UAW strike threatens to drive up car prices

UAW strike could send new and used car prices soaring

UAW strike is 'completely unnecessary': Mary Barra

FOX Business' Grady Trimble speaks with General Motors CEO Mary Barra amid the United Auto Workers' strikes.

The United Auto Workers are officially on strike against the Big Three Detroit automakers, a move that threatens to strain vehicle supply and send prices marching higher.

The longer the walkout lasts, the greater the risk it poses to Americans' ability to buy a new or used vehicle.

"If the strike gets kind of widespread, it’s not really just the Detroit automakers that will see higher prices," Tyson Jominy, vice president of data and analytics at JD Power, told FOX Business. "Consumers of any brand are likely to see higher prices if the strike persists somewhere around four to six weeks or so."

The strike is limited in scope so far as the UAW seeks to preserve its $825 million strike fund, which would support a walkout for about 11 weeks by the 146,000 union members. But the union has threatened to expand the walkout on Friday if Ford, General Motors and Stellantis — the maker of Jeep and Chrysler — fail to make "substantial progress" in negotiations.

SEN. BERNIE SANDERS TORCHES AUTOMAKER CEOS AT UAW STRIKE RALLY: ‘TIME TO END YOUR GREED’

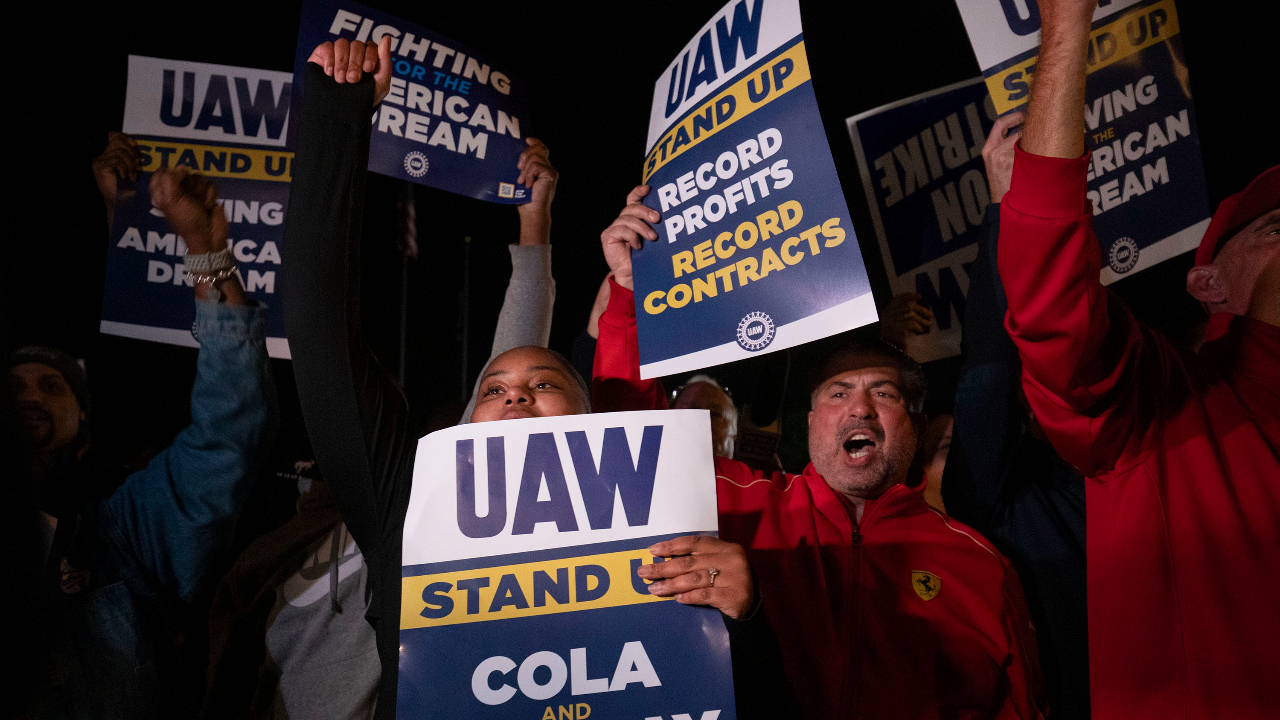

Supporters and workers cheer as United Auto Workers members go on strike at the Ford Michigan Assembly Plant in Wayne, Michigan, on Friday. (Bill Pugliano/Getty Images / Getty Images)

On Tuesday, about 13,000 autoworkers entered a fifth day of picketing at three assembly plants in Michigan, Ohio and Missouri, which primarily focus on producing mid-sized pickup trucks as well as some Jeep Wranglers and Ford Broncos.

