Americans' inflation fears return to 11-year high, New York Fed survey shows

Consumers expect prices to rise 6% one year from now

Biden blames Russia for increased prices as February inflation rate hits 40-year high

Slatestone Wealth chief market strategist Kenny Polcari weighs in as Biden shifts blame on Putin for inflation, rising gas prices.

Americans' inflation fears skyrocketed again in February, with concerns over rising prices hitting the highest level in over a decade, according to a key Federal Reserve Bank of New York survey published Monday.

The median expectation is that the inflation rate will be up 6% one year from now, matching an 11-year-high recorded in November, according to the New York Federal Reserve's Survey of Consumer Expectations. Inflation expectations over the next three years also rose to 3.8% in February; although an increase from January, when it declined sharply to 3.5%, that's a marked improvement from late 2020.

LIVE UPDATES: RUSSIA'S RELENTLESS BOMBING OF HOSPITALS, SCHOOLS CAUSES HORRIFIC CHILD DEATH TOLL

"Median inflation uncertainty – or the uncertainty expressed regarding future inflation outcomes – decreased slightly at the one-year horizon and increased at the three-year horizon. Both measures remain elevated relative to their pre-pandemic levels," the survey said.

Workers unload shipments of food at Union Market in Washington, D.C., on Feb. 9, 2022. ((Photo by Stefani Reynolds/AFP via Getty Images) / Getty Images)

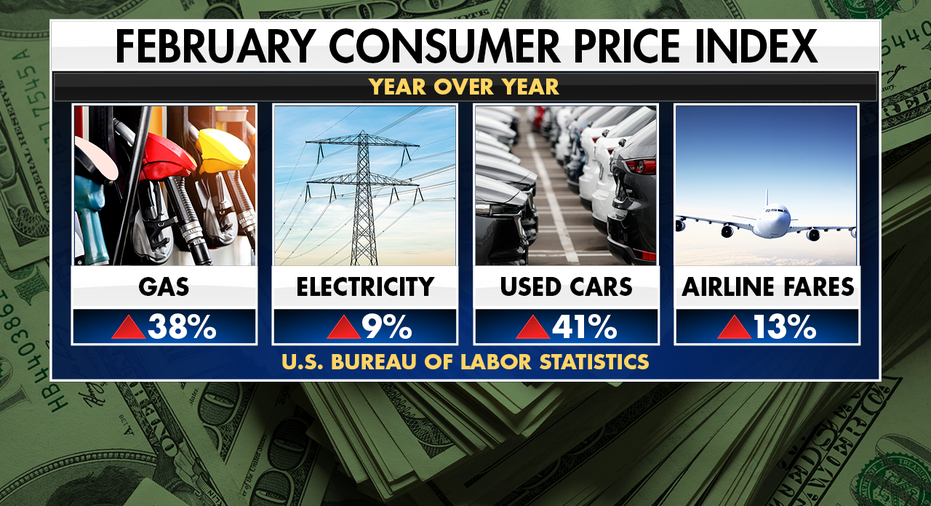

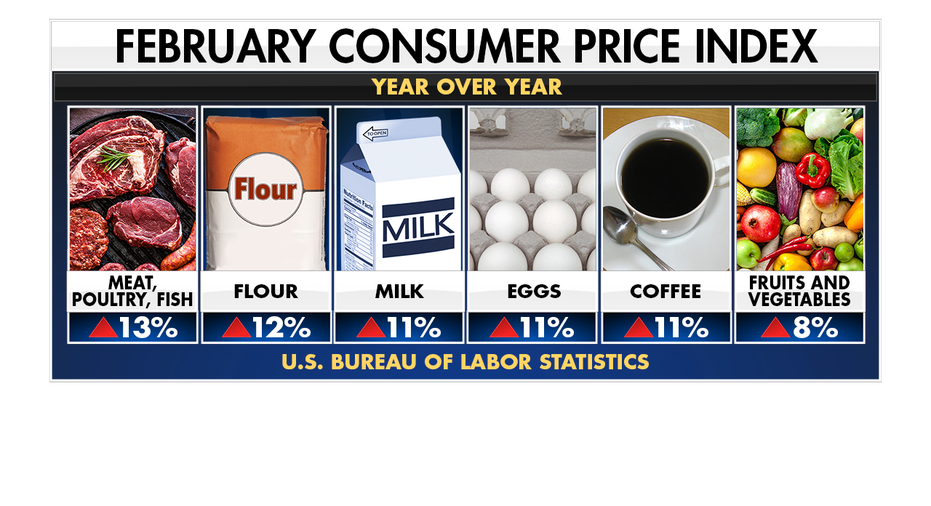

With consumers raising their expectations for inflation over the next year, they believe that things like gasoline, food, medical care, rent and college tuition will get more expensive for them to buy.

The report is based on a rotating panel of 1,300 households.

