Epstein’s private island: Business and tax breaks

Epstein guards reportedly falsified logs

Fox News senior judicial analyst Judge Andrew Napolitano on the investigation into the jail where Jeffrey Epstein was held and the potential case against former Epstein employees and alleged co-conspirators.

Wall Street financier Jeffrey Epstein – who died in prison while facing sex trafficking charges – amassed what is believed to be a fortune worth hundreds of millions of dollars, and he may have used some tax saving strategies to help him do so.

Epstein bought an island in the U.S. Virgin Islands more than 20 years ago. At that time, he also moved his financial advisory firm from New York to St. Thomas – a savvy move that likely allowed him to shave a significant chunk of change off of his tax bill.

The USVI has what is called a "mirror system" of taxation, which means the USVI adopts the U.S. Internal Revenue Code as if it were its own – however, the USVI is the recipient of revenues from bona fide residents.

Little St. James Island, one of the properties of financier Jeffrey Epstein, is seen in an aerial view near Charlotte Amalie, St. Thomas, U.S. Virgin Islands July 21, 2019. REUTERS/Marco Bello - RC15C07E7560

The U.S. government allows the USVI to grant both individuals and businesses generous tax incentives.

The Economic Development Commission grants certain qualified businesses a 90 percent reduction in both corporate and personal income tax. It also offers 100 percent exemption on gross tax receipts, business property tax and excise tax payments.

In order to qualify, a company must typically invest at least $100,000 in a USVI business and employ at least 10 people.

The USVI is also particularly attractive as a potential tax haven because – as a U.S. flagged territory – it has a familiar legal system. Airports on St. Thomas and St. Croix have daily service to New York, Miami and Atlanta.

To enjoy most of these tax benefits, however, Epstein would likely have needed to be considered a bona fide resident in addition to having active businesses there.

Typically, being considered a bona fide resident requires a 183-day presence – but special rules apply for U.S. residents who become USVI residents.

The New York Times also reported that Epstein had changed his official residence to his Virgin Islands estate.

Residents can also receive a 90 percent reduction in personal income tax.

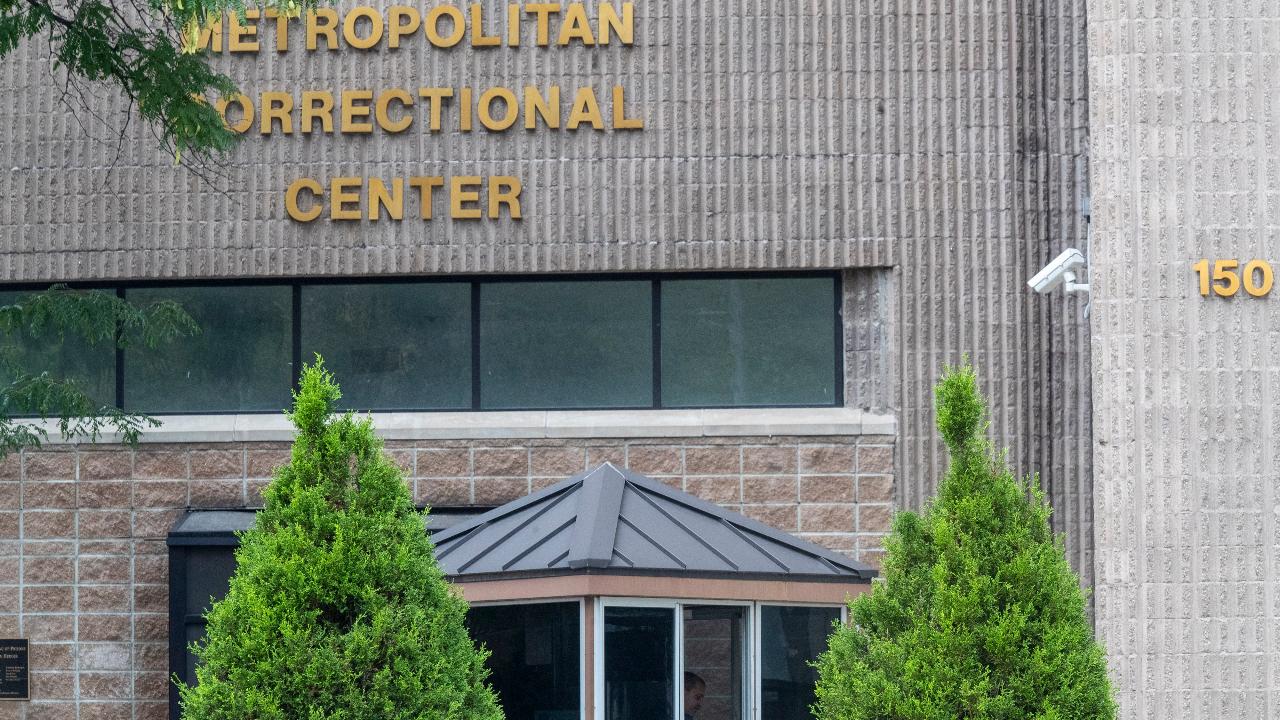

Epstein was found unconscious in his Manhattan jail cell on Saturday, and he was later pronounced dead. He faced charges of child sex trafficking and conspiracy.

He also had residences in Paris, New York, New Mexico and Florida. His estate is believed to be valued at more than $500 million.

If convicted, he faced as many as 45 years in jail.