUND - USD ACC | 76.99 | +0.30 | +0.39% |

INFLATION SLAP: WHERE CONSUMERS ARE PAYING THE MOST

Consumer prices in the U.S. surged 7.5% in January, the most since 1982, while prices at the producer level jumped 9.7%, the highest ever.

On average, American families are paying about $385 more a month for just about everything, but for some, costs are even higher according to a FOX Business exclusive based on a new report from Sen. Mike Lee, R-Utah, ranking member of the Joint Economic Committee.

Lee and his team, including senior economist Jackie Benson, found households in his home state of Utah and the Mountain West region are facing inflation rates of around 9%, adding an extra $511 in costs monthly. In the Pacific, costs are $412 more, while the West North and East North Central, as well as New England and East South Central, are seeing costs of more than $300.

"We also see President Biden doubling down on the same things that have failed. Doubling down on the need for more Federal spending that has caused inflation to skyrocket" said Lee wrote a Twitter response following the State of the Union.

The JEC report dovetails with the view of the economists at the National Association of Business Economics (NABE), who this week in a survey, warned inflation is not going away anytime soon.

INFLATION, MONETARY POLICY MISSTEPS POSE RISK TO US ECONOMY: NABE

"They see a risk that inflation will remain higher than previously expected over the next three years, coming largely from the labor market. More than two-thirds of survey respondents cite rising wages as a risk factor," David Altig, president of the National Association of Business Economics and executive vice president and director of research at the Federal Reserve Bank of Atlanta, said Monday.

Federal Reserve Chairman Jerome Powell. (Associated Press / AP Newsroom)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

All the above are complicating the job of Federal Reserve Chairman Jerome Powell, who is waiting to be reconfirmed. On Wednesday and Thursday he’ll deliver his Semiannual Monetary Policy Report to Congress, and it's likely he’ll be hammered to provide solutions for rising prices after policymakers admittedly said inflation was "transitory" before delivering a mea culpa on that call in December.