Inside American energy's fight for survival

U.S. crude has dropped 41% this year

The U.S. energy industry, which used American ingenuity and grit to overcome our dependence on foreign oil and natural gas, is in an unprecedented fight for survival.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| USO | UNITED STATES OIL FUND - USD ACC | 76.98 | +0.28 | +0.37% |

Producers are under attack from the COVID-19 fallout, Mother Nature, and the Democratic party. The U.S. energy industry, which provides over 11 million jobs and is responsible for 8% of our gross domestic product, will have to battle hard to survive. With prices plummeting on demand concerns and political risk, the fight is on.

EXXON SLASHING WHITE COLLAR JOBS

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| UNG | UNITED STATES NATURAL GAS FUND - USD ACC | 13.27 | -0.25 | -1.85% |

The coronavirus, which caused a sharp, unprecedented 8% drop in global oil demand came just as the industry was rebounding from a 2016 price drop that fueled a rash of bankruptcies in the shale industry. That same great American ingenuity, hard work and drive that broke our chains of oil dependency on foreign countries - the very same that did not like us all the while enriching themselves as they drained money out of everyday Americans’ pocketbooks - had an incredible comeback. They were becoming leaner and meaner and, at the same time, kept inflation low, giving a significant boost to the overall economy.

FORMER SHELL OIL PRESIDENT SCHOOLS BIDEN ON FRACKING

The coronavirus was complicated by a record-breaking Atlantic hurricane season that has forced many to shut down production and have hampered exports cutting into their bottom line. Three major hurricanes took direct aim at U.S. production and refining caused millions in damage and stressed already very stressed U.S. energy companies. Hurricane Laura, Hurricane Beta, and lastly, Hurricane Zeta all left a mark that energy companies will feel long after the storms have passed. Demand destruction coupled with lower prices will make it harder to bounce back.

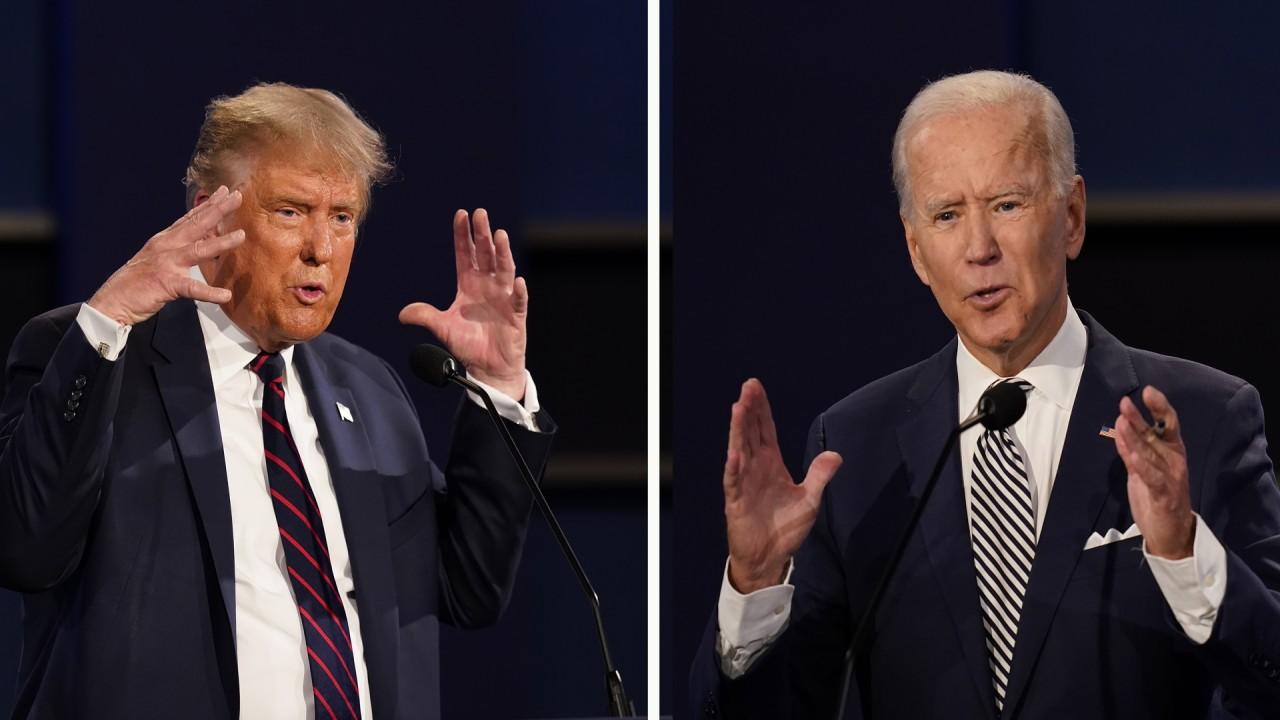

Yet, overcoming these challenges may be easy compared to a former Vice President Joe Biden presidential victory. Biden has said that he wants to reduce federal subsidies for the U.S. energy business and eventually look to replace this industry. On his website, Biden said he believes that the Green New Deal is a crucial framework for meeting the climate challenges we face. It powerfully captures two basic truths, which are at the core of his plan: (1) The United States urgently needs to embrace greater ambition on an epic scale to meet the scope of this challenge, and (2) our environment and our economy are completely and totally connected.

Yet the Green New Deal's reality does not consider the environmental impact of alternative energy sources like wind and solar. Such as solar farms require 300-400 times more land than a nuclear or natural gas plant and produce 200-300 times more waste than nuclear plants that are much more efficient. Solar energy contains toxic chemicals that will be very difficult to dispose of.

Biden wants to replace natural gas electric plants powered by cheap, U.S. produced natural gas that has allowed the U.S. to reduce greenhouse gas emissions more than the rest of the Paris Climate Accord signers. He wants to re-enter that accord that will put more restrictions on the U.S. in favor of China, costing even more American jobs.

The Green New Deal does not, in fact, promise jobs to displaced U.S. energy workers. Fracking not only changed the energy world but brought hope to the many towns that had seen economic blight because of years of offshoring jobs and manufacturing to foreign countries.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Yet instead of celebrating the enormous benefits that the U.S. energy industry has bought to this country, the Democrats are threatening to put them out of business. Biden's vision is a threat to the industry and the U.S. economy and millions of good-paying jobs, not to mention our nation's security.

READ MORE ON FOX BUSINESS BY CLICKING HERE

The U.S. energy industry is open to the use of energy renewables but only as part of an “everything and above” energy strategy. Let’s hope the U.S. energy industry wins that battle as they have fought and won so many times before.

Phil Flynn is senior energy analyst at The PRICE Futures Group and a Fox Business Network contributor. He is one of the world's leading market analysts, providing individual investors, professional traders, and institutions with up-to-the-minute investment and risk management insight into global petroleum, gasoline, and energy markets. His precise and timely forecasts have come to be in great demand by industry and media worldwide and his impressive career goes back almost three decades, gaining attention with his market calls and energetic personality as writer of The Energy Report. You can contact Phil by phone at (888) 264-5665 or by email at pflynn@pricegroup.com.