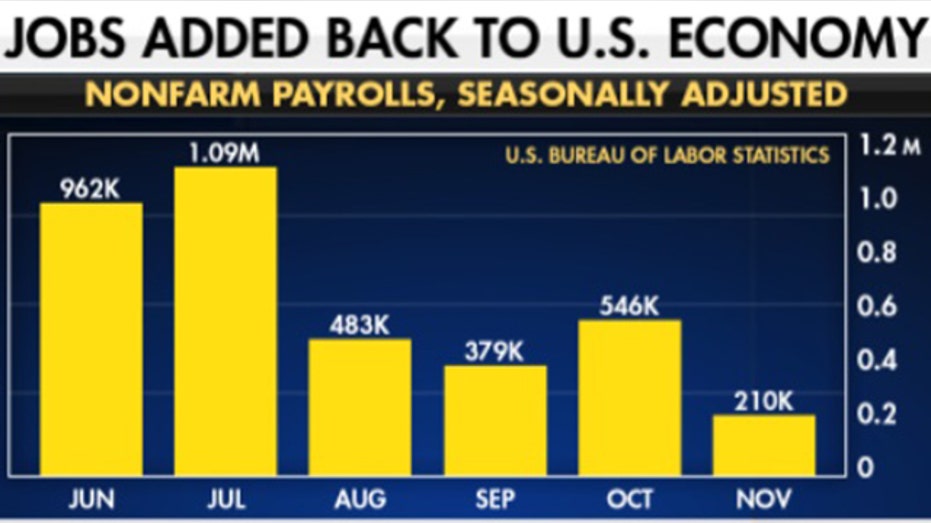

US hiring stumbles in November as economy adds just 210,000 new jobs

Economists expected payrolls to increase by 550,000 in November

US economy adds 210K jobs in November, missing expectations

FOX Business' Cheryl Casone breaks down the November jobs report as 210,000 new jobs were added to the U.S. economy, falling short of the 550,000 estimate.

U.S. job growth significantly undershot expectations in November, suggesting that difficulty in attracting new workers is weighing on the labor market's recovery from the pandemic, even as COVID-19 cases dissipated nationwide.

The Labor Department said in its monthly payroll report released Friday that payrolls in November rose by just 210,000, well below the 550,000 jobs forecast by Refinitiv economists. It marked the worst month for job creation so far this year. The unemployment rate (which is calculated based on a separate survey) dropped more than expected to 4.2% from 4.6% — the lowest level since the pandemic began.

The labor market had been gaining momentum after a delta-induced slowdown over the summer, but the latest figure represents a significant drop from October's upwardly revised number of 546,000 and September's upwardly revised 379,000. There are still about 3.9 million fewer jobs than there were last February, before the crisis began.

FED TO TAPER BOND PURCHASES BY $15B A MONTH AS IT EXITS PANDEMIC-ERA POLICY

"Today's employment report is doubly disappointing, because the reference week occurred just as it looked like Covid was on the retreat," said Justin Wolfers, a University of Michigan economist. "This was a moment for people to return to malls and to return to work. The COVID-related news has only gotten worse since then."

(U.S. Bureau of Labor Statistics)

The report wasn't all bad news, however: The labor force participation rate rose to 61.8%, wages rose 4.8% from a year ago and the survey of households offered a brighter outlook, pointing to an employment gain of 1.13 million for the month. (The jobs report consists of two surveys – one based on employers and the other on households).

RSM chief economist Joe Brusuelas described the report as a "tale of two surveys."

"Rarely has the estimate produced by the good folks at the Bureau of Labor Statistics resulted in such divergent results as that illustrated by the twin establishment and household surveys that are the foundation of the monthly tally," Brusuelas said.

Prospective employers and job seekers interact during a job fair Wednesday, Sept. 22, 2021, in the West Hollywood section of Los Angeles. (AP Photo/Marcio Jose Sanchez, File)

The job growth stumble comes before the emergence of the newly identified omicron variant of COVID-19, which could jeopardize the global economy's recovery. There is still a lack of clarity over how dangerous the new variant is, including whether it is more transmissible or capable of causing more severe illness. Early evidence suggests an increased risk of reinfection.

Public health officials have urged caution against panic.

But the economic impacts of the new strain – which has been found in at least 38 countries including the U.S. – have already been felt, with the U.S. and at least 10 European nations suspending air travel from southern Africa. The 27-nation European Union also recommended an "emergency brake" on travel from southern Africa, citing the "very concerning" new variant.

Surveys for the November jobs report were conducted about three weeks ago, before the new variant was detected.

Leisure and hospitality, one of the hardest-hit sectors that has become a bellwether of sorts for the economy's recovery, saw a gain of just 23,000 new jobs last month. By comparison, it added 170,000 new jobs in October. The sector, which includes bars, restaurants and hotels, has recovered about 7 million of the jobs it lost during the pandemic, but remains about 1.3 million below its February 2020 level.

Federal Reserve Board Chair Jerome Powell testifies before Senate Banking, Housing, and Urban Affairs hearing to examine the Semiannual Monetary Policy Report to Congress, Thursday, July 15, 2021, on Capitol Hill in Washington. (AP / AP Newsroom)

A mixed bag of industries accounted for growth last month. Substantial gains took place in professional and business services (90,000), transportation and warehousing (50,000), and construction (31,000). But retail employment fell by 20,000 last month on a seasonally adjusted basis, despite the upcoming holiday season.

Stocks In This Article:

Markets remained relatively calm, despite the disappointing report.

Federal Reserve policymakers have been closely watching the labor market for signs that employment is reaching pre-crisis levels after the pandemic triggered one of the steepest – but shortest – recessions in nearly a century.

Although the jobs figure came in well below economists' expectations, the U.S. central bank may plow ahead with tentative plans to begin more aggressively unwinding the economic support put in place in March 2020 in order to curtail surging inflation.

"If you think this report will push back the accelerated taper mentioned by Fed Chairman Jerome Powell this week, you would be mistaken," said Jamie Cox, managing partner for Harris Financial Group.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The central bank has been purchasing $120 billion in bonds each month throughout most of the pandemic in order to keep credit cheap and stabilize the financial markets. In November, Fed officials announced plans to scale back the program by $15 billion a month, a timeline that would end the program by late June.

Chairman Jerome Powell suggested this week that Fed officials may accelerate their plan to reduce their monthly purchases of bonds and mortgage-backed securities later this month.

"At this point, the economy is very strong, and inflationary pressures are high," Powell said on Tuesday. "It is therefore appropriate in my view to consider wrapping up the taper of our asset purchases, which we actually announced at our November meeting, perhaps a few months sooner."