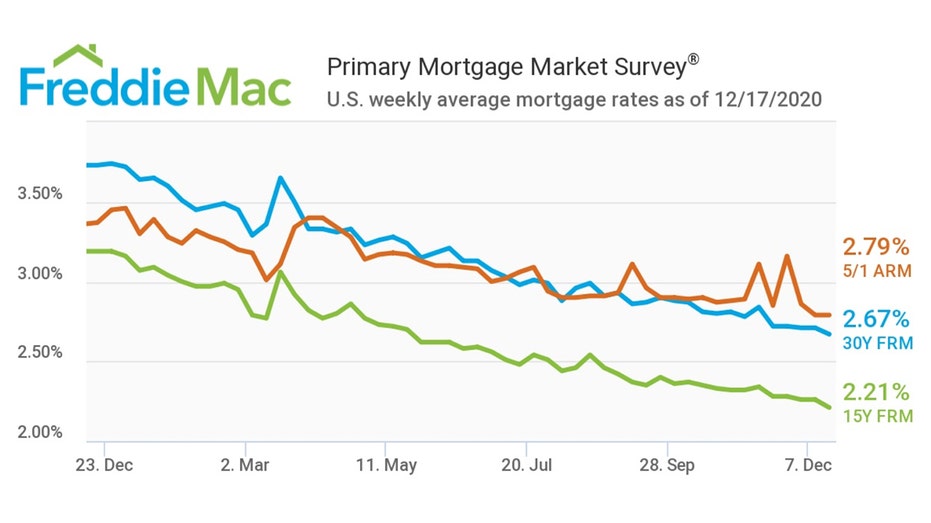

Record low mortgage rates, homebuilders keep market hot

A 30-year fixed rate mortage is 2.67%

The U.S. housing market, fueled by new record low interest rates, is so hot even builders can’t believe it.

“We met recently with a bunch of home builders and many of them in the business 30 to 40 years said they've never seen the likes of it,” said Fed Chair Jay Powell on Wednesday after policymakers left interest rates near zero and promised to keep them there through 2023.

ELON MUSK AND OTHERS CEO ARE MOVING TO THE LONE STAR STATE

Mortgage rates, on Thursday, fell again, according to Freddie Mac. A 30-year fixed now sits at 2.67%, a 15-year at 2.21% and a 5/1 adjustable-rate mortgage at 2.79%.

"Mortgage rates are at record lows and pushing many prospective homebuyers off the sidelines and into the market, Sam Khater, Freddie Mac’s chief economist, said. "Homebuyer sentiment is sanguine and purchase demand shows no real signs of waning at all heading into next year"

COVID-19 RELIEF IN THE HANDS OF CONGRESS

New indicators predict the market is getting even hotter. Housing starts rose 1.2% last month to 1.547 million units and building permits, applications for new construction, jumped 6.2% to 1.639 million. Both exceeded estimates tracked by Refinitiv.

DON PEEBLES LISTS HOME FOR COOL $15 MILLION

Powell also noted the housing sector is “fully recovered” which should keep demand humming along through 2021, at least.

As a result, homebuyers are finding themselves having to get scrappy with bidding wards. More than half, or 53.6% of home offers handled by Redfin involved bidding wars. The fiercest market; San Diego, the least competitive Minneapolis.