Caterpillar Narrows Full-Year View After 1Q Miss

Caterpillar (NYSE:CAT) said on Monday its first-quarter net income dropped 45% to $880 million, as the company’s revenue declined and demand for mining equipment continued to fall.

Peoria, Illinois-based Caterpillar also lowered its full-year outlook to $7 a share and revenue of $57 billion to $61 billion, compared to its previous call for per-share earnings of $7 to $9 and revenue of $60 billion to $68 billion.

During the latest quarter, the world’s largest seller of construction and mining equipment posted earnings of $1.31 a share, down from a profit of $1.59 billion, or $2.37 a share, in the year-earlier period.

Revenue slipped 17% to $13.21 billion.

Analysts were expecting per-share earnings of $1.40 and revenue of $13.71 billion.

Caterpillar said it will resume stock repurchases in the current period.

The company has recently taken on cost-cutting measures at its mining-equipment business amid weaker demand for its machinery. Earlier this month, Caterpillar announced plans to lay off 11% of the workforce at its mining-equipment plant in Decatur, Illinois.

Caterpillar Chairman and CEO Doug Oberhelman said inventory changes were a major factor in the first quarter. Caterpillar and its dealers usually add inventory in the period to prepare for higher end-user demand in the spring and summer, he explained, but the company cut inventory by about a half billion dollars after adding $2 billion to inventory in the same period a year ago.

“What's happening in our business and in the economy overall is a mixed picture. Conditions in the world economy seem relatively stable, and we continue to expect slow growth in 2013,” Oberhelman added.

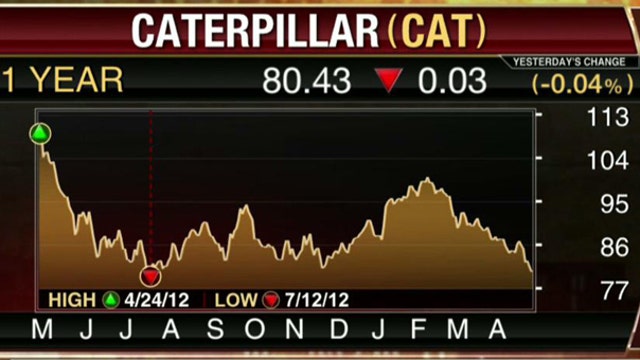

Shares of Caterpillar were up 68 cents at $81.06 in pre-market trading.