Larry Summers warns student loan debt relief could worsen inflation

Obama-era economist warns Biden to let student loan payment moratorium expire

Federal Reserve still unsure on where inflation will settle: panel

Barron’s markets editor Ben Levisohn, Barron’s reporter Carleton English and Barron’s associate editor Jack Hough discuss recent market trends, inflation and the IRS beefing up its auditing on "Barron’s Roundtable."

Former Treasury Secretary Larry Summers on Monday warned the Biden administration against "unreasonably generous" student loan relief, arguing that additional spending could exacerbate the ongoing inflation crisis.

Summers, a Harvard University professor who served in both the Clinton and Obama administrations, has repeatedly sounded the alarm over rising inflation and spent much of 2021 arguing that the Biden team, as well as Federal Reserve officials, have underestimated the risk of soaring consumer prices.

"I hope the Administration does not contribute to inflation macro economically by offering unreasonably generous student loan relief or micro economically by encouraging college tuition increases," he wrote in a series of tweets.

Summers said that spending on student loan debt relief raises demand and increases inflation — in part by causing universities to increase tuition — and suggested that Biden should instead focus on directing resources to support "those who don't get the opportunity to go to college."

YELLEN DIRECTS IRS TO DEVELOP PLAN FOR $80B OVERHAUL WITHIN 6 MONTHS

Larry Summers, president emeritus of Harvard University, speaks during a discussion on "A Reform Agenda for Europe's Leaders" during the World Bank/IMF annual meetings in Washington on Oct. 9, 2014. (Reuters/Joshua Roberts / Reuters Photos)

He called on the president to let the federal student loan payment pause expire at the end of August instead of extending the moratorium for the seventh time. The freeze — which also set the interest rate to 0% — began in March 2020 at the onset of the coronavirus pandemic.

About 41 million Americans are benefiting from the federal government’s pause on student loan payments, which has been extended six times — twice by former President Trump and four times by Biden. At least $72 billion has been provided in relief on student loan interest alone.

But the moratorium is officially slated to end on Aug. 31, meaning millions of borrowers will need to start making payments on their loans. With just over two weeks until payments resume, Biden has not signaled whether he plans to delay the payment freeze any further.

"The worst idea would be a continuation of the current moratorium that benefits among others highly paid surgeons, lawyers and investment bankers," Summers said.

IS THE UNITED STATES ENTERING A RECESSION?

The White House suggested last week that another extension on the payment freeze is still under consideration. Administration officials have promised an answer on the moratorium, as well as on broader loan forgiveness, by the end of the month.

"While I don't have an announcement here today, I will tell you we're having conversations daily with the White House, and borrowers will know directly and soon from us when a decision is made," Education Secretary Miguel Cardona said last week during an interview on "CBS Mornings."

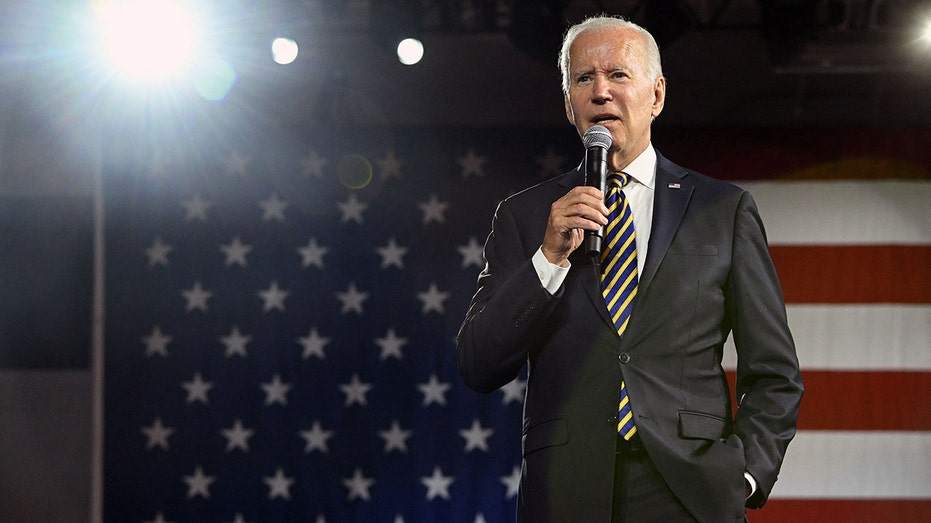

President Joe Biden speaks about the economy at Max S. Hayes High School in Cleveland, Ohio, on July 6, 2022. (Saul Loeb/AFP via Getty Images / Getty Images)

The decision comes as Biden faces mounting pressure from progressive lawmakers to not only delay the restart of payments but to wipe out student loan debt completely for millions of Americans.

Biden campaigned on canceling billions of dollars in student loan debt but has so far erased just a fraction of the pledged amount for about 72,000 borrowers, drawing ire from some progressives.

Outstanding student loan debt has doubled over the past decade, nearing a staggering $1.7 trillion. About one in six American adults owes money on federal student loan debt, which is the largest amount of non-mortgage debt in the U.S. It has been cited as a major hindrance in people’s "economic life" by Federal Reserve Chairman Jerome Powell.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Critics have argued that canceling student loan debt exceeds the president's authority granted by Congress. Canceling debt would also add to the nation's already ballooning national debt, which surged to a record-high $30 trillion last year.