Exclusive: Gov’t to Press Former AIG Chief on Crisis Plan

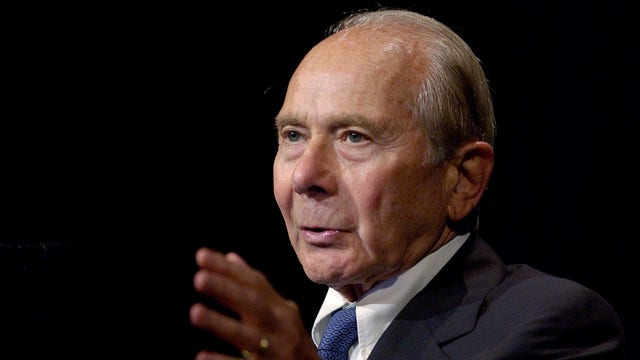

Hank Greenberg will be pressed by government attorneys this week during the AIG (NYSE:AIG) bailout trial to specifically outline what type of private market solutions he had at the ready as the insurance giant faced a massive liquidity crunch during the 2008 financial crisis, sources tell the FOX Business Network.

Sources close to the matter tell FOX Business exclusively that lead government attorneys will attempt to poke holes in the former CEO of AIG’s assertion that he had the ability on short notice to cobble together a private equity bailout with the help of foreign sovereign wealth funds.

The funds in question, sources say, are the sovereign wealth funds of both China and Singapore.

The landmark trial has riveted Wall Street and Main Street alike as a parade of bold-faced witnesses testify about billions in bailout funds spent to prop up the ailing financial system during the crisis. Greenberg and his current company Starr International are suing the government for $40 billion. Greenberg, who had departed from AIG in 2005 but remained its largest shareholder, alleges the government unconstitutionally seized equity in AIG at onerous terms and for political reasons.

The trial has stretched to six weeks and has hauled central figures from former Federal Reserve Chairman Ben Bernanke to former Treasury Secretaries Henry Paulson and Timothy Geithner to the Federal Claims court witness stand.

Because of a jam-packed witness list, FOX Business has learned that Greenberg will now most likely be called to the stand this Friday in what has become the most closely-watched trial related to the financial crisis. Sources say the 89-year-old Greenberg will be on the stand up to four hours, grilled first by government attorneys and then examined by his own lead attorney David Boies.

Greenberg's attorneys declined to comment for this report. A spokesperson for the Justice Department told FBN "we decline to comment on government's strategy while the trial is pending."

Boies has publicly maintained that the government, pursuant to the Federal Reserve Act, did not have the authorization to seize equity in AIG as a condition of the bailout of the company, nor did it have the right to impose onerous interest rates of up to 14% on the company. The Federal Reserve Act states that in a force-majeure, extreme bailout situation, the government can only charge a rate that accommodates commerce and business.

The plaintiff has argued AIG was held to a much higher standard than other banks which received bailouts. Neither Morgan Stanley (NYSE:MS) nor Citigroup (NYSE:C) had assets seized and the rates imposed upon some banks for payback of the bailout hovered closer to 2.5%. Paulson, Geithner and Bernanke have testified time was of the essence to preserve market confidence and to demonstrate to the public that punitive terms were being placed on institutions taking bailout money.

The trial will resume Wednesday after a two-day closure due to the Veterans Day holiday.