September inflation breakdown: Where are prices rising the fastest?

Steep increases in food, rent costs drove inflation higher last month

Inflation is ‘far stickier’ than what even the most ‘bearish’ investors expected: Michael Lee

Founder of ‘Michael Lee Strategy’ Michael Lee provides expert analysis of the U.S. economy’s hot inflation report for September and how it's anticipated to impact the markets on ‘Varney & Co.’

Inflation increased more than expected in September as the soaring cost of rents and food kept consumer prices running near a 40-year-high.

The Labor Department said Thursday that the consumer price index, a broad measure of the price for everyday goods including gasoline, groceries and rents, rose 0.4% in September from the previous month. Prices climbed 8.2% on an annual basis.

Those figures were both higher than the 8.1% headline figure and 0.2% monthly increase forecast by Refinitiv economists, a worrisome sign for the Federal Reserve as it seeks to cool price gains and tame consumer demand with an aggressive interest rate hike campaign.

In an even more troubling development that suggests underlying inflationary pressures in the economy remain strong, core prices – which strip out the more volatile measurements of food and energy – climbed 0.6% in September from the previous month. From the same time last year, core prices jumped 6.6%, the fastest since 1982.

INFLATION SURGED MORE THAN EXPECTED IN SEPTEMBER AS PRICES REMAIN PAINFULLY HIGH

"Despite some evidence of easing in transportation and energy costs there was no material relief in core inflation which continues to broaden out and remains stubborn," said Joe Brusuelas, RSM chief economist. "The tone and tenor of the data imply that a much tougher line on inflation than the one the Federal Reserve has already introduced is likely to be required to address the inflation problem."

Here is a breakdown of where Americans are seeing prices rise the fastest – and where there has been some reprieve from higher inflation – as they continue to wrestle with the worst sticker shock in a generation:

