Lordstown Motors remains concerned about ability to stay in business, CFO says

Automaker's financial status uncertain until it secures more funding and its market value rises

Lordstown Motors Corp.’s ability to stay in business for at least another year remains in doubt until it secures more funding and its market value rises, its finance chief said after the electric-truck maker sold its factory to raise cash.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| RIDE | NO DATA AVAILABLE | - | - | - |

Lordstown, which aims to launch its first vehicle this year and doesn’t generate any revenue yet, issued a going-concern warning in June 2021, flagging worries about its financial health.

"It will be there until we raise sufficient capital and get to a higher market capitalization," Chief Financial Officer Adam Kroll said Monday, referring to the going-concern warning. A business is considered a going concern unless management intends to liquidate it or cease operations.

LORDSTOWN MOTORS FINALIZES FACTORY SALE TO FOXCONN

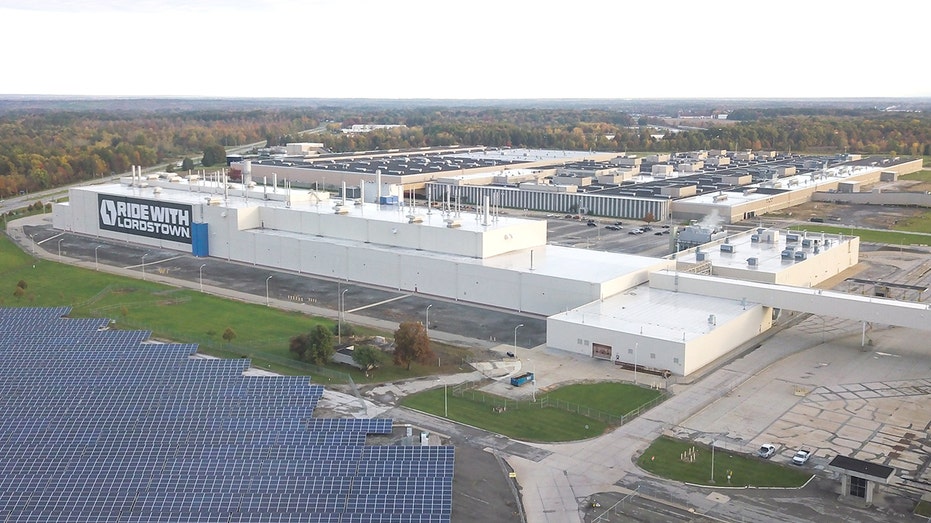

The company last week said it closed a transaction to sell its factory in Lordstown, Ohio, to affiliates of contract assembler Foxconn Technology Group. Lordstown received $230 million for the factory, formerly a General Motors Co. manufacturing site, and was reimbursed roughly $27 million in operating and expansion costs by Taipei-based Foxconn, which had earlier purchased about $50 million in Lordstown shares.

Lordstown, which went public in 2020 through a merger with a special-purpose acquisition company, is in the process of crash testing the Endurance, its first vehicle, and intends to launch commercial production in the third quarter.

Lordstown Motors Corp.’s ability to stay in business for at least another year remains in doubt until it secures more funding and its market value rises, its finance chief said after the electric-truck maker sold its factory to raise cash. (Photo by MEGAN JELINGER/AFP via Getty Images / Getty Images)

Foxconn, formally known as Hon Hai Precision Industry Co., will build the Endurance for Lordstown and has committed $100 million to a new joint venture between the two companies. The commitment includes a $45 million loan to Lordstown.

"We are not a one-trick pony anymore," Kroll said, pointing to plans to develop more vehicles with Foxconn.

Lordstown needs to raise an additional $150 million in capital before the end of the year to execute on its plans for 2022, which include building about 500 vehicles, Kroll said. The company aims to have at least $75 million to $100 million in cash on its balance sheet at the end of this year, he said.

The company held cash and cash equivalents of $203.6 million at the end of the first quarter, down from $587 million a year earlier. Lordstown booked a loss of $89.6 million for the quarter, compared with a $125.2 million loss in the same period a year earlier.

Lordstown could raise funds through a public or private offering to institutional investors, Kroll said, adding that might involve selling debt or equity. "There may be other things that could involve more strategic partners," he said.

CARVANA STOCK TUMBLES ON STIFEL DOWNGRADE

Management is working full throttle toward the commercial launch of the Endurance, Kroll said, adding that would be an important milestone for the company. "A big part of raising cash is getting to launch," he said.

Lordstown could face challenges raising the funds it needs amid the recent market selloff, which has hit technology and other stocks hard. The company’s shares closed at $2.27 Monday, down by 7.4% for the day and by 39% since the beginning of the year. Its market capitalization stood at $448.1 million.

"We are definitely in a risk-off environment for EV-startups," Kroll said. "I cannot project if or when that might change."

Analysts remain skeptical about the company’s outlook, pointing to issues including fundraising and changing investor sentiment. "Ultimately, we see the path ahead for [the company] as increasingly complicated," Emmanuel Rosner, an analyst at Deutsche Bank, wrote in a note to clients last week.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Lordstown last year disclosed investigations by the Securities and Exchange Commission and the Justice Department related to its SPAC transaction and its representations of preorders for the Endurance.

Lordstown Motors

The company earlier this month said it didn’t have enough cash to execute its business plan for the year. It said the situation raised substantial concerns about its ability to continue as a going concern.

CLICK HERE TO READ MORE ON FOX BUSINESS

"As we seek additional sources of funding, there can be no assurance that such financing would be available to use on favorable terms or at all," Lordstown said in its quarterly report. The company also cited higher materials costs and uncertainty around regulatory approval as risk factors, among other things.