Markets not an economic bellwether: Mnuchin

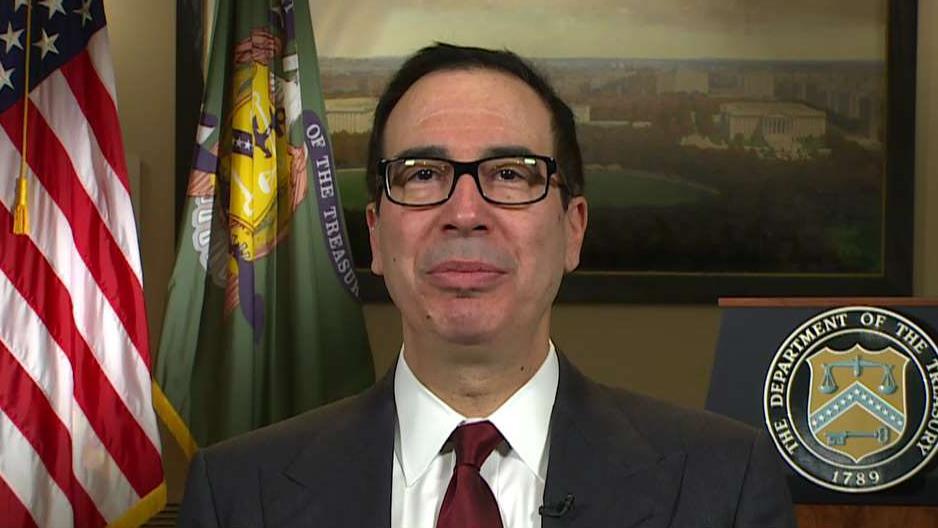

Underlying technical issues – not necessarily the economy -- are impacting supply and demand for securities, Treasury Secretary Steven Mnuchin said.

Mnuchin is keeping a very close eye on the U.S. markets, and he said they are not a good gauge for the economy.

“I’ve never believed that markets are efficient,” he said to FOX Business’ Maria Bartiromo on Tuesday. “Markets move too far in both directions. It is important to take this information in, but I don’t see the market being an indicator as the future of the economy.”

However, Mnuchin does see the market being an indicator of interest rates.

On Monday the U.S. yield curve inverted for the first time in over a decade. The yield curve has been viewed as a bellwether for an economic recession because it means the interest rates on long-term bonds is lower than the rate on short-term bonds. But Mnuchin said underlying technical issues are impacting supply and demand and he sees an overall strong economy even though housing is one area of weakness.

"I think the two most important metrics are the GDP [gross domestic product] numbers and the inflation numbers,” he said. “I think what we are focused on is having strong growth while we keep inflation in check. I think the fact that the oil prices have come down recently... I think the fact that you see inflation hovering below 2 percent — so below the Fed target is a good thing for growth.”

U.S. unemployment remains at 3.7 percent, the lowest level in nearly 50 years and U.S. GDP remained at 3.5 percent in the third quarter.

Mnuchin expects sustained GDP of 3 percent within the next year.