"They seem to be targeting a space that has very limited inventory to begin with," Jominy said. "So if you’re a consumer, and you’re looking for a mid-sized pickup truck — meaning Ranger and Colorado and a few others — you may find very tight inventory and higher prices almost immediately in those segments where they’re striking."

UAW, AUTOMAKERS RETURN TO TABLE WHILE STRIKES CREATE PARTS SHORTAGE

Vehicle prices are currently about 4% below the peak level reached last year during the supply chain crisis, he said. In a worst-case scenario, the strike could send prices soaring back to those highs. For a $46,000 vehicle — the average selling cost of a new car — that could translate to an additional $1,500 to $2,000 for the consumer.

Used vehicle prices may also be affected by the strike. That's because when consumers can't find the car or truck they are looking for on the new side, they will switch over and start looking for used vehicles. At the same time, dealers may anticipate that inventory could tighten and buy as "many used vehicles as they can to stay in business," according to Jominy.

"You get that shift of demand, both from consumers and dealers at the same time, which can lead to higher used prices," he said.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GM | GENERAL MOTORS CO. | 81.47 | -2.20 | -2.63% |

| FORD | NO DATA AVAILABLE | - | - | - |

| STLA | STELLANTIS NV | 7.52 | -0.33 | -4.20% |

UAW STRIKES AT GM, FORD, STELLANTIS PLANTS AFTER NO NEW CONTRACT REACHED

The strike marks the first time in the UAW's 88-year history that it walked out on Ford, GM and Stellantis simultaneously.

The main point of contention between the two sides is higher pay, with the union seeking a more than 36% general pay raise for rank-and-file members over four years. That is down from the original demand for a 46% wage increase.

Full-time assembly plant workers at Ford and GM earn $32.32 an hour, while part-timers currently make about $17 an hour. Full-time employees at Stellantis earn $31.77 an hour, and part-time workers earn close to $16 an hour.

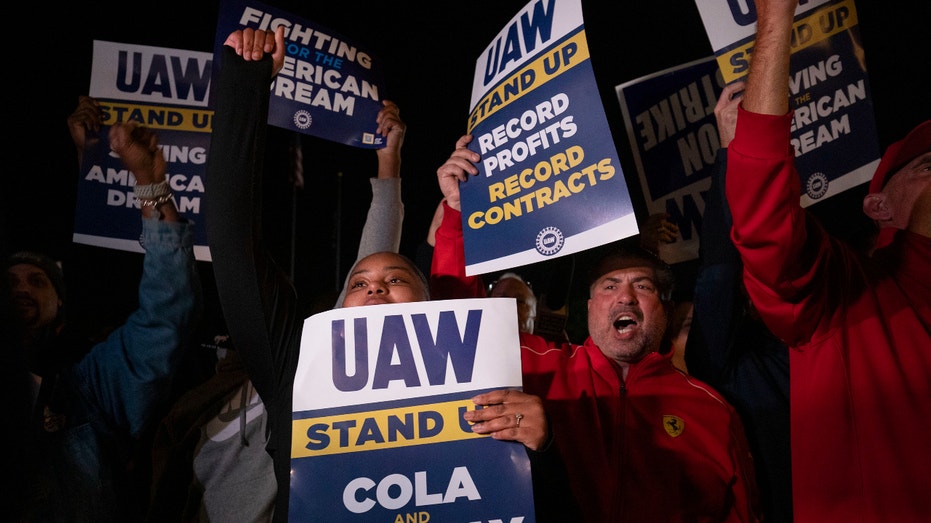

United Auto Workers members picket outside a Jeep Plant in Toledo, Ohio, on Monday. (Sarah Rice/Getty Images / Getty Images)

The union is also pushing for cost-of-living pay adjustments, an end to forced overtime, and increases in pension benefits for current retirees and the restoration of pensions for new hires, among other benefits.

BIDEN ADMINISTRATION DISCUSSES EMERGENCY AID FOR SMALLER AUTO SUPPLIERS AMID UAW STRIKE THREAT

UAW President Shawn Fain has called the demands the "most audacious and ambitious list of proposals they've seen in decades."

"They could double our raises and not raise car prices and still make millions of dollars in profits," Fain said. "We’re not the problem. Corporate greed is the problem."

Automakers — who have noted they are facing a multibillion-dollar shift to electric vehicles — made a counteroffer that includes far more modest pay increases. GM, Ford and Stellantis all offered 20%.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Ford CEO Jim Farley said Thursday during an interview with CNBC that UAW's proposal could bankrupt the company. Had the contract been in place since 2019, he said, the company would have lost about $15 billion "and gone bankrupt by now."

"You want us to choose bankruptcy over supporting our workers," Farley said.