How Etsy Helped Me Pay Off $20K of Debt

Their marriage had a less-than-ideal start. She had $20,000 in debt. He was about to lose his home, and the bank wouldn’t negotiate. He also had a student loan, a car loan and some credit card debt. When she moved to Cleveland to be with him, she’d be unemployed. He’d have to work overtime as a truck driver just to put a few hundred dollars toward paying down the debt.

But Nancy and Dan Nemeth — both 49 years old — took the plunge anyway, getting hitched in a $300 budget wedding in April 2012. Thanks to a short sale, Dan was able to get out from under his mortgage and when they moved into a rental, they had a fresh start but a $30,000 mountain to climb — not including their car loan.

“His take home pay was only $2,000 a month, so Dan did all the overtime he could to bump it to $2,600,” Nancy said. “We paid just over minimum payments at first.”

Then, her love of birds, bags, and sewing changed everything.

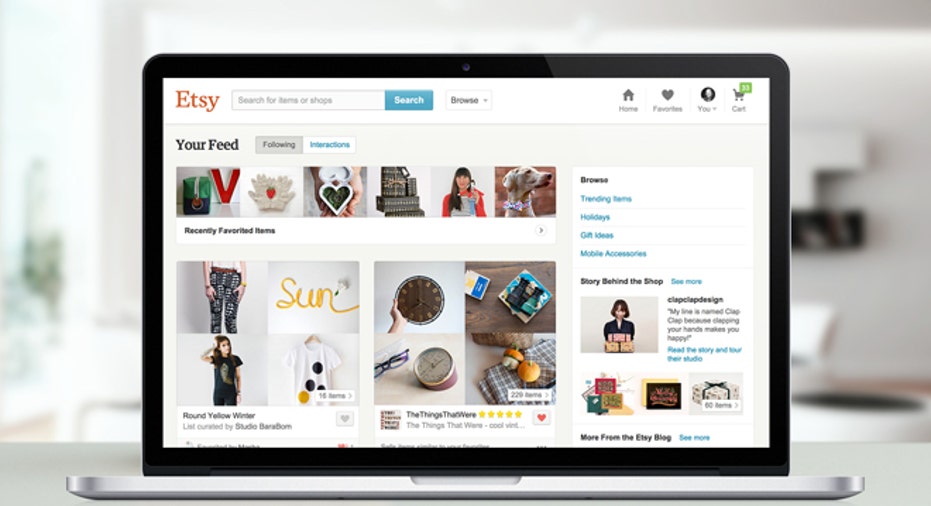

“I love to craft. So one day, a friend was watching me sew at home and mentioned she wanted a couple things made for a friend’s birthday,” Nancy said. “So I sewed a few items for her. Then that turned into another item for another friend. Then (a different) friend said, ‘Hey, put your stuff on Etsy.’ I didn’t know what it was at the time. Within a couple months… I made enough for a new sewing machine.”

Nancy started making handbags and clutches, often with designs inspired by her pet birds. She made a vow that half the money she made on Etsy would go back into the business, but the other half would be used to pay down her debt. She was making a “couple of hundred” a month for a while, but eventually saved enough to upgrade her machine, which soon was running 10 hours a day, 6 days a week.

“I spent every day sewing and making my little shop bigger and better,” she said. “Studying how to expand and do social media to get my little shop out there. It has blossomed so much.”

And while the business blossomed, the Nemeths’ debt shrank fast. She averages about $2,500 in sales a month, which means she puts more than $1,000 a month toward paying down her debt. They’re not finished yet, but the $30,000 mountain is now more of a $10,000 molehill…plus about $8,000 remains on the car loan.

Paying down debts can also have a positive effect on credit scores – making payments on time and keeping revolving debts on credit cards low relative to credit limits have a big impact over time. This calculator can show you how long it’ll take you to pay off your credit cards. You can also get a free credit report summary on Credit.com, updated monthly, to see how you debt levels and payment history are affecting your credit.

“We will be completely debt free in ONE year. Can hardly wait,” she said. “Then all the extra will go into savings and a portion to our dream trip to Europe.”

Etsy wasn’t the only step the Nemeths took to attack their debt problem. They also cut out almost all extras. When they go food shopping, they bring the budgeted amount in cash, and never overspend. They plan date nights well in advance so they have something to look forward to, and make choices to keep those costs down, like eating before going to the theater to avoid paying for expensive candy and popcorn.

But finding a way to supplement their income has been the most important step towards climbing out of the hole they were in.

“I have always said do what you love, and if you can find a way, make some of that dream happen,” she said.

Her husband has gotten into the act, too. He recently went back to his old hobby performing comedy. He puts half his comedy income into paying down debt, too. Laughing together is helping their relationship, too.

While their marriage didn’t have an ideal financial beginning, Nancy actually thinks that might have made them closer.

“I think it’s just that we are proud of (our) really tough beginnings being together, but overcoming so much at the same time,” she said. “Go figure. You’re supposed to meet and get married when things are great and all that. But our (story) is opposite. Maybe that was a good thing. Maybe seeing the worst times at the beginning gives a healthy dose of realism and something to really bind a future together. It was a struggle… but nothing we could blame each other for. Just a desire to get out of this life that we ‘think’ we should have according to the white picket fence syndrome.”

And the couple might be able to get out of debt even sooner than expected. After Credit.com began chatting with Nancy about her debt, Etsy featured her store, Birds and Bagz, in an email. Orders spiked for a day, and she earned around $3,500 in July.

“Paying off another credit card tomorrow,” she said. “Feels great.”

What did the couple do to celebrate?

“We are treating ourselves to sushi dinner tonight…which of course we go at happy hour, which is half off,” she said. “Never pay full price.”

Did you manage to dig out of a big debt hole? How did you do it? Write to Bob@Credit.com and we may feature your story.

More from Credit.com:How Much Debt Is Too Much?Chase Slate Review: A Very Competitive Balance Transfer OfferTips for Paying Off Credit Card Debt

This article originally appeared on Credit.com.

Bob Sullivan is author of the New York Times best-sellers Gotcha Capitalism and Stop Getting Ripped Off. His stories have appeared in The New York Times, the Wall Street Journal, and hundreds of other publications. He has appeared as a consumer advocate and technology expert numerous times on NBC's TODAY show, NBC Nightly News, CNBC, NPR's Marketplace, Terry Gross' Fresh Air, and various other radio and TV outlets. He helped start MSNBC.com and wrote there for nearly 20 years, most of it penning the consumer advocacy column The Red Tape Chronicles. See more at www.bobsullivan.net. Follow Bob Sullivan on Facebook or Twitter. More by Bob Sullivan