Food

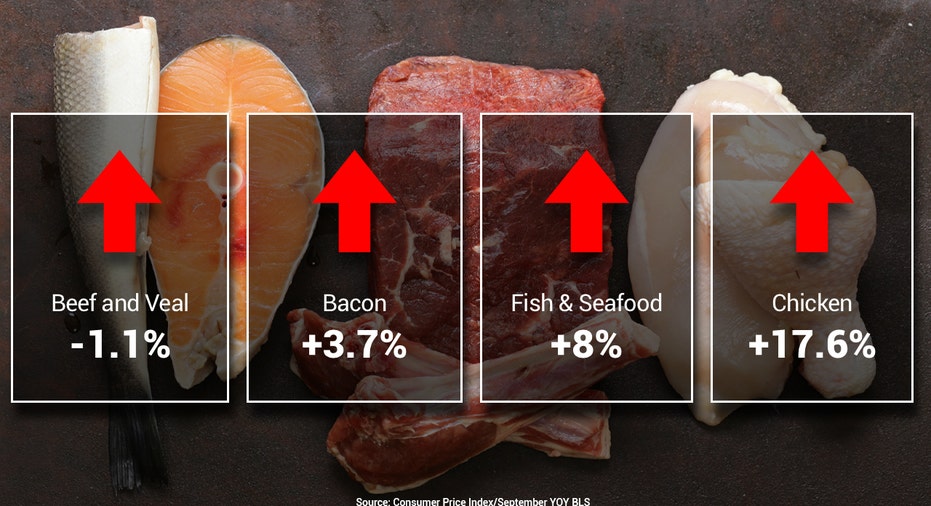

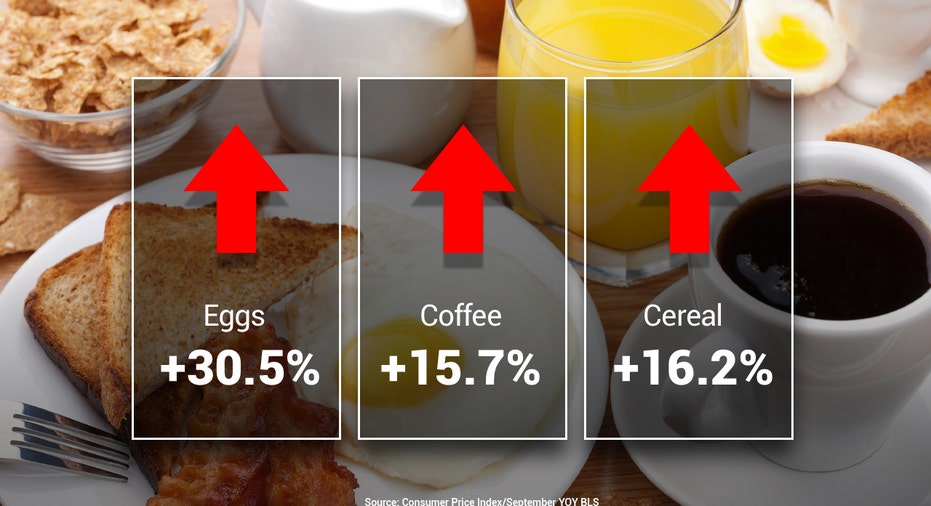

Meat and fish costs in September, according to the consumer price index released on Oct. 13, 2022. The inflation reading for the month came in hotter than expected. | Fox News

Food has been one of the most visceral reminders of red-hot inflation for Americans, with grocery prices climbing 0.7% over the month, according to unadjusted figures. On an annual basis, food prices have soared 11.2%.

The cost of groceries, meanwhile, climbed 0.6%, putting the 12-month increase at 13%, near a 43-year-high. Americans are paying more at the grocery store than they were just one month ago for a majority of items, including staples like lettuce (6.8%), salad dressing (3.6%), apples (2%), pork (1.1%), cheese (0.7%) and chicken (0.5%).

BILLIONAIRE DAVID RUBENSTEIN WARNS INFLATION WILL BE 'DIFFICULT' FOR THE FED TO REDUCE

"Food prices continued to soar," said Ben Ayers, Nationwide senior economist, adding that they are a "growing burden for U.S. households."

Rent

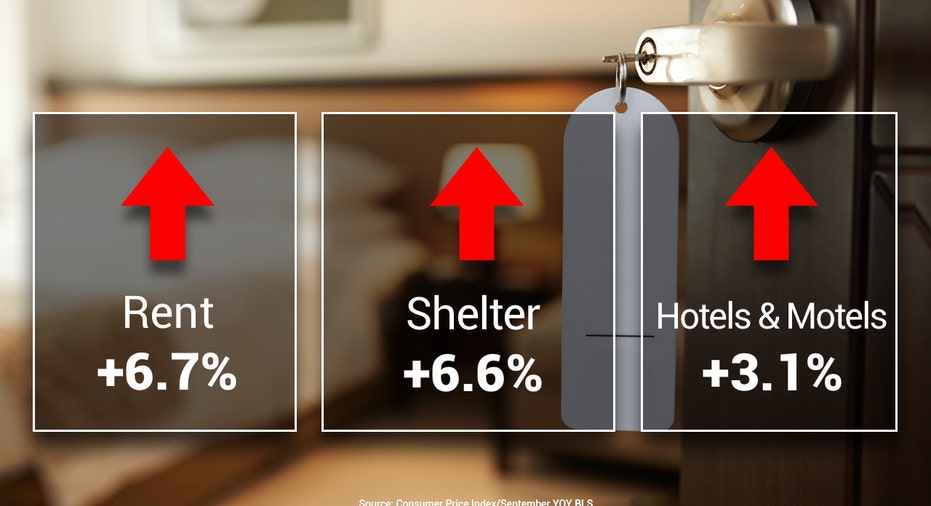

Shelter costs in September, according to the consumer price index released on Oct. 13, 2022. The inflation reading for the month came in hotter than expected. | Fox News

In another worrisome trend that will further squeeze U.S. households, shelter costs — which account for roughly one-third of the CPI — sped up again in September, climbing 0.7% from the previous month.

On an annual basis, shelter costs have climbed 6.6%, the fastest since February 1991.

