Inflation's grip tightens in Mountain states, Midwest as consumer prices surge higher

Consumer prices rose by 9% year over year in certain states last month, well above national average

Inflation dominates talk on Capitol Hill

Congressional correspondent Chad Pergram has the details on 'Cavuto: Coast to Coast.'

American consumers are grappling with the hottest inflation in a generation, and some parts of the country are seeing steeper price increases than others.

The consumer price index rose 7.5% in January from a year ago, according to a Labor Department report released last week, marking the fastest increase since February 1982, when inflation hit 7.6%. The CPI – which measures a bevy of goods, ranging from gasoline and health care to groceries and rents – jumped 0.6% in the one-month period from December.

JANUARY INFLATION BREAKDOWN: WHERE ARE PRICES RISING THE FASTEST?

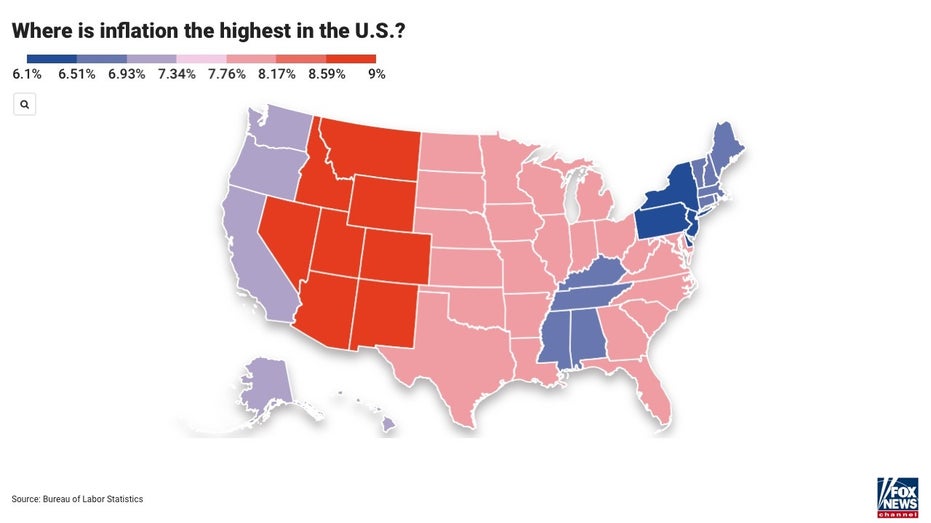

But the increase was starkest in the region that encompasses Montana, Wyoming, Idaho, Nevada, Utah, Colorado, Arizona and New Mexico, with prices surging by a staggering 9%.

Other states are also experiencing inflation that's well above the national average: Prices were up 7.9% in a slew of states, including North Dakota, South Dakota, Nebraska, Kansas, Minnesota, Iowa, Maryland, West Virginia, North Carolina, South Carolina, Georgia, Florida, Texas, Oklahoma, Louisiana, Arkansas, Missouri, Illinois, Wisconsin, Indiana, Michigan and Ohio.

By comparison, prices in the mid-Atlantic – New York, New Jersey and Pennsylvania – were far lower, climbing 6.1% in January from the year-ago period. The New England region experienced the next-lowest rates with 6.6% inflation.

Rising inflation is eating away at strong wage gains that American workers have seen in recent months: Real average hourly earnings rose just 0.1% in January from the previous month, as the 0.6% inflation increase eroded the 0.7% total wage gain, according to the Labor Department. On an annual basis, real earnings actually declined 1.7% in January.

The average American is shelling out an extra $276 a month on goods and services because of inflation, according to a new Moody's Analytics analysis.

The inflation spike has been bad news for President Biden, who has seen his approval rating plunge as consumer prices rose. The White House has blamed the price increases on supply-chain bottlenecks and other pandemic-induced disruptions in the economy, while Republicans have pinned it on the president's massive spending agenda.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Following the data release, Biden acknowledged that higher inflation is creating more financial stress for American families. But he claimed there are "signs that we will make it through this challenge."

"It's a real bump in the road," he told reporters at the White House. "It does affect families when you walk into a grocery store and you're paying more for whatever you're purchasing. It matters to people when you're paying more for gas, although in some states we've got the price down below three bucks a gallon, but the point is it's not gone down quickly enough. But I think it will."