US barreling toward recession, experts say, as inflation hits 40-year-high

'We seem to be following the same formula' of the Carter administration, one expert says

Inflation 'out of control' at a time when the economy 'is headed towards a recession': Kevin Hassett

Former Chairman of the Council of Economic Advisers Kevin Hassett weighs in on the Labor Department's inflation report for February, noting that 'wages aren't keeping up with prices,' which means 'real incomes are going down.'

Inflation hit a 40-year high in February, and the worst is yet to come as the U.S. economy barrels toward a recession, experts say.

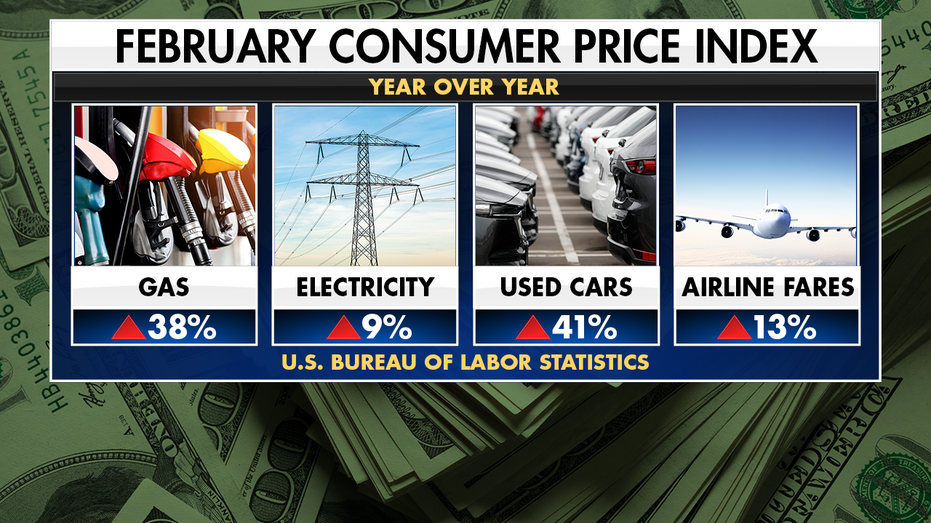

The consumer price index (CPI) climbed 7.9% on an annual basis, according to data released Thursday by the Bureau of Labor Statistics. Month over month, inflation rose 0.8%.

LIVE UPDATES: STOCKS FALL, INFLATION JUMPS 7.9%, GAS HITS NEW HIGH

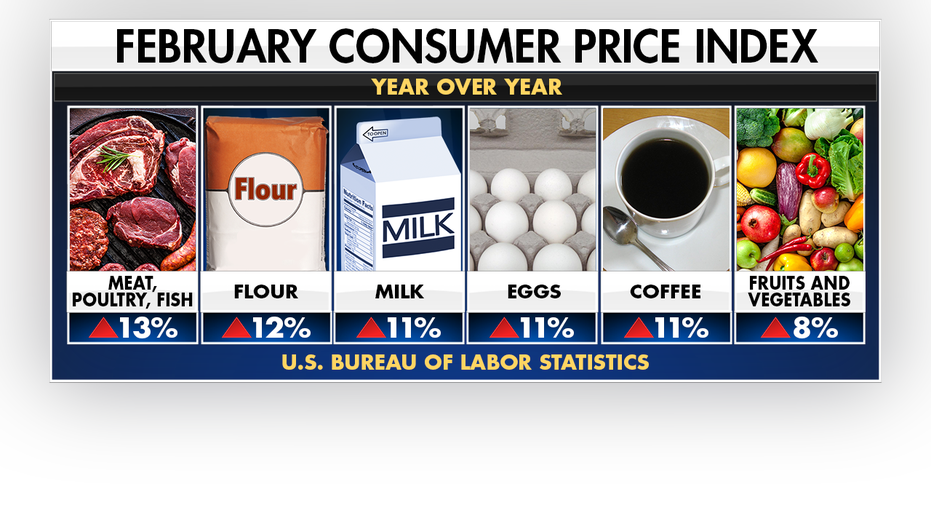

Gas jumped 6.6% in February and accounted for almost a third of price hikes. Food rose by 1%.

The February data does not include Russia’s war on Ukraine, which has accelerated the rise in gas prices. As of Thursday, the U.S. national average hit a record high of $4.35 per gallon.

