Jobless claims jump more than expected to highest level since 2021

Number of Americans filing for unemployment jumps to highest level since 2021

What should Americans takeaway from the May jobs report?

Breitbart's John Carney and economist Joe LaVorgna react to the employment statistics on 'Kudlow.'

The number of Americans filing for unemployment benefits last week surged to the highest level since 2021, evidence the historically tight labor market is softening in the face of rising interest rates.

Figures released Thursday by the Labor Department show initial claims for the week ended June 3 surged by 28,000 to 261,000, well above the 2019 pre-pandemic average of 218,000 claims. It marks the steepest level for jobless claims since October 2021.

Continuing claims, filed by Americans who are consecutively receiving unemployment benefits, fell slightly to 1.76 million for the week ended May 27, a decrease of 37,000 from the previous week.

"The sustained increase in weekly jobless claims from last year’s cyclical low is meaningful, clearly illustrating a softening in conditions," said Jim Baird, Plante Moran Financial Advisors CIO. "That’s encouraging news for Fed policymakers who have been looking for evidence that the aggressive rate hikes of the past year are having an impact."

THE HOUSING RECESSION ISN'T OVER YET

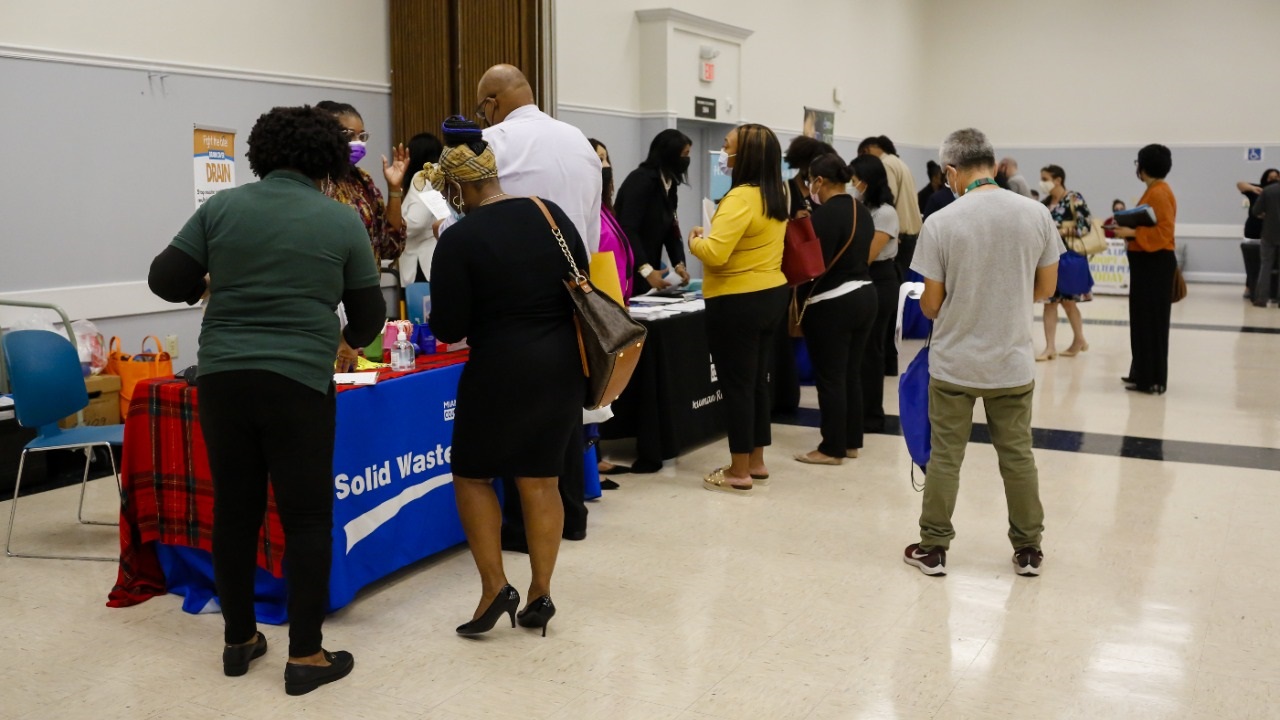

A "Now Hiring" sign during a job fair at a Schneider Electric manufacturing facility in South Carolina on Jan. 18, 2023. (Photographer: Micah Green/Bloomberg via Getty Images / Getty Images)

For months, the labor market has remained a strong point in the cooling economy, defying expectations for a slowdown despite the aggressive interest-rate hike campaign by the Federal Reserve, chronic inflation and declining economic growth.

The government reported last week that employers added 339,000 jobs in May, nearly double what economists projected.

SILVER LINING OF HIGHER INTEREST RATES: SAVINGS ACCOUNT RATES

At the same time, a separate report based on a survey of households offered a slightly different picture of the labor market. The report indicated the unemployment rate climbed to 3.7% from 3.4%, even though the labor force participation rate remained unchanged last month.

It was the highest jobless rate since October 2022 and the biggest increase since the early days of the COVID-19 pandemic.

Construction workers on a job site on May 5, 2023, in Miami, Florida. ((Photo by Joe Raedle/Getty Images) / Getty Images)

Still, the outlook for the labor market remains hazy.

Economists widely expect unemployment to climb higher as a result of steeper interest rates, which could force consumers and businesses to pull back on spending.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Policymakers approved the 10th straight rate increase in early May, lifting the federal funds rate to the highest level since August 2007.

The central bank previously projected in March that the jobless rate will climb substantially higher to 4.6% and remain elevated in 2024 and 2025 as steeper rates continue to take their toll by pushing up borrowing costs. That could amount to more than 1 million job losses.