The survey plays a critical role in determining how Fed policymakers respond to the recent inflation spike. That's because actual inflation depends, at least in part, on what consumers think it will be. It's a sort of self-fulfilling prophecy – if everyone expects prices to rise by 3% in the year, that signals to businesses that they can increase prices by at least 3%. Workers, in turn, will want a 3% pay raise to offset the rising costs.

"This is about well-anchored inflation expectations," Fed Vice Chairman Richard Clarida said during a question-and-answer session at the Cleveland Fed last year. "Getting actual inflation down close to 2% is going to be an important part of keeping those expectations anchored."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

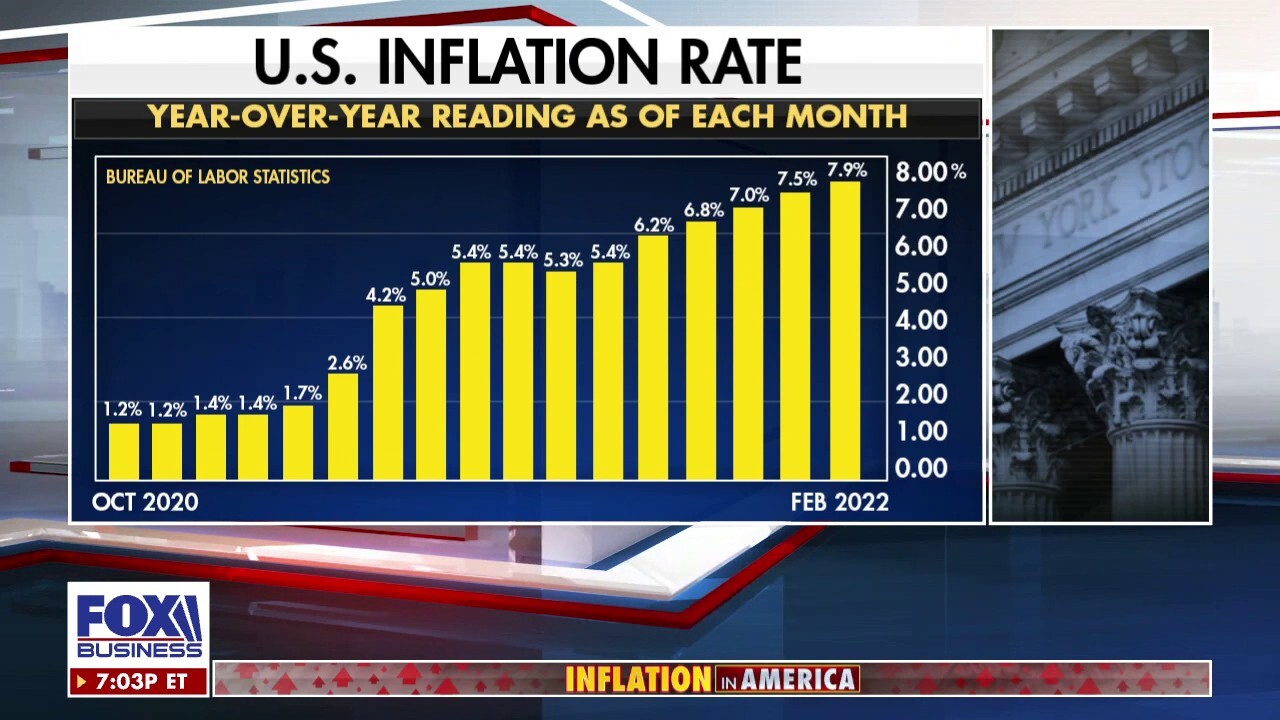

The survey comes one week after the Labor Department said the consumer price index rose 7.9% in February from a year ago, marking the fastest increase since January 1982, when inflation hit 8.4%. The CPI – which measures a bevy of goods ranging from gasoline and health care to groceries and rents – jumped 0.8% in the one-month period from January.

Data from the U.S. Bureau of Labor Statistics shows year-over-year rise in indexes from February 2022. | FOXBusiness

The eye-popping reading – which marked the ninth consecutive month the gauge has been above 5% – has ramped up pressure on the Federal Reserve to tame red-hot inflation with a series of interest rate hikes this year. Raising the federal funds rate tends to create higher rates on consumers and business loans, which slows the economy by forcing them to cut back on spending.

Fed Chairman Jerome Powell has left open the possibility of a rate hike at every meeting this year and has refused to rule out a more aggressive, half-percentage point rate hike, but said it's important to be "humble and nimble."

Federal Reserve Chair Jerome Powell pauses during a news conference in Washington. on Jan. 29, 2020. (AP Photo/Manuel Balce Ceneta, File / AP Newsroom)

Asked earlier this month whether the Fed is prepared to do whatever is needed to control inflation, even if that means hurting growth, Powell said: "I hope that history will record that the answer to your question is yes."

Still, there is added uncertainty from the war in Ukraine, as the fallout from weeks of shelling and a broadening humanitarian crisis ripple across the U.S. economy, with record-high gas prices and new supply shortages.

"We will proceed, but we will proceed carefully as we learn more about the implications of the Ukraine war for the economy," Powell told lawmakers earlier this month.