Insurance costs skyrocket in several states after severe weather

Florida and Louisiana have significantly higher home insurance premiums than the national average of $1,899

Insurance premiums skyrocketing in the south due to severe weather

FOX Business’ Ashley Webster reports on the rising costs of home insurance for residents in southern states like Florida and Louisiana due to devastating storms.

The devastation from Hurricane Ian in Florida and severe weather in parts of Louisiana have prompted insurance companies to pack their bags or hike prices.

Residents now face rising premiums if they are even able to find coverage.

According to data from policygenius.com, the national average for annual home insurance rates is $1,899. In sharp contrast, Florida's average annual home insurance rate is $2,442 and Louisiana's is $2,507.

FOX Business' Ashley Webster noted that Florida, which is already a pricey spot, endured Hurricane Ian in the fall of 2022, causing severe damages to Florida's west coast beaches as a Category 4 storm.

As the full extent of damages is still being assessed, Webster added that the impact of Hurricane Ian was "the second-largest insurance loss behind Katrina back in 2005."

Hurricane Ian brought high winds, storm surges, and rain to the Fort Myers area, causing severe damage. ((Photo by Joe Raedle/Getty Images) / Getty Images)

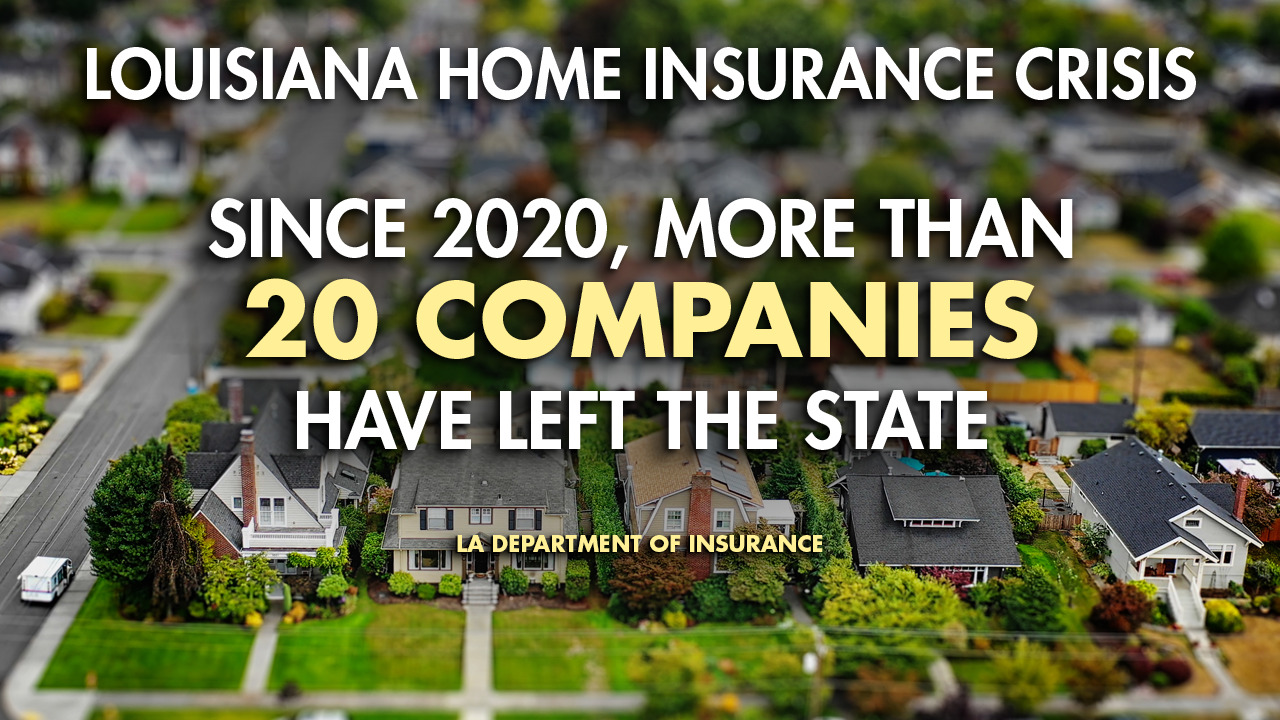

MORE INSURANCE COMPANIES PULL OUT OF LOUISIANA: ‘WE ARE IN A CRISIS’

Louisiana, which bared the brunt of Katrina's wrath in 2005, has faced numerous natural disasters since the catastrophic storm. Hurricane Laura in 2020 and Hurricane Ida in 2021 prompted higher premiums for Louisiana residents.

Last year, dangerous storms and tornadoes caused damage across the state just before the Christmas holiday, adding to rising costs and an insurance company exodus.

"More than 20 companies have gone under or withdrawn from the state, forcing hundreds of thousands of families to pay higher premiums or go without coverage," Fox News' Rebekah Castor reported earlier this month.

Louisiana Department of Insurance Commissioner Jim Donelon told Castor that natural disasters across the country are also contributing to the state's rising costs.

"We are in a crisis": more insurance companies pull out of Louisiana

Thousands of folks in the south no longer have insurance because companies are leaving the region after years of devastating storms.

"All of it coming out of the reinsurance market is global. And those challenges are affecting us and making insurance much more difficult to come by."

Many residents in southern states like Florida and Louisiana are facing the decision of whether to purchase home insurance.

In Florida, it is estimated that roughly 12% of homeowners do not have home insurance. Data from the state also notes that the Sunshine State accounts for about 9% of all claims nationally, but 79% of all lawsuits in the U.S. over home insurance. Many of these suits are deemed fraudulent.

Insurance companies weighing these factors have often dropped customers, leaving the residents to pursue expensive state-backed insurance.

FLORIDA LAWMAKERS SEEKING TO CALM PROPERTY INSURANCE STORM

One Jupiter, Florida resident shared that when he was dropped from his home insurance company, state-backed insurance would cost him roughly $6,000 annually.

"It remains a problem," George Kyritsopoulos said. "The cost then goes up because it's not only the $5,000 that it's costing me. In a non-flood zone, I still have to have flood insurance [in] the event that there is a flood. It's another $750. It's almost $6,000."

In Louisiana, lawmakers have recreated the state's insurance incentive program which would offer companies millions of dollars if they commit to doing business in the state. The program was first created in the aftermath of Hurricane Katrina and Hurricane Rita in 2005 when it experienced a similarly difficult homeowners' insurance market.

Hurricane Ian victims should get insurance claims in early: Deborah Hoffman

SWFL Insurance owner Deborah Hoffman discusses how Hurricane Ian is affecting Florida's insurance market on 'The Claman Countdown.'

Florida Gov. Ron DeSantis has urged private insurance companies to step up and help address the issue.

CLICK HERE TO READ MORE ON FOX BUSINESS

"But you've got to have a solvent private market. You can't dump everybody on citizens' property insurance. It's not solvent," DeSantis said last month. "So it would be a massive financial liability. And so that's why you got to get a market that's actuarially sound."

In addition, the state passed sweeping property insurance legislation to address some of the concerns of homeowners last month.

While state leadership is working to find tangible solutions to the insurance company exodus and premiums price spikes, residents remain under financial strain awaiting long-term solutions for the insurance crisis.

Fox News' Rebekah Castor contributed to this report.