US economy shrank at the beginning of 2022 and stagflation could be next

If we have another three months of negative growth in output, we’re officially in a recession

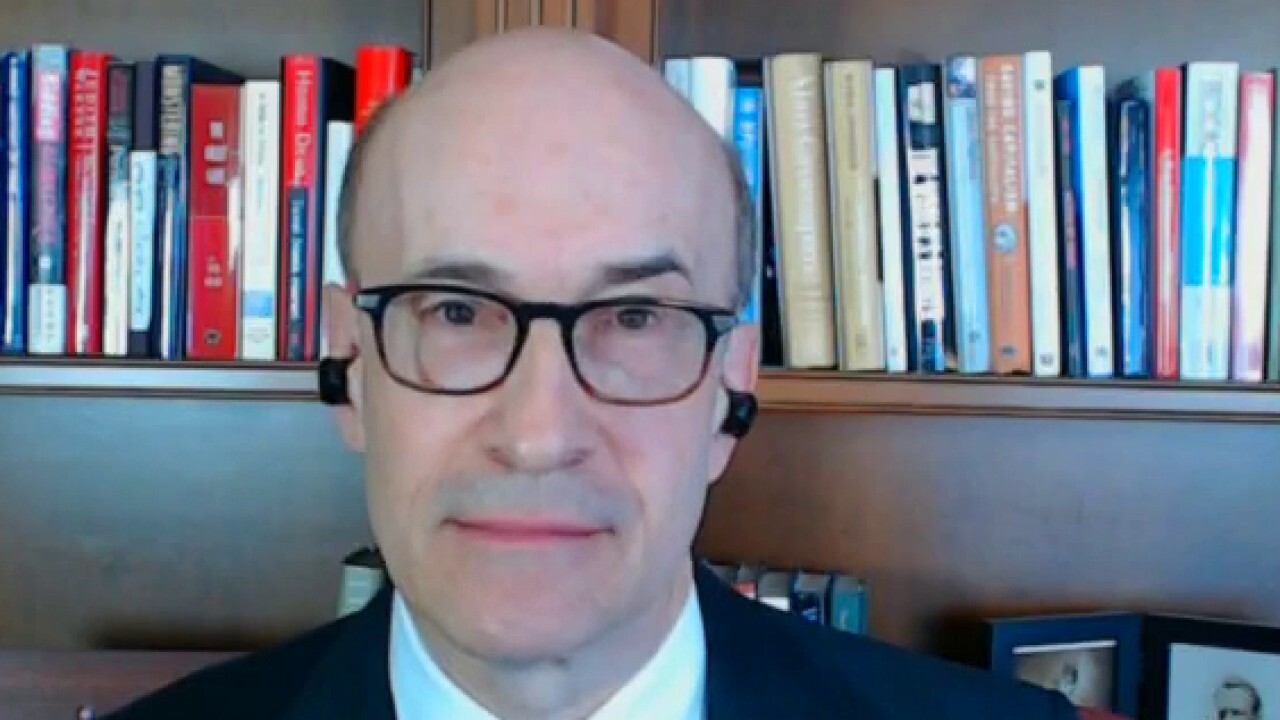

Harvard economist on 'shocking' contraction of US economy in Q1

Harvard University professor Kenneth Rogoff, a former chief economist at the International Monetary Fund, tells 'Mornings with Maria' that GDP falling at a 1.4% annualized rate is 'even below the worst' he thought it might have been.

Thursday’s report from the Commerce Department on total output of goods and services for the first quarter of this year provides further evidence that the economy is approaching stagflation territory. That’s the combination of slow growth and high inflation.

Don’t forget, if we have another three months of negative growth in output, we’re officially in a recession.

Let’s take a panoramic view of where we are with the economy right now: adjusting for inflation over the past 12 months, real wages and family incomes are down roughly 2%, stocks and family nest eggs are down roughly 4%, and now for the first quarter of this year the rate of growth of the economy is in the red as well.

US ECONOMY SHRANK 1.4% AT BEGINNING OF 2022, MARKING WORST QUARTER IN 2 YEARS

Given that COVID is in retreat, businesses are reopening, and life appears to be getting back to normal, the economy should be flying high right now. Why isn’t it?

One word: inflation. Rising prices of everything from food to gas to rental cars to airline tickets are the cancer cells that are silently killing this economy.

COLLAPSING TRUCKER DEMAND COULD FORESHADOW LOOMING RECESSION

If we look at closely at Thursday’s report on GDP, before accounting for the 8% Biden inflation, the economy GREW by 6.5%. Normally, that’s a very healthy number, right? Except that when you are running on a treadmill and you’re jogging at a pace of 7 mph and the machine is rotating at 8 mph, you will eventually fall off.

Or here’s another way to think about it. If today we had the same inflation rate of 1.5% that we had when Trump left office, and all else were the same, the economy would be growing briskly and so would worker pay.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The last time we had inflation this high in the late 1970s and early 1980s, the compounding effect of those rising prices led to a steep recession as factories and stores shutdown – and American’s jobs disappeared with them.

It’s not too late to avoid the misery of stagflation. But to do so we need three policy pivots.

First, we need to start producing more American energy to create jobs and bring down prices.

CLICK HERE TO READ MORE ON FOX BUSINESS

Second, we need to cut the multi-trillions of dollars of government spending and debt that Biden (and Trump) pumped into the economy over the past two years. Drain it out of the system.

And third, the Fed has to take more timely and aggressive action to suck hundreds of billions of dollars of excess dollar liquidity out of the global economy.

That may seem like a painful prescription, but as anyone who lived through the 1970s remembers, the alternative of stagflation will hurt a lot more.

Stephen Moore is a senior fellow at the Heritage Foundation and an economist with Freedom Works. His latest book is "Govzilla: How the Relentless Growth of Government Is Devouring Our Economy" (Post Hill Press, December 2021).