U.S. shakes off China's currency jabs

China and President Trump have been playing a global game of chess that has roiled the stock and currency markets this week with the Chinese, on Thursday, pushing the yuan to the weakest level since 2008 - 7.0039 yuan per dollar.

However, investors seem to be placing bets that the U.S. may come out ahead in this trade war. U.S. equity markets jumped on Thursday, continuing the rebound that followed the worst session of 2019 on Monday when the Dow lost over 700 points.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 50115.67 | +1,206.95 | +2.47% |

| SP500 | S&P 500 | 6932.3 | +133.90 | +1.97% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23031.213218 | +490.63 | +2.18% |

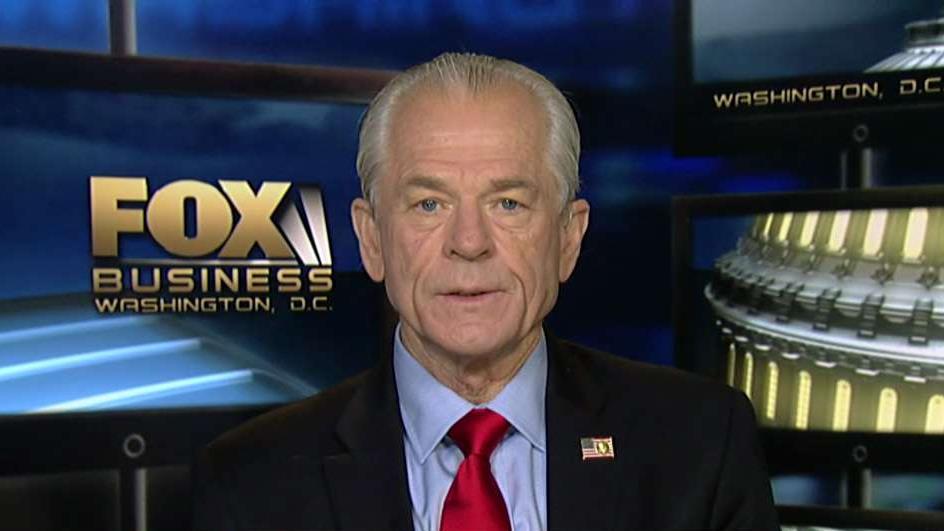

Speaking on FOX Business' "Mornings With Maria", White House advisor Peter Navarro says China will get inline as the U.S ups the pressure.

"This is not something that is threatening to the global economy, its an adjustment. The good news is that President Trump, by branding China a currency manipulator has stopped China's currency's manipulation in its tracks. China has stated it will stabilize the yuan and that is the first step back to getting more stability in the currency markets."

On Monday, Trump tweeted "China dropped the price of their currency to an almost a historic low," after the Chinese yuan weakened below seven per dollar for the first time in over a decade. "It’s called “currency manipulation.”

Later that day, the Treasury Department labeled Beijing a "currency manipulator," fanning fears the world's two largest economies are on the brink of a currency war.

While the Chinese economy has been slowing down, trade data released Thursday showed it is still hanging in there. Dollar-denominated exports rose 3.3% year-over-year in July, better than the 2% drop that was expected. Still, its trade surplus of $27.97 billion was below last month's surplus of $29.92 billion.

But the resilience of the Chinese economy isn't expected to last.

“Looking ahead, exports still look set to remain subdued in the coming quarters as any prop from a weaker renminbi should be overshadowed by further U.S. tariffs and broader external weakness,” wrote Julian Evans-Pritchard, senior China economist at Capital Economics.

Last week, Trump announced a new 10% tariff on $300 billion worth of Chinese goods beginning Sept 1., and said they could be lifted in stages to "well beyond 25 percent." He has already levied a tax of 25 percent on $250 billion worth of Chinese goods.

CLICK HERE TO GET THE FOX BUSINESS APP

"Our country is doing incredibly well," Trump told reporters Wednesday. "China is not doing well if you look at the trade situation."