Larry Summers, Neel Kashkari question soft landing viability

Former Treasury Secretary Larry Summers said the odds of a soft landing are 'quite low'

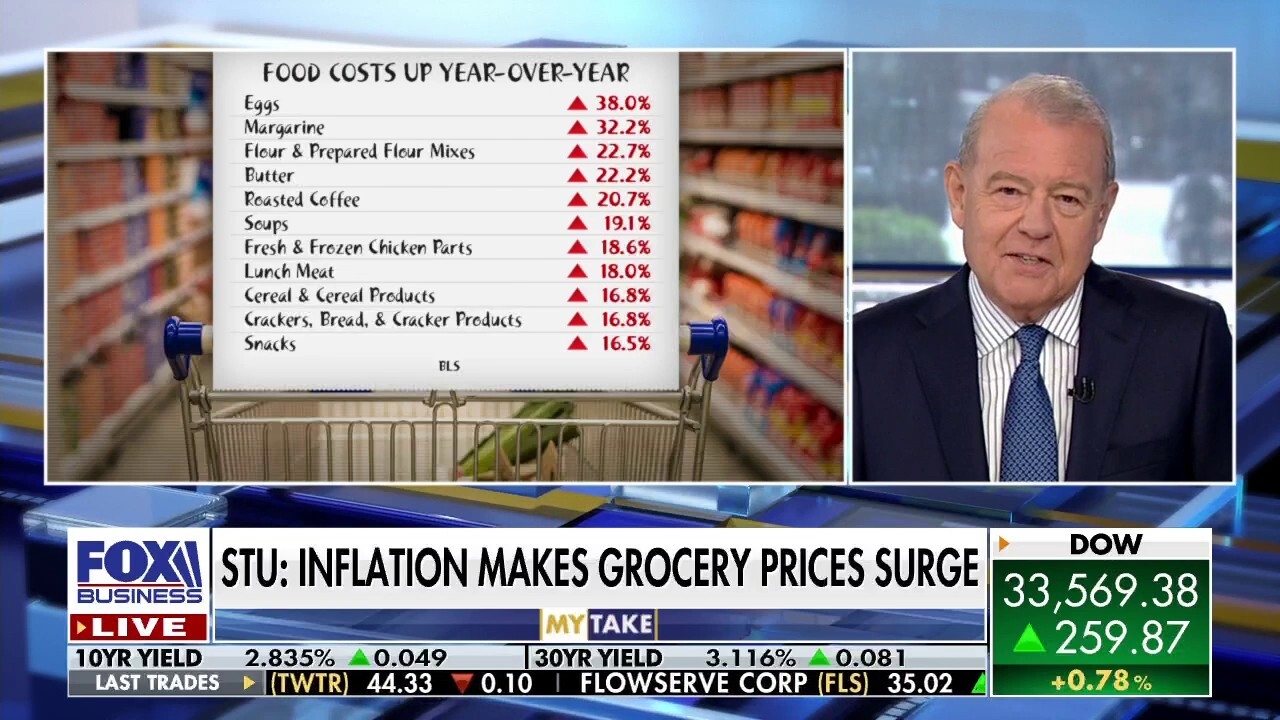

Stuart Varney on Biden’s ‘zero’ inflation claim: We’re worse off, despite what the president says

FOX Business host Stuart Varney argues Biden doesn't want to "admit" that inflation is high ahead of the midterms.

While some members of the Biden administration spent their Wednesday celebrating an 8.5% year-over-year inflation rate for July, one former Democratic U.S. Treasury secretary expressed a little more skepticism.

"Historically, every time we have had unemployment below four and inflation above four, we have had a recession within the next two years […], so the odds that the exit from this will involve […] a completely soft landing are, I think, quite low," said former Treasury Secretary Larry Summers at an Aspen Institute event titled, "Is the U.S. headed for stagflation?" this week.

Summers quickly identified a root cause for the record inflation: government spending.

"We basically had inflation under control for 40 years […] we lost the thread, along with many other countries about a year and a half ago, with massive expansionary policies relative to the size of the GDP gap," the former National Economic Council director under President Obama remarked.

Former Treasury secretary and White House economic advisor Larry Summers is interviewed by FOX News' Maria Bartiromo at FOX Studios on May 24, 2017, in New York City. (Robin Marchant/Getty Images / Getty Images)

"The fiscal stimulus was five times as large as it had been during the financial crisis and at the same time massively accommodative monetary policies […] the consequence is that we now have a very substantial inflation rate," the Harvard economist added.

However, one member on the panel, BlackRock chairman and CEO Larry Fink, disagreed with Summers’ assessment of the problem.

"From my vantage point, the recession is not just because of aggressive monetary policy. The inflation that we're facing is so much policy-oriented. Our policies of movement away from consumerism to populism is inflationary, and policies have been built around those, you know, the domestic issues that we have today," Fink commented.

The billionaire businessman claimed that a lack of legal immigration was a significant driver of inflation.

"More importantly, we've eliminated a large component of legal immigration […] one of the reasons why we have such job needs, we have 10 and a half million job openings right now and 5 million unemployed. So, we have this mismatch," the BlackRock founder said.

Laurence Fink, founder and chief executive officer of BlackRock Inc., speaks during the Reuters Global Investment Outlook Summit in New York on Nov. 13, 2017. (Reuters/Lucas Jackson / Reuters Photos)

CONCHA BLASTS BIDEN'S ‘LAUGHABLE’ INFLATION ASSERTION

Fink used the floor to advocate for a change in U.S. policy to help inflation.

"We're seeing rising wages across the board […] and so all these issues are confronting us and these issues are not going to go away when the Federal Reserve tightens because these are policy-oriented issues. And if we just put all the pressure on our central bank and every other central bank, we may put the economy into a recession. We may bring down some inflation, but some of this inflation that we have can only change if we change policies," he added.

Whereas some on the panel were optimistic about the general outlook of the U.S. economy, one panelist who expressed doubt was Minneapolis Federal Reserve President Neel Kashkari.

Referring to yesterday’s CPI numbers, Kashkari said, "I’ll welcome — I'll take it, but far, far, far away from declaring victory. I mean, this is just the first hint that maybe inflation is starting to move in the right direction, but it doesn't change my path."

Like Summers, Kashkari also conveyed concern about a possible U.S. recession.

Minneapolis Federal Reserve President Neel Kashkari warned that the current state of inflation is "very concerning" and continues to "spread out more broadly across the economy" during an appearance on CBS' "Face The Nation" on July 31, 2022. (John Lamparski/Getty Images / Getty Images)

"I think the transition from where we are in this high inflation environment to [a pre-COVID world] is not going to be linear […] we may be in a recession in the near future. You know, I don't know yet, but I agree with Chair Powell. We're going to do our best to avoid it," the Minneapolis Fed official continued.

CLICK HERE TO READ MORE FROM FOX BUSINESS

Discussing a possible recession, Summers cautioned that government official signals that inflation was transitory last year being wrong don’t help the situation.

"I think one of the reasons why we have some of the deep problems we do of lack of faith in public institutions is that people have just wanted to make [other] people happy. And so they give optimistic forecasts because they think it's good to inject confidence into the situation, and that's kind of a short-sighted thing," he said.

And as for whether Summers believes a soft landing is indeed possible?

"History teaches something quite clearly, and that is that soft landings represent what George Bernard Shaw said of second marriage: the triumph of hope over experience. We just don't have them," the former Treasury secretary under President Clinton analogized.