US economy's wild ride during COVID pandemic gives clues for 2021

The Fed, taxes, jobs and COVID-19 are shaping 2021 economy

The U.S. economy, without question, had an unexpectedly wild ride in 2020.

The coronavirus pandemic torpedoed the nation into its worst state since the Great Depression. The nation's GDP spiraled down 32.9% in the second quarter, the steepest contraction on record. At the peak of the crisis, about 22 million Americans found themselves out of work as unemployment spiked to a record 14.7% as reported by the Bureau of Labor Statistics.

While the economy, with the help of the Federal Reserve, the U.S. Treasury and Congress, is on the mend, 2021 is shaping up to be a year of recovery but not without the COVID hangover.

FOX Business takes a look at what may be in store for the coming year.

U.S. Economic Growth, Jobs & Vaccines

In general, economists are expecting 2021 to be a stronger and less volatile year for the U.S. economy as the COVID-19 vaccine rolls out and following the passage of the $900 billion stimulus package which included $600 stimulus checks. This week, Goldman Sachs boosted its GDP forecast to 5% for the first quarter and 5.8% for the full year. That’s more optimistic than the Fed's 4.2% forecast.

GOLDMAN SACHS BOOSTS 2021 GDP FORECASTS

“The biggest difference relative to our prior assumption is the inclusion of stimulus checks, which now imply a large increase in disposable income” in the first quarter followed by a sequential decline in the second and third quarters, wrote a Goldman Sachs research team led by chief economist Jan Hatzius.

The job market is also expected to rebound, according to the Fed, with the unemployment rate dropping to 5% from the last read in November of 6.7%.

CORONAVIRUS, UNEMPLOYMENT, STIMULUS CHECKS TOP GOOGLE’S 2020 SEARCHES

Federal Reserve - More of the Same - Ultra-Low Rates

Don’t expect Fed Chief Jay Powell to veer off the rails in 2021. He made it clear policymakers will stand pat continuing to support the U.S. economy by keeping rates near record lows. “Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses. The path of the economy will depend significantly on the course of the virus” read the Federal Open Market Committee (FOMC) statement from the final meeting of the year in December.

However, Powell cautioned “The ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.”

The stock market and investors like transparency and the easy lift from the Fed may keep stocks, already trading at record levels, humming along.

Record Low Mortgage Rates – Home Buyers Utopia

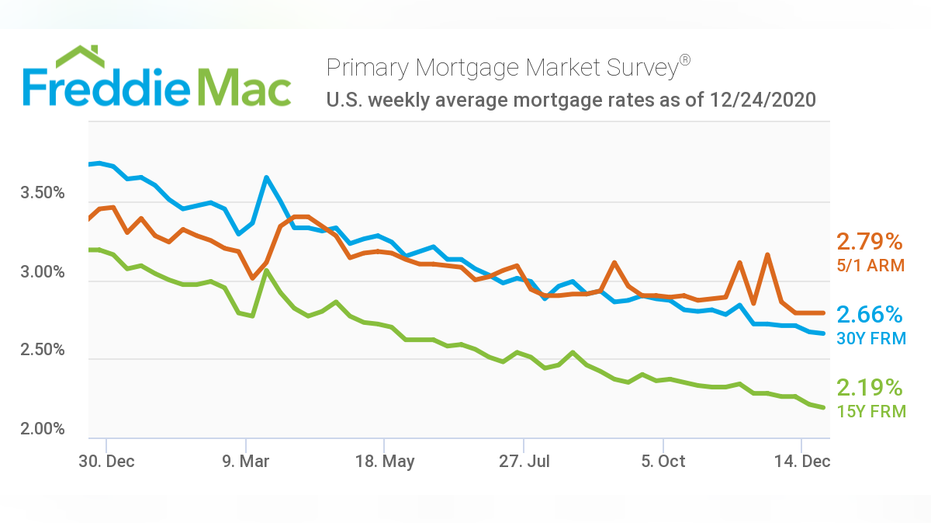

If there are any silver linings to this pandemic, record low mortgage rates may be one of the few. A 30-year fixed rate has never been lower at 2.66%, as tracked by Freddie Mac, with the 15-year at 2.19% and a 5/1 adjustable-rate mortgage at 2.79%.

Low rates mean prospective home buyers have more purchasing power which has already ignited the housing market with no signs of cooling off. “Homebuyer sentiment is sanguine and purchase demand shows no real signs of waning at all heading into next year," said Sam Khater, Freddie Mac’s chief economist.

The demand is boosting prices which saw a 14% median jump to an average of $320,714 according to Redfin. In November, existing home sales were 25.8% higher than a year ago according to the National Association of Realtors (NAR) -- and this in a month that saw a drop in sales of 2.5% after five straight months of gains.

The red-hot demand is also seeing evaporation in the number of available homes. November saw just 1.28 million homes for sales according to the NAR -- down 22% from a year earlier.

“Going into the new year, it will truly be out with the old, because there will be very few homes from 2020 left on the market,” said Redfin chief economist Daryl Fairweather in a year-end report.

Kudlow, Mnuchin Exit, Biden’s Team Moves In

Larry Kudlow, who leads the National Economic Council and Treasury Secretary Steven Mnuchin became even bigger power players as COVID-19 hit, helping steer the U.S. economy through the worst economic crisis in modern history.

The rapid shoring up of the Coronavirus Aid, Relief, and Economic Security (CARES) Act provided American workers and businesses with fresh capital to keep going. This included the first round of $1,200 stimulus checks and PPP loans, followed by a second round of $600 checks cleared in late December giving struggling Americans another infusion of cold hard cash.

In January, President-elect Joe Biden will officially usher in his new economic team tapping former Fed Chair Janet Yellen for Treasury. The former Chair of the Council of Economic Advisors under President Bill Clinton is well qualified given her experience at the Fed and in the White House say, experts. As a result, she is expected to continue a seamless working relationship with Fed Chair Jerome Powell. In November, Yellen in a tweet said one of her goals, if confirmed, would be to “restore the American dream.”

BlackRock executive Brian Deese has been selected to run the National Economic Council (NEC).

REUTERS/Mandel Ngan/Pool (Reuters)

While lesser-known, he has an impressive resume serving as a former Senior Advisor to President Obama and he also “played a key role in engineering the rescue of the U.S. auto industry” as noted in his bio.

BIDEN INDICATES HE SUPPORTS RAISING TAX RATES TO BUSH-ERA HIGHS

Taxes: Hikes or Cuts?

Who ends up controlling the Senate remains anyone’s best guess as the Georgia race hangs in the balance. Still, the outcome will likely impact the future of taxes for everyday Americans and businesses. A Democratic win may water down President Trump’s 2017 Tax Cuts and Jobs Act, or reverse it all together, according to Americans For Tax Reform’s Grover Norquist.

“Dead center, a median-income family of four will see a $2,000 tax increase if the Democrats win those two seats in Georgia and Biden is able to repeal the Trump tax cuts,” he said.

As for the corporate tax rate, which Trump chopped to 21% from 35%, may also get ratcheted higher to 28%.

“He wants to take our tax rate higher than Communist China so that investment would flow to other countries rather than the U.S.” he also warned which would impact the 401(k) accounts of more than 100 million people or 53% of U.S. households.

The Biden-Harris team did not immediately respond to FOX Business' request for comment.