Keystone oil spill could tighten US Gulf crude stocks

Previous spill saw pipeline, which brings 600,000 bpd to gulf and Midwest refineries, was shut for two weeks

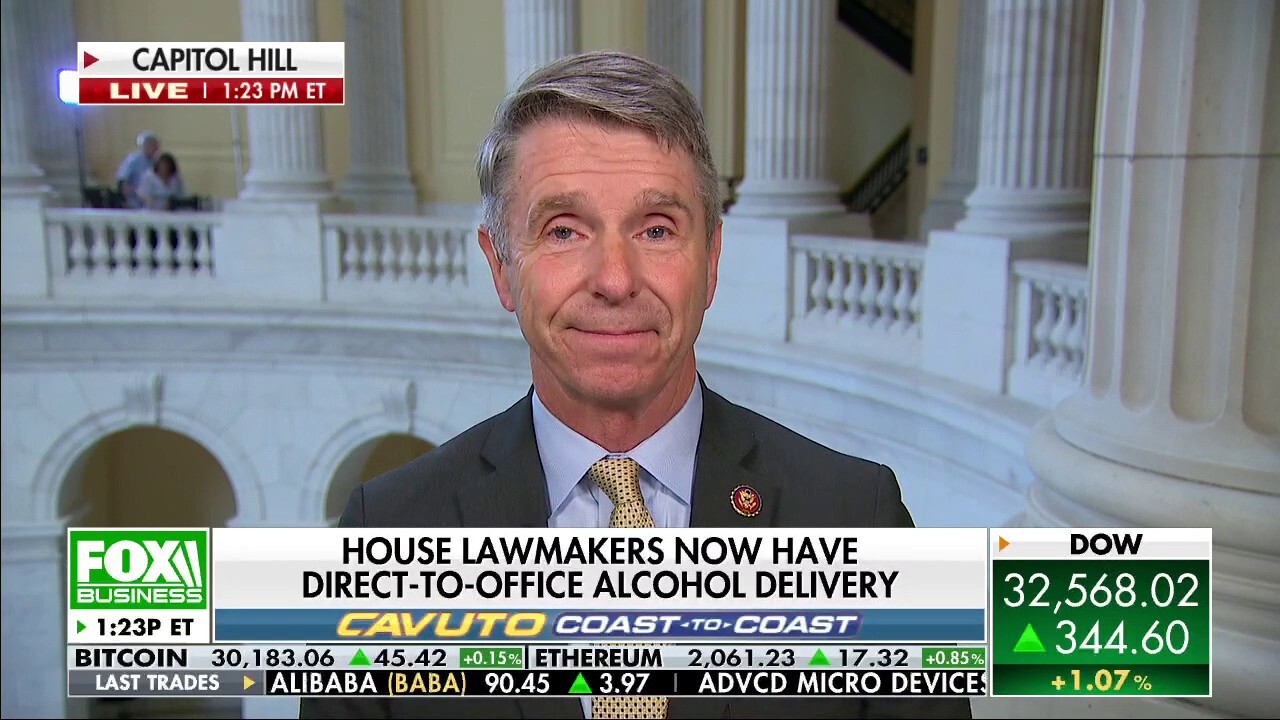

Canceling Keystone pipeline was 'foolishness' amid record-high gas prices: Rep. Wittman

Rep. Rob Wittman, R-Va., argues the U.S. could be importing oil directly from 'our friends' in Canada if the Keystone XL Pipeline wasn't canceled.

An oil spill that shut TC Energy's Keystone pipeline in the United States on Wednesday could squeeze crude inventories at the country's primary storage hub and in two main refining regions, the Midwest and Gulf Coast, analysts and traders said on Friday.

The Keystone line is a key artery bringing more than 600,000 barrels of Canadian crude per day (bpd) to various parts of the United States. It was shut late Wednesday after leaking more than 14,000 barrels of oil into a creek in Kansas, making it the largest crude spill in the United States in nearly a decade.

Canadian crude prices have already slumped on the news, widening on Thursday to a discount of roughly $33 per barrel to benchmark West Texas Intermediate crude futures (WTI) - which is currently trading at about $72 a barrel - from about $27 on Wednesday.

A remediation company deploys a boom on the surface of an oil spill after a Keystone pipeline ruptured at Mill Creek in Washington County, Kansas, on Thursday, Dec. 8, 2022. Vacuum trucks, booms and an emergency dam were constructed on the creek to i (AP Newsroom)

While TC Energy is yet to give details on when it will restart the pipeline, a previous Keystone spill had caused the pipeline to remain shut for about two weeks.

OIL INDUSTRY EXEC RIPS BIDEN ADMIN FOR 'THROWING WET BLANKETS' AT US ENERGY, 'HURTING' POCKETBOOKS

The line runs directly to the Cushing, Oklahoma, storage hub and delivery point for WTI, which is currently about 31% full with nearly 24 million barrels in stock. If the line is closed for more than a week, it could reduce Cushing stocks by about 2.5 million barrels, data analytics firm Wood Mackenzie said.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TRP | TC ENERGY CORP. | 59.82 | -0.09 | -0.15% |

Refineries in the U.S. Midwest may be more affected depending on when the line is restarted.

Washington County Road Department constructs an emergency dam to intercept an oil spill after a Keystone pipeline ruptured at Mill Creek in Washington County, Kanas, on Thursday, Dec 8, 2022. Vacuum trucks, booms and an emergency dam were constructed (AP Newsroom)

The spill in Kansas took place downstream from a key junction in Steele City, Nebraska, where Keystone splits to run into Illinois. That stretch of the line could be restarted, but the other segment affected by the spill will not come back until regulators approve a restart.

ENERGY GROUPS SUE BIDEN ADMIN FOR FAILING TO HOLD OIL, GAS LEASE SALES AGAIN

By contrast, Gulf Coast refiners can draw on more sources for crude, both from offshore Louisiana facilities and from countries like Colombia, Mexico and Ecuador.

Oil from a Keystone pipeline rupture flows into Mill Creek in Washington County, Kansas, on Thursday, Dec 8, 2022. Vacuum trucks, booms and an emergency dam were constructed on the creek to intercept the spill. (Kyle Bauer/KCLY/KFRM Radio via AP) (AP Newsroom)

Still, volumes to the Gulf from Cushing have already dropped. Volumes on TC Energy's Marketlink pipeline, which flows from Cushing to Nederland, Texas, fell by about 300,000 bpd to less than 500,000 bpd, Wood Mackenzie estimates, after the leak was discovered.

CLICK HERE TO GET THE FOX BUSINESS APP

That could leave the Gulf Coast refineries short of heavy Canadian barrels.