'All-out war' would decimate Iran's economy, cause oil prices to soar

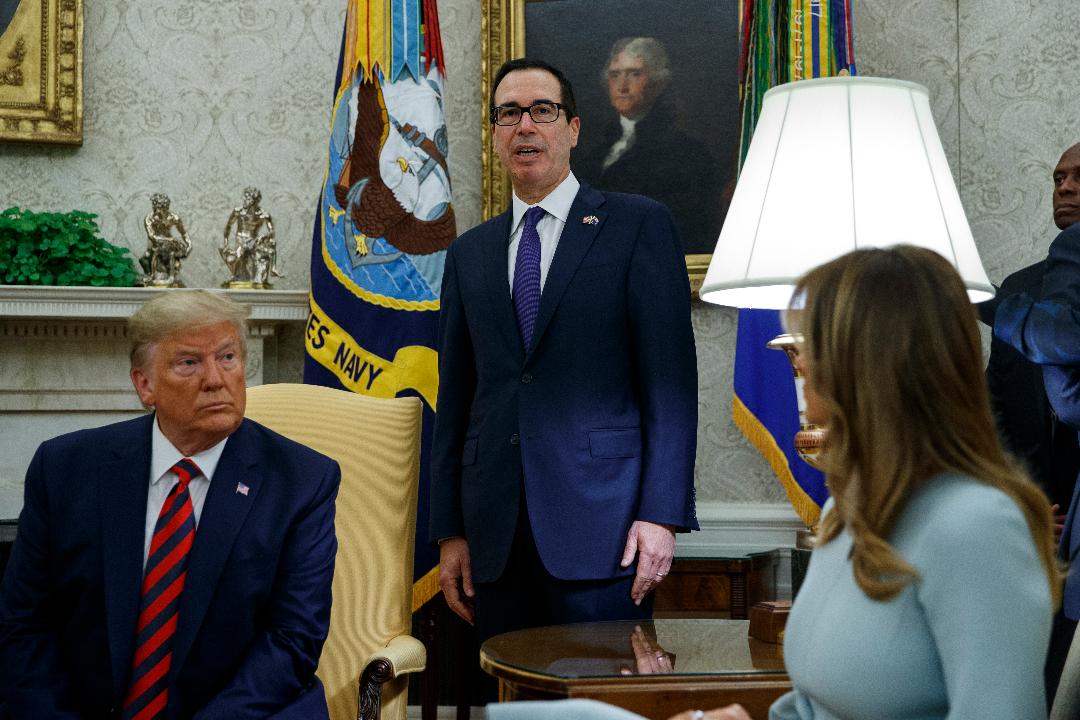

President Trump and Treasury Secretary Steven Mnuchin announced new sanctions Friday on Iran's national bank, isolating a last source of funds for the Islamic Republic.

“We are continuing the maximum pressure campaign,” Mnuchin said in a press conference in the Oval Office. “Both the central bank of Iran as well as the national development fund, which is their sovereign wealth fund, will be cut off from our banking system. This is on top of our oil sanctions and our financial instiution sanctions."

The penalties come less than a week after drone attacks on a Saudi oilfield -- which the U.S. has blamed on Iran -- knocked 5 percent of the world’s daily production offline. Saudi Arabia has restored some of the lost output, and said the rest would be back online by the end of the month.

Secretary of State Mike Pompeo called the attacks “an act of war” on Wednesday, setting off a verbal duel with Iranian leaders.

“We won't blink to defend our territory," Iran Foreign Minister Javad Zarif told CNN when asked about the consequence of a U.S. or Saudi military strike. He said such an attack would result in "all-out war."

That outcome would produce “a collapse in Iran’s economy” and cause a “surge in oil prices,” according to economists Jason Turvey and James Swanston at Capital Economics, a London-based research firm, although they admit the chances of a "full-scale invasion" are small.

“Our assumption is that, if war did break out, it would take the form of targeted strikes by the U.S. and its Gulf allies on Iranian military infrastructure,” they wrote in a note sent to clients on Friday. “Iran would probably respond by stepping up disruption of maritime transit through the Strait of Hormuz.”

The economists point to the Syrian civil war and the Persian Gulf War as examples of the military conflicts that damage economies. Syria’s gross domestic product plunged by 60 percent, while Kuwait’s fell 50 percent.

Iran’s economy, which is much bigger than both Syria’s and Kuwait’s, accounts for 1.2 percent of global GDP and might therefore experience a more modest 25 percent drop in growth, Turvey and Swanston said. That would shave about 0.3 percentage point off of global growth, about the same impact as the U.S.-China trade war.

Spillover effects would be particularly noticeable in the energy market.

“If Iran attempted to shut the Strait of Hormuz, thereby blocking around 20 percent of global supplies, Brent crude would surge to around $150 per barrel,” the economists wrote. That would be a more than 130 percent jump from the current price of $64.60 a barrel, erasing an additional 0.2 percentage point from global GDP.

Iran’s economy will be pressured even without a military conflict: Pompeo said on Sept. 8 that the sanctions will cause the country's GDP to shrink by 12 or 14 percent this year.

“This will reduce their capacity to purchase the things they need, the equipment they need, the materials they need to inflict terror around the world,” he said.

CLICK HERE TO READ MORE ON FOX BUSINESS

“Iran has no desire for war, but we will, and always have, defend our people and our nation,” Zarif tweeted Friday.