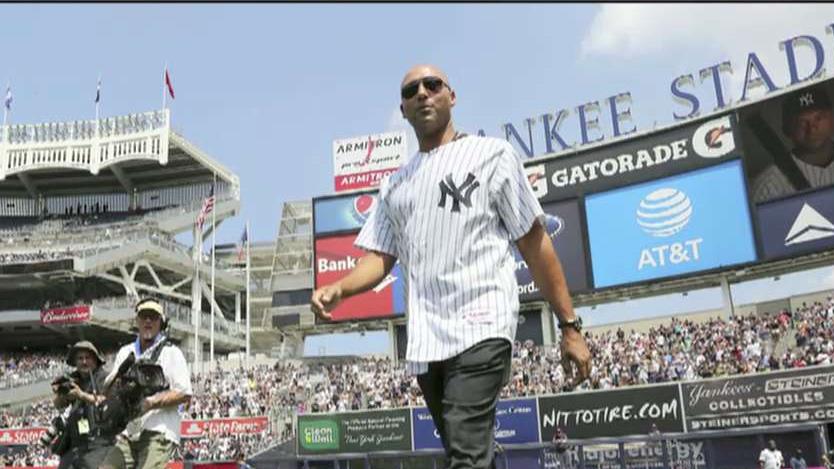

Derek Jeter has a handshake agreement with Miami Marlins, may not call the shots

Derek Jeter’s dream of running a baseball team could be nearing reality as he and a group of well-heeled investors have signaled that they have reached a “handshake agreement†with Miami Marlins owner Jeffrey Loria to purchase the struggling baseball team for as much as $1.2 billion, FOX Business has learned.

The deal is not complete and could hit a last minute snag, throwing the process into disarray. Meanwhile, it’s still unclear if Jeter has indeed come up with the necessary cash to complete the transaction, Major League officials tell Fox Business.

But if Jeter’s bid does pass muster, the former Yankee All-Star and likely future Hall of Famer will be the new chief executive officer of the Marlins, and have a heavy hand in the team’s baseball operations, people with direct knowledge of the matter say. The team’s all-important “control person,†who is considered the de facto owner of the franchise, will be Bruce Sherman, a 68-year old former money manager who agreed to invest $300 million into the team and is the Jeter’s largest investor, these people say.

A person close to the Jeter investment group said the deal could be inked in the next 24 to 48 hours barring any issues.

In event the Jeter and his group prevails, they would beat out a local legend for the rights to buy the Marlins: Jorge Mas, a billionaire, South Florida businessman and a fixture in the local Cuban-American community. His father, Cuban exile Jorge Mas Canosa led a prominent opposition group to Cuban dictator Fidel Castro; Mas’s ties to the local business community and deep pockets, appeared to make him the favorite to buy the team until recently.

But as FOX Business was first to report, Mas had begun to sour on the lengthy and at times volatile negotiating process with team owner Jeffrey Loria and Marlins president David Samson. Mas has indicated he wasn’t willing to meet what baseball executives said was Loria’s target price of $1.2 billion or more given the team's dire financial condition of large operating losses (it is said to lose tens of millions of dollars annually) and large levels of debt.

Still, if the Jeter bid hits a snag, or gets rejected by Major League Baseball, Mas may swoop in and land the team, albeit at a lower price, according to baseball executives.

A spokesman for Jeter had no immediate comment; when reached by telephone, Marlins president David Samson said he had no comment. A press official for Major League Baseball didn’t return calls for comment. A spokesman for Mas didn’t return calls for comment.

Sources close to Jeter say while his group has a “handshake†or verbal agreement with Loria, several possible roadblocks loom. First, the deal isn’t signed and Jeter will have to show he has enough cash to make a $1.2 billion bid.

His bid would also have to be approved by Major League Baseball, which is leery of purchases of teams with the use of debt or debt-like instruments. As FOX Business was first to report, Jeter’s bid includes an investment of $175 million in so-called preferred stock from a company linked to computer impresario Michael Dell.

Preferred stock, while technically equity, has many of the characteristics of debt in that it guarantees the holder a fixed payment either monthly or quarterly in the form of a dividend. Also in the case of bankruptcies, preferred shareholders are treated along the lines of debt holders in that these investments are paid off ahead of common stock holders when a business is liquidated.

Another possible issue for the MLB is Jeter’s role in the management of the team. A perennial All-Star shortstop during his playing days with the New York Yankees and a likely Hall of Famer, Jeter has made no secret that after his 2014 retirement he wanted to own a Major League Baseball team.

But sources close to the sales process say he is willing to invest relatively little of his own money, just around $20 million, making it impossible for him to retain title of “control person†or point person running the team.

The control person title will be going to Sherman, a wealthy Florida based investor with a long career managing money. It’s unclear if Sherman is willing to deal with the day-to-day rigors of running a baseball team, particularly one like the Marlins, which in addition to losing money, is suffering from declining attendance and thus needs a seasoned businessman to boost the team’s bottom line (Sherman didn’t return calls for comment).

Under the terms of the deal, Jeter will be the team’s CEO, meaning at least on paper, he will be running the Marlin’s business operations. It’s unclear if such an arrangement will fly with Major League Baseball if Sherman, as a control person, doesn’t play some role in managing the business end of the operations, baseball executives say.

It’s also unclear if Jeter has the knowledge of the business end of the game to run a team in such financial dire straits as the Marlins.

“Jeter can’t be the control person; he has been told that by the MLB,†said one baseball executive.

That said, people close to baseball commissioner Rob Manfred said he might be willing to compromise on such matters given Jeter’s prominence in the sport. “The league wants to take care of Jeter and thinks he should play a big role in running the team,†one baseball executive said.

People close to the negotiations say an announcement could be made as early as this weekend, or before next week’s owners meeting in Chicago, if terms can be met.

Since Loria has expressed interest in selling the Marlins, the bidding war for one of the league’s more mediocre franchises (the team’s record is 53-60 so far this season) has captivated Major League Baseball given the possible list of potential owners that included the likes of former Florida governor Jeb Bush and Tagg Romney, a hedge fund manager and son of 2012 GOP presidential candidate Mitt Romney, and the massive sales price that those bidders appeared willing to pay.

Adding to the drama is what both baseball executives and bidders have described as the erratic nature of the sales process led by Loria and Samson; some baseball executives say the two prolonged the process as they pushed for the highest possible price (a spokesman for the Marlins didn’t return calls for comment).

Loria paid just $158 million for the team back in 2002, and the scarcity of MLB teams available to be purchased, helped him demand top dollar even for his struggling franchise.

As FOX Business was first to report, developments in recent days signaled that the bidding war was coming to an end. Financier Wayne Rothbaum said he was dropping out of the contest while Mas was balking on Lauria’s price.

Both moves enhanced Jeter’s position in the negotiations since he and his investment banker Gregory Fleming, a former Morgan Stanley executive, had made strides in putting together enough investments from outside parties to meet the possible $1.2 billion asking price.

Indeed, if the deal is completed, it would be a big victory for Fleming, who has a long career on Wall Street and nearly became CEO of both Merrill Lynch and Morgan Stanley. He is currently working as an independent investment banker, and aside from the Jeter-Marlins bid, he recently helped sell Skybridge Capital, a so-called fund-of-funds owned by former adviser to President Donald Trump, Anthony Scaramucci, to the Chinese conglomerate HNA Capital is a deal worth $240 million.

The Skybridge deal is awaiting regulatory approval.