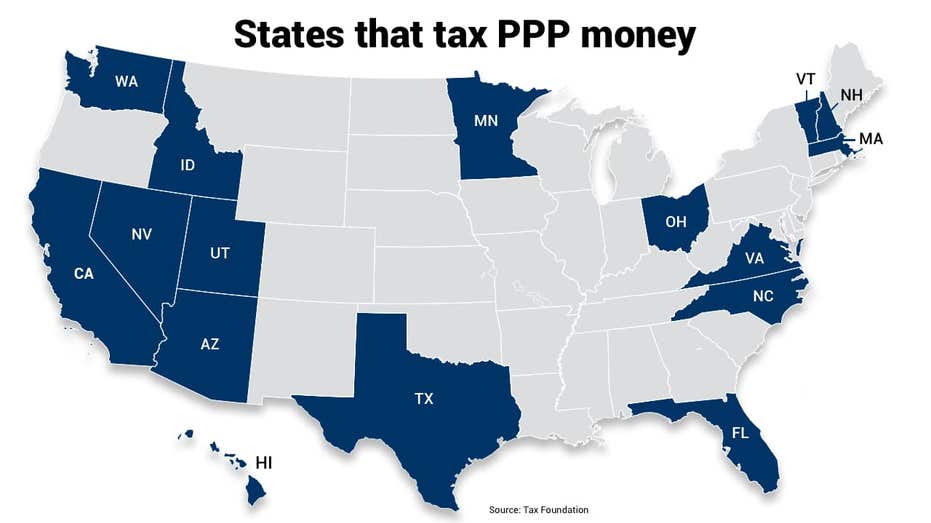

States taxing business on federal jobs relief package

Smal Business PPP loans may come with a price

Legislatures are scrambling to ensure money from forgivable federal loans meant to keep businesses afloat and employees on the payroll during the darkest moments of the COVID-19 crisis isn't taxed by state coffers.

However, struggling businesses in many states will still be hit with a steep tax bill for accepting federal aid.

BIDEN TO UNVEIL MULTI-TRILLION DOLLAR INFRASTRUCTURE PLAN IN PITTSBURGH NEXT WEEK

Earlier this month, Maine and Kentucky exempted businesses getting loans from the federal Paycheck Protection Program, or PPP. Still, at least 16 states will tax the loans if laws are not changed, according to an analysis from the Tax Foundation, a tax policy think tank.

NYC BILLBOARD RIPS BIDEN FOR LOOMING SMALL BIZ TAX

“This supplemental budget is the result of a long and, at times, arduous debate. But ultimately it was sensible compromise on all sides that got it across the finish line,” said Maine Gov. Janet Mills, a Democrat, in a statement after signing the legislation. “Because of that, approximately 160,000 Maine people who received unemployment benefits and the 28,000 Maine businesses that received PPP funds will receive tax relief – important progress as we continue to fight the pandemic, keep Maine people healthy and vaccinate them as quickly as possible, and accelerate our economic recovery.”

BIDEN PROPOSING 'UNDERCOVER TAXES'

Recently, Kentucky Gov. Andy Beshear, a Democrat, also signed a measure exempting businesses from paying taxes on money from PPP loans.

The forgivable loan program that’s exempt from federal taxes was part of the $2.2 trillion CARES Act, the earliest COVID-19 relief package that Congress passed.

The states that tax PPP money in one form or another are Arizona, California, Florida, Hawaii, Idaho, Massachusetts, Minnesota, Nevada, New Hampshire, North Carolina, Ohio, Texas, Utah, Vermont, Virginia and Washington.

CLICK HERE TO READ MORE ON FOX BUSINESS

However, Minnesota and Virginia enacted measures last week to provide partial exemptions from paying taxes on PPP loans. Virginia will tax PPP relief of more than $100,000, while Minnesota will tax aid of more than $350,000.

These states are levying taxes either including the forgiven loans in taxable income, denying the deduction for expenses paid for using those loans, or through a gross receipts tax, according to the Tax Foundation. A gross receipt tax — which Nevada, Texas and Washington impose – doesn’t allow deductions for business expenses.

The federal PPP loans are forgivable as long as a business uses 60% of the money to keep employees on the payroll, pay for rent and utilities and essentials to survive. From the outset, Congress excluded the federal money from taxable income and in late 2020 also allowed firms to write off the expenses used by the government money.

About 14 states have passed or are considering changes to exempt, or at least reduce, the amount of PPP dollars that are taxed, said Katherine Loughead, a senior policy analyst with the Center for State Tax Policy at the Tax Foundation.

“Some legislators and governors have complained they will be losing revenue if they don’t tax this. These loans didn’t exist last year. So excluding them from taxation is revenue neutral,” Loughead told FOX Business.

This month, Arkansas enacted a law ensuring businesses will not pay taxes on PPP loans. In February, Georgia, West Virginia and Wisconsin did the same.

“Some states are trying to make the case they need the revenue, but they are trying to skim the revenue off of businesses the federal government was trying to help,” Loughead added. “Taxing the very businesses that the federal government — on a bipartisan basis — decided to support is counterproductive to the economies of those states when these states say they are trying to keep these businesses open.”

At issue is whether states conform to the federal Internal Revenue Code, which if they did would not tax the PPP money in most cases. Fewer than half the states conform their own state tax codes with the federal code, according to the U.S. Small Business Administration.

“Florida and Texas are two examples of low tax states” that tax PPP money, Loughead said. “There is not consistency here. Some generally low tax states will tax PPP loans, while some generally high tax states – such as New York and New Jersey – don’t tax the loans.”