Geltrude & Company founder Dan Geltrude told FOX Business he thinks gas prices will hit $5 this month and that it could even go as high as $10 unless the Biden administration expands domestic oil production.

"It would not surprise me," he said. "So until the United States decides, or this administration decides that we are going to pump more oil, it is not going to change. It's not. Fuel costs are just going to continue to rise."

Geltrude said the U.S. is on track to enter a full-blown recession within the year.

"If nothing were to change, I see that happening within the next six to 12 months," he said. "Fuel costs are skyrocketing, which impacts everything, because all goods and services go from point A to point B using fuel. So as those costs go up, the price of everything goes up."

Data from the U.S. Bureau of Labor Statistics shows year-over-year rise in indexes from February 2022. (FOX Business / FOXBusiness)

Geltrude said the Federal Reserve will eventually be forced to take aggressive action by "dramatically" increasing interest rates, which will throw the country into a recession.

"It happened during the Carter administration," he said. "We seem to be following that, different times, but we seem to be following the same formula. … Back then, what was happening, prices at the pump [were] out of control, inflation [was] out of control, so in order to get those things under control, meaning inflation, the Federal Reserve increased interest rates dramatically. And ultimately, that threw us into a recession."

INFLATION RISES 7.9% IN FEBRUARY, A NEW 40-YEAR-HIGH

Campbell Faulkner, senior vice president at OTC Global Holdings, told FOX Business that gas prices could "easily" rise to $5 in places like Houston, where the average is currently topping $3.96.

"That's a big number, and it really can harm a wide variety of consumers," he said.

"Really, the problem is we have pipelines that are ready to go, and they're getting re-reviewed," he said. "A lot of a lot of it has to do with removing the red tape and changing the discourse."

Data from the U.S. Bureau of Labor Statistics shows year-over-year rise in the consumer price of common household goods from February 2022. (FOX Business / FOXBusiness)

Faulkner said he believes the U.S. is already seeing the beginnings of a recession.

"I'll be blunt," he said. "I'm basically a data scientist, and I work in commodities, and I think we're already in one. I just think because of the lags in the data, we're not going to see it yet.

"It really seemed around December, I started noticing prices going up. Yes, I knew that they were coming up, I knew CPI and everything else was moving. The problem is, you always know you're in a recession well after it’s already begun. That's going to be the difficult part is to tell when it has happened.

"I think we unfortunately slipped into one, and hopefully it's not going to be a particularly egregious one. We have had strong job growth, but that too is going to be lagged as well because a lot of firms are going to have to start rationalizing their input costs and everything else."

White House press secretary Jen Psaki said Wednesday that the White House was expecting a high inflation report, and she blamed the rise in gas prices on Russia’s military buildup and subsequent invasion of Ukraine.

President Biden said earlier this week that he "can’t do much" about the rising prices and also blamed the situation on Russia.

President Biden speaks about expanding access to health care and benefits for veterans affected by military environmental exposures at the Resource Connection of Tarrant County in Fort Worth, Texas, Tuesday, March 8, 2022. (AP Photo/Patrick Semansky / AP Newsroom)

The president announced Tuesday a ban on Russian oil, gas and energy imports to the U.S. in an effort to weaken Russian President Vladimir Putin, warning that it would contribute to the rise in prices.

Republicans and some Democrats have called for more domestic oil drilling as a solution, but Biden has continued to push his green agenda.

"Loosening environmental regulations won’t lower prices," the president declared in a tweet Tuesday evening. "But transforming our economy to run on electric vehicles, powered by clean energy, will mean that no one will have to worry about gas prices. It will mean tyrants like Putin won’t be able to use fossil fuels as a weapon."

Geltrude told FOX Business that while the Biden administration’s push for clean energy is a "noble intention," it’s not rooted in reality.

"Everybody wants a clean environment," he said. "I don't think anyone can reasonably argue that we don't want to have a cleaner planet. However, that doesn't happen overnight. There needs to be a transition from fossil fuel to clean energy, and in my mind it will happen, but it's going to take decades."

CLICK HERE TO READ MORE ON FOX BUSINESS

"There are countries on the other side of the world using dirty energy," he added. "We don't have a dome over the United States that keeps us shielded from that. So unless you have a collective effort around the globe, the United States having its noble intentions towards clean energy only puts us behind economically."