Mortgage rates climb to 5.66% after Fed pledges 'forceful' action on inflation

Higher mortgage rates are pushing potential homebuyers out of the market

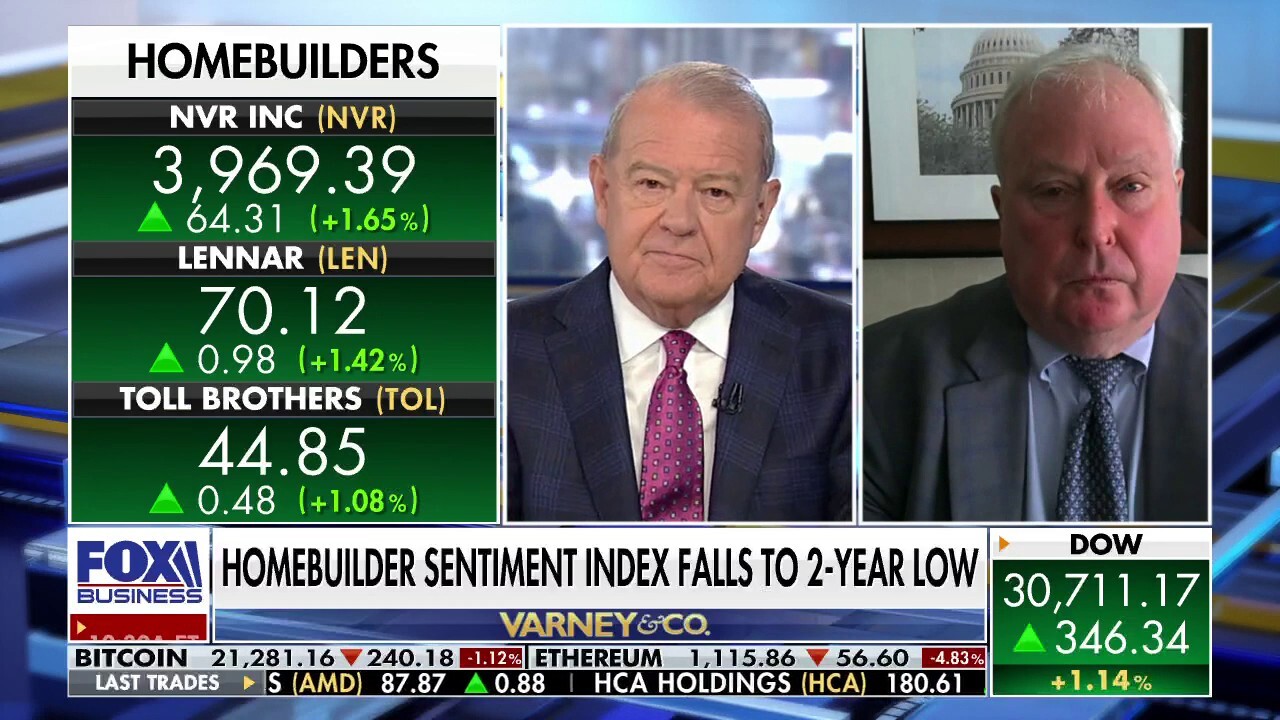

Soaring inflation, higher mortgage rates slowing home sales: NAHB

National Association of Home Builders CEO Jerry Howard warns that builder confidence in the market, for newly built single-family homes, posting its sixth straight monthly decline in June is a 'sign of a real slowdown.'

U.S. mortgage rates rose to their highest level in two months this week after Federal Reserve Chairman Jerome Powell promised to deliver "forceful" action on inflation that he warned would cause economic "pain."

Mortgage buyer Freddie Mac said Thursday that the average rate on the 30-year loan this week rose to 5.66% from 5.55% for the week ending Sept. 1. The rate is well above the 2.87% recorded just one year ago.

The average rate on a 15-year mortgage – which is more popular among homeowners who choose to refinance – climbed to 4.98%, up from last week's 4.85. By comparison, the average rate on a 15-year mortgage was just 2.18% one year ago.

"The market's renewed perception of a more aggressive monetary policy stance has driven mortgage rates up to almost double what they were a year ago," said Sam Khater, Freddie Mac's chief economist.

HOME SALE CANCELLATIONS SURGE TO ANOTHER 2-YEAR HIGH AS BUYERS PULL BACK

A "For Sale" sign is posted in front of a property in Monterey Park, California, on Aug. 16, 2022. (Frederic J. Brown/AFP via Getty Images / Getty Images)

The interest rate-sensitive housing market has started to cool noticeably in recent months as the Fed moves to tighten policy at the fastest pace in three decades. Policymakers already approved a 75-basis point rate increase in both June and July and have signaled that another super-sized hike is possible in September.

Mortgage rates rose sharply during the first half of the year as the Fed began hiking rates, but have cooled in recent weeks amid growing fears about the state of the U.S. economy and the threat of a looming recession.

However, Powell's comments during a keynote speech in Jackson Hole, Wyoming, last week renewed the specter of an increasingly hawkish Fed that is determined to wrestle inflation closer to its 2% goal, regardless of the potential economic fallout.

"While higher interest rates, slower growth and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses," Powell said. "These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain."

Combined with high home prices, the rapid rise in borrowing costs has pushed many entry-level homebuyers out of the market.

Fed Chairman Jerome Powell speaks during a news conference in Washington, D.C., May 4, 2022. (Al Drago/Bloomberg via Getty Images / Getty Images)

A new report from Redfin last week showed that home sale cancellations soared in July to another two-year high as buyers retreated from the market. About 63,000 home purchase agreements were called off in July, equal to 16% of homes that went into contract that month.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The latest Freddie Mac average is based on its survey of lenders, which was conducted before the central bank's Wednesday meeting. Some rates climbed as high as 6% in the aftermath of the Fed meeting.