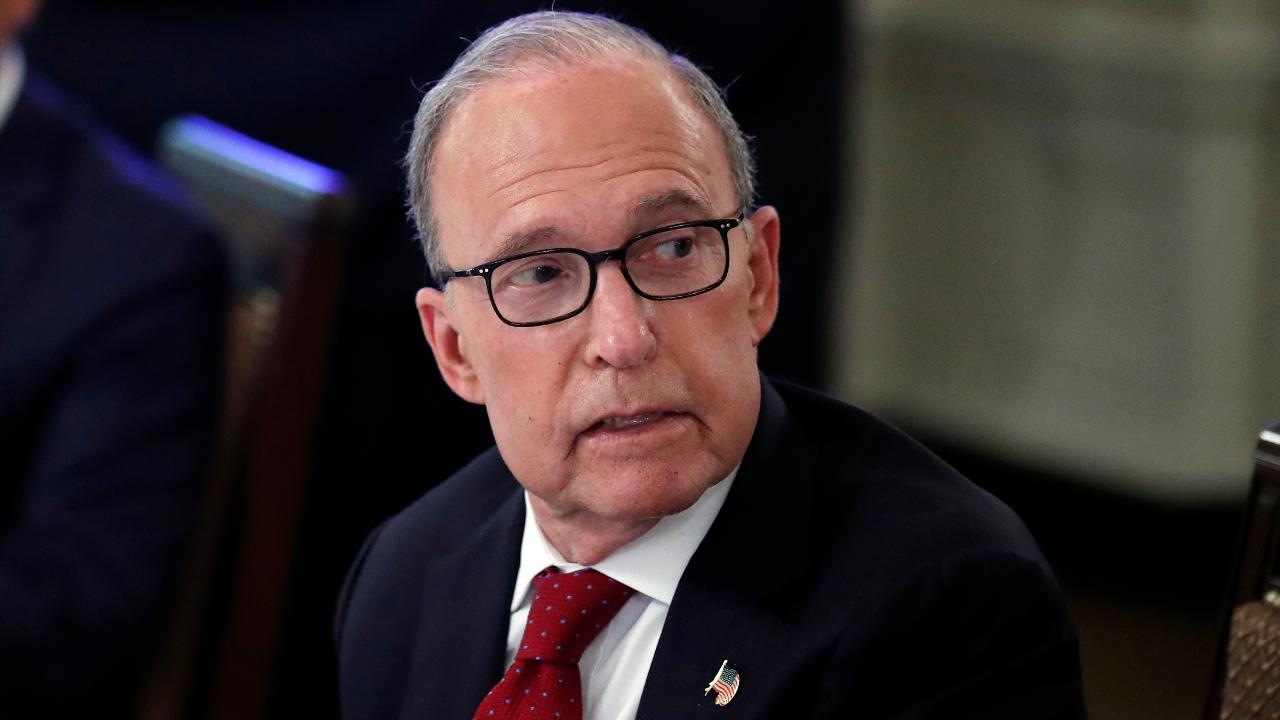

Kudlow predicts surge in economic growth in third, fourth quarters, despite gloomy Fed outlook

Kudlow's comments come on the heels of a grim forecast by Federal Reserve policymakers

White House economic adviser Larry Kudlow on Thursday predicted economic growth will surge in the latter half of 2020 as states continue to reopen their economies from the coronavirus-induced lockdown.

"With the markets this morning, the trends are pointing upward," Kudlow said during an interview with FOX Business Stuart Varney. "And therefore I will defend the president's optimism. I think you've got 20 percent growth in the third and fourth quarters, and I think you'll get 4 percent or better in 2021."

WHAT HAPPENS TO YOUR UNEMPLOYMENT BENEFITS IF YOU REFUSE TO GO BACK TO WORK?

Kudlow's comments come on the heels of a grim forecast by Federal Reserve policymakers.

Central bankers projected that GDP, the broadest measure of goods and services produced across the economy, will plunge by 6.5 percent this year before rebounding by 5 percent in 2021.

Stocks In This Article:

They also indicated the economy faces an arduous recovery from the coronavirus recession. They said they expect unemployment to end 2020 at 9.3 percent and remain elevated for years, eventually falling to 5.5 percent in 2022. That's still well above the pre-crisis level of 3.5 percent.

Stocks plunged Thursday morning on the dour forecast and a resurgence of COVID-19 cases in some states.

TRUMP SIGNS PPP REFORM BILL LOOSENING RESTRICTIONS ON SMALL BIZ LOAN RECIPIENTS

The Dow Jones Industrial Average tumbled 1,300 points, or 4.83 percent, while the S&P 500 fell 4.11 percent and the Nasdaq Composite dropped 3.33 percent.

“I know today’s a rough day but I don’t think today is the last word,” Kudlow said. “And by the way, we’re still 40 percent above the March 23 low.”

Kudlow also praised the Federal, and its Chairman Jerome Powell, for planning to keep interest rates near-zero for the next two years.

FED'S POWELL SAYS US ECONOMY MAY NEED MORE POLICY HELP TO AVOID 'PROLONGED' RECESSION

"Chairman Powell is giving us zero interest rates for two years," Kudlow said. "That's really quite good. You can't probably get any more dovish than that. The balance sheet is going to rise by about $10 trillion by year-end."

The Fed reiterated previous guidance that the benchmark federal fund rate will stay at a range between 0 percent and 0.25 percent until "it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals."

The projections showed all policymakers expect to keep the benchmark federal funds rate at near zero through the end of 2021. All but two officials saw rates staying there through 2022.

GET FOX BUSINESS ON THE GO BY CLICKING HERE