Payments for new cars squeeze buyers amid inflation, high interest rates

Payments on new cars are at a record high after rising more than 11% year-over-year according to Experian data from LendingTree

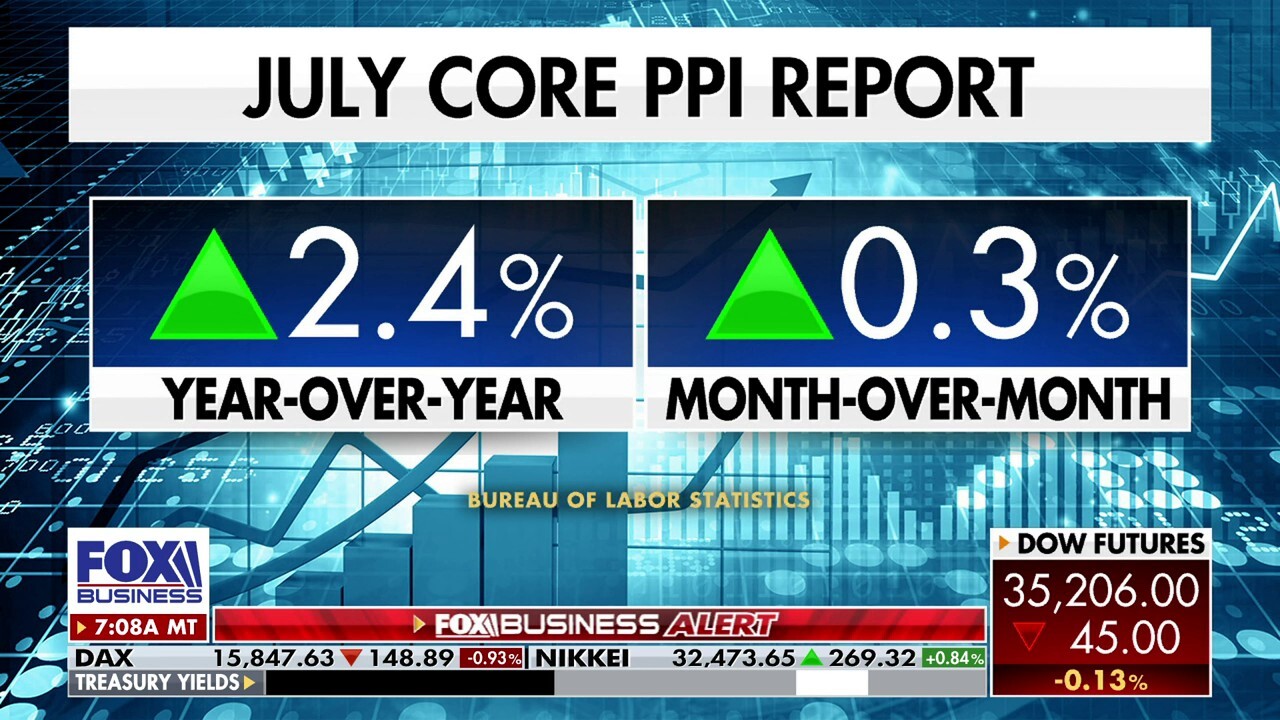

Inflation is making a comeback, Fed will raise rates again: Kenny Polcari

Slatestone Wealth chief market strategist Kenny Polcari reacts to wholesale inflation rising more than expected in July on Varney & Co.

People looking to buy a car are feeling the sting of inflation and high interest rates brought on by the Federal Reserve’s push to restore price stability in the economy.

The average car payment for a new vehicle has risen from $650 in 2022 to a record high of $725 in 2023 – a year-over-year increase of 11.5% according to an analysis by LendingTree using Experian data. For comparison, that increase is more than triple the most recent inflation reading, which came in at 3.2% year-over-year in July.

"It doesn’t sound like a lot of money, but the truth is that most Americans have pretty limited wiggle room in their budgets anyway, so an extra $75, $80 a month isn’t nothing," LendingTree chief credit analyst Matt Schulz told FOX Business. "And then when you factor in the cost of everything else rising, it just makes for an even more difficult situation."

INFLATION FORCING AMERICANS TO SPEND $709 MORE PER MONTH THAN 2 YEARS AGO: ECONOMIST

Payments on new cars are at a record high after rising more than 11% year-over-year amid high inflation and elevated interest rates. (Photo by: David Paul Morris/Bloomberg via Getty Images / Getty Images)

Schulz noted that low inventory stemming from supply chain disruptions has contributed to the rise in auto prices, while inflation and rising interest rates have put borrowers in the position of facing higher monthly payments on a more constrained household budget.

"The combination of high sticker prices and high interest rates is really making things tough on folks who are looking for a car," Schulz said. "And it’s a shame because so many times when somebody needs a car, they need it yesterday and they don’t necessarily have the time to try and build some savings to put towards a down payment."

AMERICANS’ INFLATION EXPECTATIONS DROP TO LOWEST LEVEL IN TWO YEARS

Higher car payments can strain household budgets and cut into savings for a down payment on home and retirement savings. (iStock / iStock)

The impact of price inflation and higher interest rates on auto loans can be seen in the latest household debt and credit report from the Federal Reserve, which found that newly originated auto loans and leases totaled $179 billion in Q2 of 2023 – even though the number of newly originated loans and leases was below pre-pandemic levels.

Higher car payments can not only force buyers to reevaluate their preferences in light of their budget, which could have the effect of eating into funds that otherwise might have gone to paying down debt from credit cards or student loans, retirement contributions, savings in a rainy day fund or for another big ticket item, like a home purchase.

"It makes for a really tough situation and they find themselves having to finance more cost at a higher rate than they would’ve liked to, or having to dial back their expectations because of how high interest rates are – we’re seeing similar stuff in the mortgage market," Schulz said. "Life is really expensive in 2023 almost no matter what purchase you’re looking at. But when it’s something as expensive already as a new automobile is, it just makes it all the tougher."

CREDIT CARD DEBT HITS $1T FOR THE FIRST TIME EVER

Buyers looking for a new car should consider getting pre-approved and saving as much as possible for a down payment. (Photo by Spencer Platt/Getty Images / Getty Images)

Schulz suggested that consumers should look to get pre-approved and shop around for the lowest possible interest rates on auto loans before they go to a dealer to buy a new car.

"Shopping around and getting preapproved for a loan before you go to that car dealer is a really good idea because that outside lender is almost always going to be able to give you a better rate than what you would get at the dealer," he said.

Although it can be challenging given the high cost of living, Schulz said that car buyers who have a chance to start saving in advance of making a purchase should look to take advantage of higher yields on savings accounts to make their savings go further towards a down payment.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"One of the silver linings of the Fed raising interest rates every 20 minutes for the last year and a half is that savings accounts are returning the most that they have in years, so when you do put some money away, it works a little harder for you than it used to," Schulz said. "It’s not always easy to put that money away, but if you can over an extended period of time then it can really make a difference."