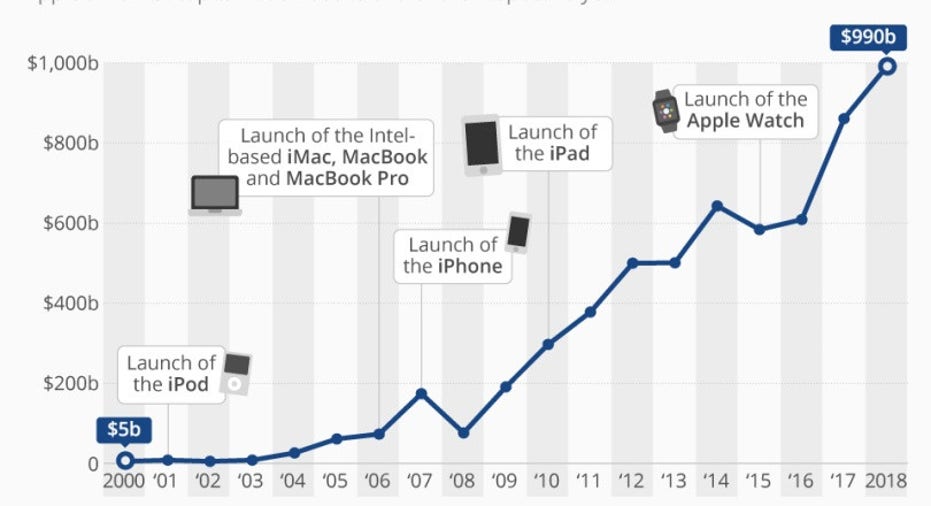

How Apple Made it to a Trillion

The race to a trillion-dollar market cap is over, and the frontrunner took it by a mile. After a false alarm in Apple's Stocks app based on outdated share prices from Yahoo Finance, Apple is officially the first company to cross the trillion-dollar mark.

Apple's stock rise has been a meteoric one over the past decade. In 2008, the company's revenue was $76 billion, but iPhone and iPad helped secure massive revenue growth from 2008-2012.

Its market cap continued to climb from 2013-2016, albeit with some peaks and valleys. In the past two years, revenue was bolstered by a steady uptick in sales of Apple Watch, Beats products, and especially its services sector and the recurring revenue from products like iCloud and Apple Music.

Apple's recent Q3 earnings report shows that more than half of the company's revenue during the quarter came from iPhone sales, but its services sector is now the second most profitable division at 18 percent of total revenue, eclipsing tablet and Mac sales.

Software and cloud services revenue is the open secret to how Apple closed the gap to reach a trillion-dollar market cap. In Q1 2018, Apple generated $3.7 billion in services revenue. This quarter, services accounted for $9.6 billion.

As long as iOS users keep paying their Apple Tax and shelling out a few bucks a month for more iCloud storage, Apple's recurring monthly services revenue has nowhere to go but up.

This article originally appeared on PCMag.com.