Employer Health Insurance Premiums Soared from 2003 to 2011

Average premiums for employer-sponsored family health insurance plans rose 62 percent between 2003 and 2011, from $9,249 to $15,022 per year, according to a new Commonwealth Fund report. The report, which tracks state trends in employer health insurance coverage, finds that health insurance costs rose far faster than incomes in all states.

Workers are also paying more out-of-pocket as employee payments for their share of health insurance premiums rose by 74 percent on average and deductibles more than doubled, up 117 percent between 2003 and 2011.

The report finds that total health insurance premiums now amount to 20 percent or more of annual median family incomes in 35 states, affecting 80 percent of the U.S. working-age population. States in the south and south-central U.S. had the highest costs relative to household income: West Virginia, New Mexico, South Carolina and Texas saw average total health insurance premiums amount to more than 25 percent of median incomes.

"Wherever you live in the United States, health insurance is expensive, and for many middle as well as low-income families it is becoming ever less affordable," said Commonwealth Fund senior vice president Cathy Schoen, lead author of the report. "Workers are paying more for less financial protection when they get sick. The steady increase in health care costs over the past decade underscores the urgent need to build on the groundwork laid by the Affordable Care Act to slow the growth in private insurance costs."

In 2011, average annual premiums for family plans ranged from about $12,400 to $13,500 in the lowest-cost states (Arkansas, Alabama, Iowa, Tennessee, Idaho, Mississippi, Utah and North Dakota), to more than $15,000 a year in 21 states. Premiums averaged from $16,000 to nearly $17,000 in Delaware, Alaska, Connecticut, Vermont, New York, the District of Columbia, New Hampshire, and Massachusetts, which have the highest average family premiums.

Paying more for less

Premiums rose far faster than incomes across the country from 2003 to 2011. While average family premiums jumped 62 percent during that time, median family income rose just about 11 percent. The increase in premiums ranged from 42 percent in the lowest-growth state, Tennessee, to 76 percent in the highest-growth state, New York. Twenty-seven states had increases of 60 percent or more.

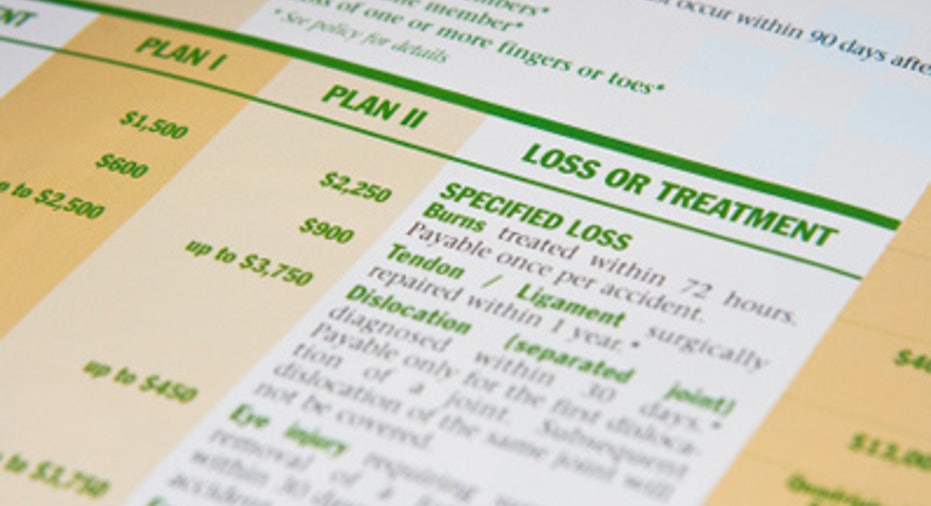

The report finds that deductibles and employees' premium shares grew, leaving employees with more out-of-pocket expenses and less protective health insurance benefits. The average annual amount an employee paid toward a family health insurance plan rose from $2,283 in 2003 to $3,962 in 2011 — a 74 percent increase. Looking state-by-state, employee contributions ranged from about $3,300 in Indiana, Hawaii, West Virginia, Ohio and Wisconsin, to more than $4,600 in Arizona, South Carolina, New Mexico, Colorado and Mississippi.

Deductibles more than doubled from 2003 to 2011, increasing an average of 117 percent per person during the eight years the report studied. In 2011, 78 percent of workers faced deductibles, up from 52 percent in 2003. Average deductibles also exceeded $1,000 in 35 states in 2011, compared to none in 2003. Deductibles have been rising for employees working for large as well as small firms. However, workers in small firms with fewer than 50 employees typically face higher deductibles than those working for larger firms. Deductibles in small firms were highest in North Carolina, Texas, and Vermont, exceeding $2,200 per person.

Follow BusinessNewsDaily on Twitter @BNDarticles. We're also on Facebook & Google+.