Rent costs jumped 0.7% over the month and 6.7% on an annual basis. Rising rents are a concerning development because higher housing costs most directly and acutely affect household budgets. Another data point that measures how much homeowners would pay in equivalent rent if they had not bought their home, climbed 0.8% in September from the previous month.

"Whatever relief in core inflation that is in the pipeline is not flowing through to an easing in rents, which is clearly the primary driving price in inflation across the real economy," Brusuelas said. "On a three-month average annualized pace rent of primary residence are up 9.9% and owners equivalent residences are up 9.5%, both of which are simply brutal."

Energy

Energy costs in September, according to the consumer price index released on Oct. 13, 2022. The inflation reading for the month came in hotter than expected. | Fox News

There was some real reprieve for U.S. households last month in the form of lower gas prices, which dropped 5.6% in September from the previous month. Still, gas prices remain 18.2% higher than just one year ago.

Gas prices have also started to tick higher this month after the Saudi-led OPEC and its allies, known as OPEC+, announced they would cut oil production by 2 million barrels.

INFLATION MAY HIT SOME RETIREES TWICE

The average price for a gallon of regular gas was $3.91 nationwide on Thursday, according to AAA. While that marks a major drop from the record high of $5.01 set in mid-June, it is still up from one month ago when prices sat at $3.70. It is also a marked increase from one year ago, when prices hovered around $3.28.

In total, energy prices fell 2.6% last month. However, the drop was not broad-based: Electricity prices, for instance, rose 0.1% in the one-month period from August to September and were up 15.5% from a year ago.

Cars

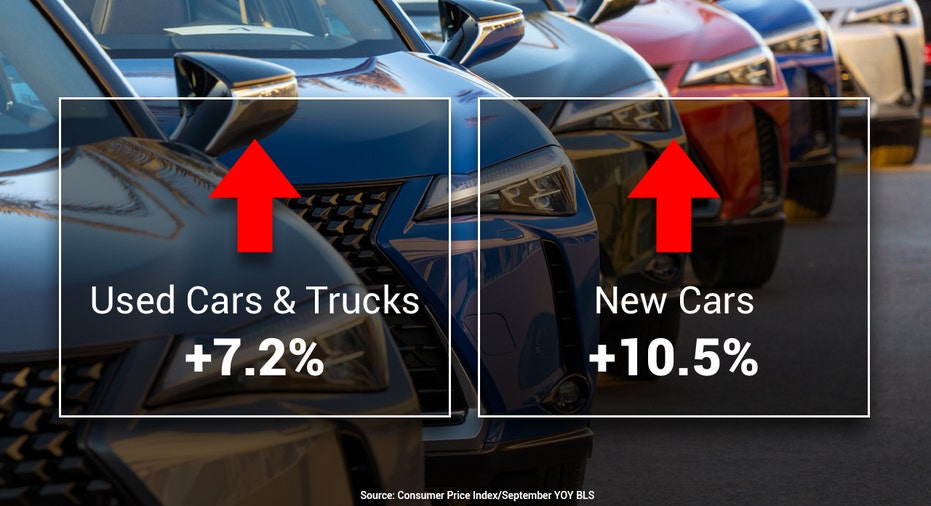

Automobile costs in September, according to the consumer price index released on Oct. 13, 2022. The inflation reading for the month came in hotter than expected. | Fox News

Unfortunately for Americans who needed to buy a car in September, the price of new vehicles continued to march higher.

The cost of new vehicles is up 9.4% from the prior year, largely because semiconductor shortages continue to delay car manufacturing. On a monthly basis, the price of new vehicles jumped 0.4%, according to the unadjusted Labor Department data.

However, used car and truck prices, which have been a major component of the inflation increase, actually fell 4.2% in September from the previous month. The cost of a used car or truck is still about 7.2% higher than it was one year ago.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Travel and transportation

American Airlines Boeing 787 Dreamliner aircraft as seen departing at take off and flying phase from Athens International Airport ATH LGAV near the Greek capital. | Getty Images

Airline fares rose in September after declining for three straight months. Prices rose 0.1% from the previous month and are up 42.9% over the past year, according to unadjusted data – in part because airlines are passing along the cost of more expensive fuel to consumers.